Berkshire Hathaway 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

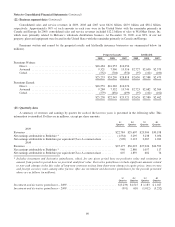

Insurance—Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

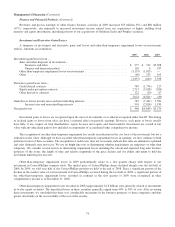

Underwriting losses from retroactive reinsurance include the recurring amortization of deferred charges that were initially

established at the inception of these reinsurance contracts. At the inception of a contract, deferred charges represent the

difference between the premium received and the estimated ultimate losses payable. Deferred charges are subsequently

amortized over the estimated claims payment period using the interest method and are based on estimates of the timing and

amount of loss payments. Amortization charges are recorded as a component of losses and loss adjustment expenses.

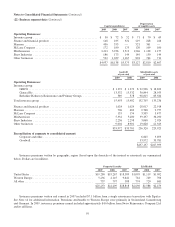

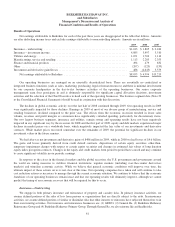

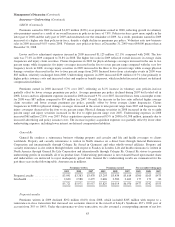

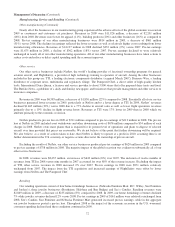

Premiums earned in 2009 from other multi-line business of $3.89 billion were relatively unchanged from 2008. Premiums

earned in 2009 and 2008 included $2.77 billion and $1.83 billion, respectively, from a 20% quota-share contract with Swiss Re

covering substantially all of Swiss Re’s property/casualty risks incepting from January 1, 2008 and running through

December 31, 2012. Excluding the Swiss Re quota-share contract, other multi-line business premiums earned in 2009 declined

$969 million (46%) compared to 2008, primarily due to significant reductions in aviation, property, workers’ compensation and

Lloyd’s market volume. Other multi-line premiums earned in 2008 increased $1.31 billion (50%) over 2007 reflecting

premiums earned from the Swiss Re quota-share contract partially offset by lower premium volume from workers’

compensation programs.

Pre-tax underwriting results from other multi-line reinsurance in 2009 included foreign currency transaction losses of about

$280 million. The non-cash losses arose from the conversion of certain reinsurance loss reserves and other liabilities

denominated in foreign currencies (primarily the U.K. Pound Sterling). The value of these currencies rose overall relative to the

U.S. Dollar in 2009, resulting in losses. In 2008, underwriting results included foreign currency transaction gains of

approximately $930 million, resulting from sharp declines in the Euro and U.K. Pound Sterling versus the U.S. Dollar.

Excluding the effects of the currency gains/losses, other multi-line business produced a pre-tax underwriting gain of $295

million in 2009, $32 million in 2008 and $435 million in 2007. Pre-tax underwriting results in 2008 included approximately

$435 million of estimated catastrophe losses from Hurricanes Gustav and Ike. There were no significant catastrophe losses in

2009 or 2007, which also benefited from relatively low property loss ratios and favorable loss experience on workers’

compensation business.

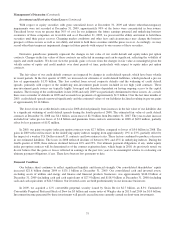

In December 2007, we formed a monoline financial guarantee insurance company, Berkshire Hathaway Assurance

Corporation (“BHAC”). BHAC commenced operations during the first quarter of 2008 and is licensed in 49 states. In its first

year of operation, BHAC produced $595 million of written premiums. In 2009, as a result of changing market conditions and

demand, BHAC wrote about $40 million in premiums, most of which was in the first half of the year.

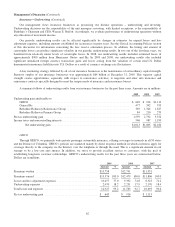

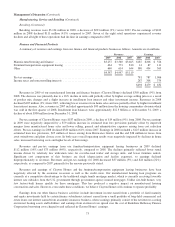

Berkshire Hathaway Primary Group

Our primary insurance group consists of a wide variety of independently managed insurance businesses that principally

write liability coverages for commercial accounts. These businesses include: Medical Protective Corporation (“MedPro”), a

provider of professional liability insurance to physicians, dentists and other healthcare providers; National Indemnity

Company’s primary group operation (“NICO Primary Group”), a writer of commercial motor vehicle and general liability

coverages; U.S. Investment Corporation, whose subsidiaries underwrite specialty insurance coverages; a group of companies

referred to internally as “Homestate” operations, providers of standard commercial multi-line insurance; Central States

Indemnity Company, a provider of credit and disability insurance to individuals nationwide through financial institutions;

Applied Underwriters, a provider of integrated workers’ compensation solutions; and BoatU.S., a writer of insurance for owners

of boats and small watercraft.

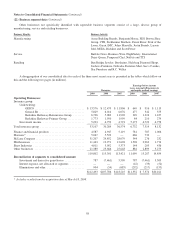

Earned premiums by our primary insurance businesses were $1,773 million in 2009, $1,950 million in 2008 and $1,999

million in 2007. In 2009, with the exception of BoatU.S., each of our primary businesses generated lower premiums written and

earned compared to 2008. Pre-tax underwriting gains as percentages of premiums earned were approximately 5% in 2009, 11%

in 2008 and 14% in 2007. The declines in underwriting gains in 2009 compared to 2008 and 2007 resulted from higher loss

ratios as increased price competition narrowed profit margins, and higher expense ratios, which reflected the impact of fixed

costs on lower premium volume.

66