Berkshire Hathaway 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

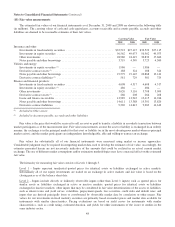

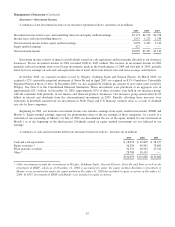

Notes to Consolidated Financial Statements (Continued)

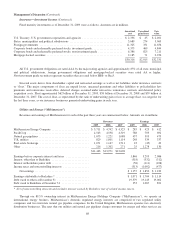

(22) Business segment data (Continued)

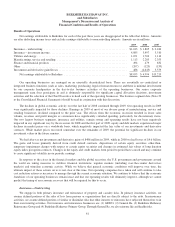

Other businesses not specifically identified with reportable business segments consist of a large, diverse group of

manufacturing, service and retailing businesses.

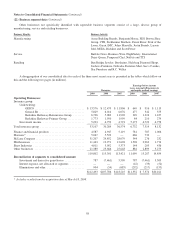

Business Identity Business Activity

Manufacturing Acme Building Brands, Benjamin Moore, H.H. Brown Shoe

Group, CTB, Fechheimer Brothers, Forest River, Fruit of the

Loom, Garan, IMC, Johns Manville, Justin Brands, Larson-

Juhl, MiTek, Richline and Scott Fetzer

Service Buffalo News, Business Wire, FlightSafety, International

Dairy Queen, Pampered Chef, NetJets and TTI

Retailing Ben Bridge Jeweler, Borsheims, Helzberg Diamond Shops,

Jordan’s Furniture, Nebraska Furniture Mart, See’s Candies,

Star Furniture and R.C. Willey

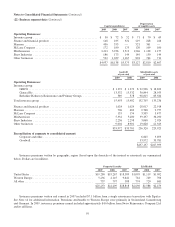

A disaggregation of our consolidated data for each of the three most recent years is presented in the tables which follow on

this and the following two pages (in millions).

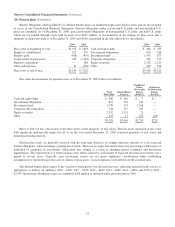

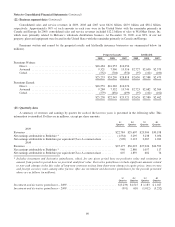

Revenues

Earnings before income

taxes, noncontrolling interests

and equity method earnings

2009 2008 2007 2009 2008 2007

Operating Businesses:

Insurance group:

Underwriting:

GEICO ................................... $ 13,576 $ 12,479 $ 11,806 $ 649 $ 916 $ 1,113

General Re ................................ 5,829 6,014 6,076 477 342 555

Berkshire Hathaway Reinsurance Group ........ 6,706 5,082 11,902 349 1,324 1,427

Berkshire Hathaway Primary Group ............ 1,773 1,950 1,999 84 210 279

Investment income ............................. 5,223 4,759 4,791 5,173 4,722 4,758

Total insurance group ............................... 33,107 30,284 36,574 6,732 7,514 8,132

Finance and financial products ........................ 4,587 4,947 5,119 781 787 1,006

Marmon * ........................................ 5,067 5,529 — 686 733 —

McLane Company .................................. 31,207 29,852 28,079 344 276 232

MidAmerican ..................................... 11,443 13,971 12,628 1,528 2,963 1,774

Shaw Industries .................................... 4,011 5,052 5,373 144 205 436

Other businesses ................................... 21,380 25,666 25,648 884 2,809 3,279

110,802 115,301 113,421 11,099 15,287 14,859

Reconciliation of segments to consolidated amount:

Investment and derivative gains/losses .............. 787 (7,461) 5,509 787 (7,461) 5,509

Interest expense, not allocated to segments .......... — — — (42) (35) (52)

Eliminations and other .......................... 904 (54) (685) (292) (217) (155)

$112,493 $107,786 $118,245 $11,552 $ 7,574 $20,161

* Includes results from the acquisition date of March 18, 2008.

58