Berkshire Hathaway 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

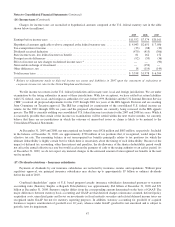

(18) Fair value measurements (Continued)

Level 3 – Inputs include unobservable inputs used in the measurement of assets and liabilities. Management is required to

use its own assumptions regarding unobservable inputs because there is little, if any, market activity in the assets or

liabilities or related observable inputs that can be corroborated at the measurement date. Unobservable inputs require

management to make certain projections and assumptions about the information that would be used by market participants

in pricing assets or liabilities. Measurements of non-exchange traded derivative contracts and certain other investments

carried at fair value are based primarily on valuation models, discounted cash flow models or other valuation techniques

that are believed to be used by market participants. We value equity index put option contracts based on the Black-Scholes

option valuation model which we believe is widely used by market participants. Inputs to this model include current index

price, expected volatility, dividend and interest rates and contract duration. Credit default contracts are primarily valued

based on indications of bid or offer data as of the balance sheet date. These contracts are not exchange traded and certain of

the terms of our contracts are not standard in derivatives markets. For example, we are not required to post collateral under

most of our contracts. For these reasons, we classified these contracts as Level 3.

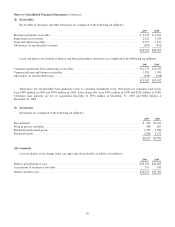

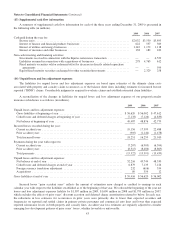

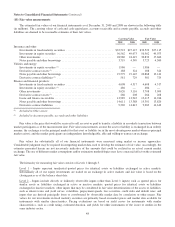

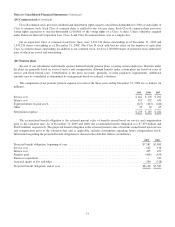

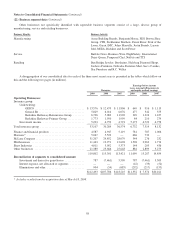

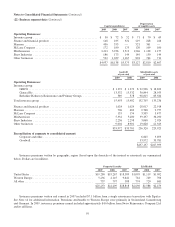

Financial assets and liabilities measured and carried at fair value on a recurring basis in our financial statements as of

December 31, 2009 and December 31, 2008 are summarized according to the hierarchy previously described as follows (in

millions).

Total

Fair Value

Quoted

Prices

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable Inputs

(Level 3)

December 31, 2009

Insurance and other:

Investments in fixed maturity securities .................. $32,523 $ 5,407 $26,596 $ 520

Investments in equity securities ......................... 56,562 56,169 89 304

Other investments ................................... 17,504 — — 17,504

Utilities and energy:

Investments in equity securities ......................... 1,986 1,986 — —

Net derivative contract (assets)/liabilities ................. 393 (1) 35 359

Finance and financial products:

Investments in fixed maturity securities .................. 4,608 — 4,210 398

Investments in equity securities ......................... 486 485 1 —

Other investments ................................... 1,058 — — 1,058

Net derivative contract liabilities ........................ 9,003 — 166 8,837

December 31, 2008

Insurance and other:

Investments in fixed maturity securities .................. $27,115 $ 4,961 $21,650 $ 504

Investments in equity securities ......................... 49,073 48,666 79 328

Other investments ................................... 8,223 — — 8,223

Utilities and energy:

Net derivative contract liabilities ........................ 405 — 2 403

Finance and financial products:

Investments in fixed maturity securities .................. 4,517 — 4,382 135

Net derivative contract liabilities ........................ 14,404 — 288 14,116

49