Berkshire Hathaway 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

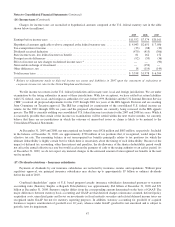

Notes to Consolidated Financial Statements (Continued)

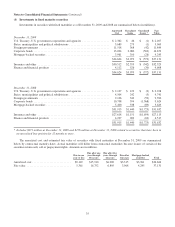

(12) Derivative contracts

We enter into derivative contracts primarily through our finance and financial products businesses and our energy and

utilities businesses. The derivative contracts of our finance and financial products businesses, with limited exceptions, are not

designated as hedges for financial reporting purposes. These contracts were initially entered into with the expectation that the

premiums received would exceed the amounts ultimately paid to counterparties. Changes in the fair values of such contracts are

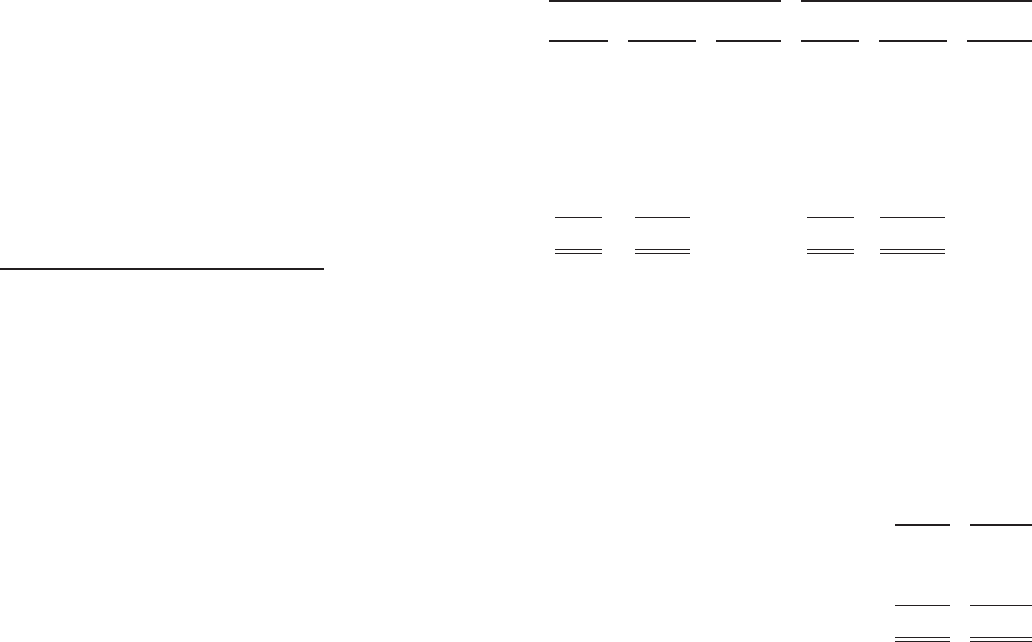

reported in earnings as derivative gains/losses. A summary of derivative contracts of our finance and financial products

businesses follows (in millions).

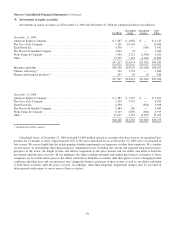

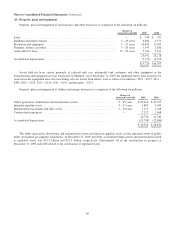

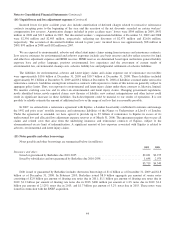

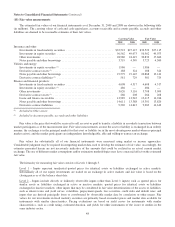

December 31, 2009 December 31, 2008

Assets (3) Liabilities

Notional

Value Assets (3) Liabilities

Notional

Value

Equity index put options ................................. $— $7,309 $37,990(1) $ — $10,022 $37,134(1)

Credit default obligations:

High yield indexes ................................. — 781 5,533(2) — 3,031 7,892(2)

States/municipalities ................................ — 853 16,042(2) — 958 18,364(2)

Individual corporate ................................ 81 — 3,565(2) — 105 3,900(2)

Other ................................................ 378 360 503 528

Counterparty netting and funds held as collateral ............. (193) (34) (295) (32)

$ 266 $9,269 $ 208 $14,612

(1) Represents the aggregate undiscounted amount payable at the contract expiration dates assuming that the value of each

index is zero at the contract expiration date.

(2) Represents the maximum undiscounted future value of losses payable under the contracts, assuming a sufficient number of

credit defaults occur. The number of losses required to exhaust contract limits under substantially all of the contracts is

dependent on the loss recovery rate related to the specific obligor at the time of the default.

(3) Included in Other assets of finance and financial products businesses.

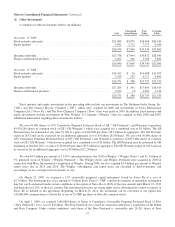

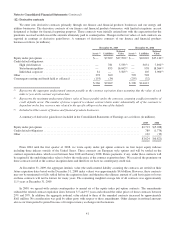

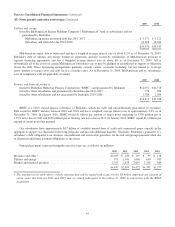

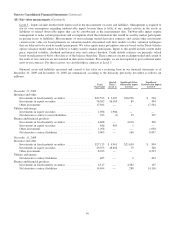

A summary of derivative gains/losses included in the Consolidated Statements of Earnings are as follows (in millions).

2009 2008

Equity index put options ................................................................... $2,713 $(5,028)

Credit default obligations ................................................................... 789 (1,774)

Other .................................................................................. 122 (19)

$3,624 $(6,821)

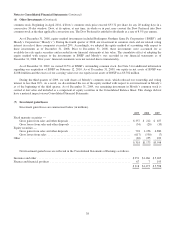

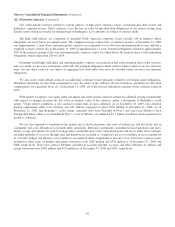

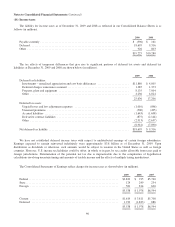

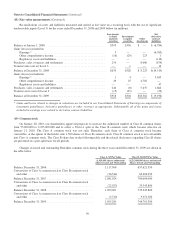

From 2004 until the first quarter of 2008, we wrote equity index put option contracts on four major equity indexes

including three indexes outside of the United States. These contracts are European style options and will be settled on the

contract expiration dates, which occur between June 2018 and January 2028. Future payments, if any, under these contracts will

be required if the underlying index value is below the strike price at the contract expiration dates. We received the premiums on

these contracts in full at the contract inception dates and therefore we have no counterparty credit risk.

At December 31, 2009, the aggregate intrinsic value (the undiscounted liability assuming the contracts are settled on their

future expiration dates based on the December 31, 2009 index values) was approximately $4.6 billion. However, these contracts

may not be terminated or fully settled before the expiration dates and therefore the ultimate amount of cash basis gains or losses

on these contracts will not be known for many years. The remaining weighted average life of all contracts was approximately

11.5 years at December 31, 2009.

In 2009, we agreed with certain counterparties to amend six of the equity index put option contracts. The amendments

reduced the related contract expiration dates between 3.5 and 9.5 years and reduced the strike prices of those contracts between

29% and 39%. In addition, the aggregate notional value related to three of the amended contracts increased by approximately

$161 million. No consideration was paid by either party with respect to these amendments. Other changes in notional amounts

also occur from period to period because of foreign currency exchange rate fluctuations.

41