Berkshire Hathaway 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

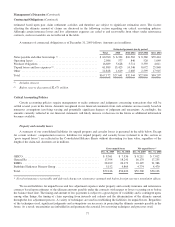

Manufacturing, Service and Retailing (Continued)

Other manufacturing (Continued)

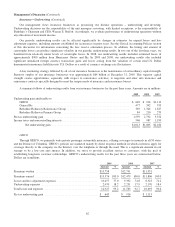

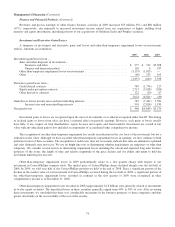

Nearly all of the businesses in our manufacturing group experienced the adverse effects of the global economic recession in

2009 as consumers and customers cut purchases. Revenues in 2009 were $11,926 million, a decrease of $2,201 million

(16%) from 2008. Revenues were lower for apparel (11%), building products (20%) and other businesses (16%) as compared to

2008. Pre-tax earnings of our other manufacturing businesses were $814 million in 2009, a decrease of $861 million

(51%) versus 2008. The declines in earnings reflected the lower revenues as well as relatively higher costs resulting from lower

manufacturing efficiencies. Revenues of $14,127 million in 2008 declined $332 million (2%) versus 2007. Pre-tax earnings

were $1,675 million in 2008, a decline of $362 million (18%) versus 2007. Pre-tax earnings declined or were relatively

unchanged in nearly all of our other manufacturing operations. All of our other manufacturing businesses have taken actions to

reduce costs and reduce or delay capital spending until the economy improves.

Other service

Our other service businesses include NetJets, the world’s leading provider of fractional ownership programs for general

aviation aircraft, and FlightSafety, a provider of high technology training to operators of aircraft. Among the other businesses

included in this group are: TTI, a leading electronic components distributor (acquired March 2007); Business Wire, a leading

distributor of corporate news, multimedia and regulatory filings; The Pampered Chef, a direct seller of high quality kitchen

tools; International Dairy Queen, a licensor and service provider to about 5,800 stores that offer prepared dairy treats and food;

The Buffalo News, a publisher of a daily and Sunday newspaper; and businesses that provide management and other services to

insurance companies.

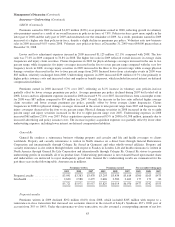

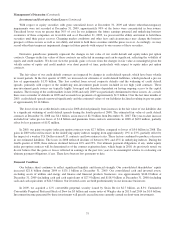

Revenues in 2009 were $6,585 million, a decrease of $1,850 million (22%) compared to 2008. Essentially all of our service

businesses generated lower revenues in 2009, particularly at NetJets and to a lesser degree at TTI. In 2009, NetJets’ revenues

declined $1,465 million (32%) versus 2008 due to a 77% decline in aircraft sales as well as lower flight operations revenues

primarily due to a 19% decline in flight revenue hours. Revenues at TTI were 17% lower in 2009 than in 2008 which we

attribute primarily to the economic recession.

NetJets produced a pre-tax loss in 2009 of $711 million compared to pre-tax earnings of $213 million in 2008. The pre-tax

loss at NetJets in 2009 included asset writedowns and other downsizing costs of $676 million compared to $54 million of such

charges in 2008. NetJets owns more planes than is required for its present level of operations and plans to dispose of selected

aircraft over time provided that prices are reasonable. We do not believe at this point that further downsizing will be required.

We also believe, as a result of actions taken to date, that NetJets is likely to operate at a profit in 2010, assuming there is no

further deterioration in the U.S. economy or negative actions directed at the ownership of private aircraft.

Excluding the results of NetJets, our other service businesses produced pre-tax earnings of $620 million in 2009 compared

to pre-tax earnings of $758 million in 2008. The negative impact of the global recession was evident on substantially all of our

other service businesses.

In 2008, revenues were $8,435 million, an increase of $643 million (8%) over 2007. The inclusion of twelve months of

revenues from TTI in 2008 versus nine months in 2007 accounted for over 80% of the revenue increase. Excluding the impact

of TTI, other service revenues in 2008 increased 2% over 2007. Pre-tax earnings in 2008 were $971 million, relatively

unchanged from 2007. The impact from the TTI acquisition and increased earnings of FlightSafety were offset by lower

earnings from NetJets and The Pampered Chef.

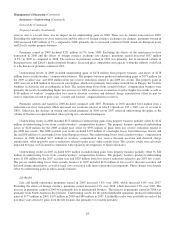

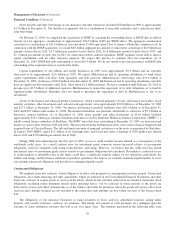

Retailing

Our retailing operations consist of four home furnishings businesses (Nebraska Furniture Mart, R.C. Willey, Star Furniture

and Jordan’s), three jewelry businesses (Borsheims, Helzberg and Ben Bridge) and See’s Candies. Retailing revenues were

$2,869 million in 2009, a decrease of $235 million (8%) compared to 2008. In 2009, our home furnishings revenues declined

7% while jewelry revenues declined 12% versus 2008. Pre-tax earnings in 2009 of $161 million were relatively unchanged from

2008. See’s Candies, Star Furniture and Nebraska Furniture Mart generated increased pre-tax earnings, while in the aggregate

our jewelry businesses posted a pre-tax loss. Throughout 2008 as the impact of the economic recession in the U.S. worsened,

consumer spending declined and these conditions continued in 2009.

72