Berkshire Hathaway 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Property and casualty losses (Continued)

General Re and BHRG (Continued)

The timing of claim reporting to reinsurers is delayed in comparison with primary insurance. In some instances there are

multiple reinsurers assuming and ceding parts of an underlying risk causing multiple contractual intermediaries between us and

the primary insured. In these instances, the delays in reporting can be compounded. The relative impact of reporting delays on

the reinsurer varies depending on the type of coverage, contractual reporting terms and other factors. Contracts covering

casualty losses on a per occurrence excess basis may experience longer delays in reporting due to the length of the claim-tail as

regards to the underlying claim. In addition, ceding companies may not report claims to the reinsurer until they believe it is

reasonably possible that the reinsurer will be affected, usually determined as a function of its estimate of the claim amount as a

percentage of the reinsurance contract retention. However, the timing of reporting large per occurrence excess property losses or

property catastrophe losses may not vary significantly from primary insurance.

Under contracts where periodic premium and claims reports are required from ceding companies, such reports are

generally required at quarterly intervals which in the U.S. range from 30 to 90 days after the end of the accounting period.

Outside the U.S., reinsurance reporting practices vary. In certain countries clients report annually, often 90 to 180 days after the

end of the annual period. The different client reporting practices generally do not result in a significant increase in risk or

uncertainty as the actuarial reserving methodologies are adjusted to compensate for the delays.

Premium and loss data is provided to us through at least one intermediary (the primary insurer), so there is a risk that the

loss data provided is incomplete, inaccurate or outside the coverage terms. Information provided by ceding companies is

reviewed for completeness and compliance with the contract terms. Reinsurance contracts generally allow us to have access to

the cedant’s books and records with respect to the subject business and provide us the ability to conduct audits to determine the

accuracy and completeness of information. Audits are conducted as we deem them appropriate.

In the normal course of business, disputes with clients occasionally arise concerning whether certain claims are covered

under the reinsurance policies. We resolve most coverage disputes through the involvement of our claims department personnel

and the appropriate client personnel or by independent outside counsel. If disputes cannot be resolved, our contracts generally

specify whether arbitration, litigation, or alternative dispute resolution will be invoked. There are no coverage disputes at this

time for which an adverse resolution would likely have a material impact on our consolidated results of operations or financial

condition.

In summary, the scope, number and potential variability of assumptions required in estimating ultimate losses from

reinsurance contracts are more uncertain than primary property and casualty insurance due to the factors previously discussed.

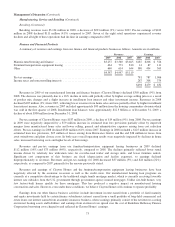

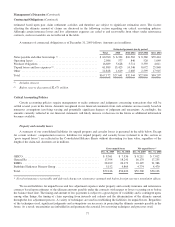

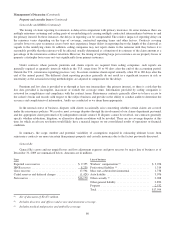

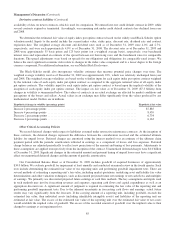

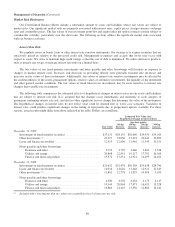

General Re

General Re’s gross and net unpaid losses and loss adjustment expenses and gross reserves by major line of business as of

December 31, 2009 are summarized below. Amounts are in millions.

Type Line of business

Reported case reserves ........................ $ 9,355 Workers’ compensation (1) ................... $ 3,076

IBNR reserves ............................... 8,239 Professional liability (2) ...................... 1,314

Gross reserves ............................... 17,594 Mass tort–asbestos/environmental ............. 1,738

Ceded reserves and deferred charges ............. (1,424) Auto liability .............................. 3,076

Net reserves ................................. $16,170 Other casualty (3) ........................... 2,968

Other general liability ....................... 2,890

Property .................................. 2,532

Total .................................... $17,594

(1) Net of discounts of $2,473 million.

(2) Includes directors and officers and errors and omissions coverage.

(3) Includes medical malpractice and umbrella coverage.

80