Berkshire Hathaway 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

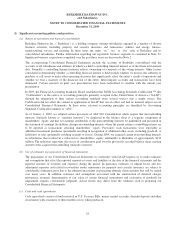

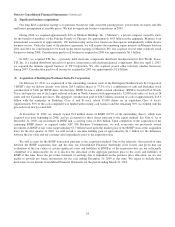

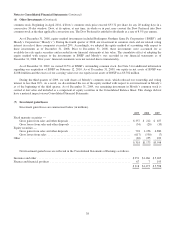

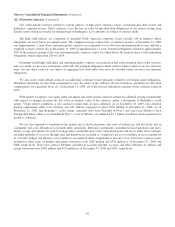

(2) Significant business acquisitions

Our long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on equity and able

and honest management at sensible prices. We had no significant business acquisitions in 2009.

During 2008, we acquired approximately 64% of Marmon Holdings, Inc. (“Marmon”), a private company owned by trusts

for the benefit of members of the Pritzker Family of Chicago, for approximately $4.8 billion in the aggregate. Marmon is an

international association of approximately 130 manufacturing and service businesses that operate independently within diverse

business sectors. Under the terms of the purchase agreement, we will acquire the remaining equity interests in Marmon between

2011 and 2014 for consideration to be based on the future earnings of Marmon. We also acquired several other relatively small

businesses during 2008. Consideration paid for all businesses acquired in 2008 was approximately $6.1 billion.

In 2007, we acquired TTI, Inc., a privately held electronic components distributor headquartered in Fort Worth, Texas.

TTI, Inc. is a leading distributor specialist of passive, interconnect and electromechanical components. Effective April 1, 2007,

we acquired the intimate apparel business of VF Corporation. We also acquired several other relatively smaller businesses

during 2007. Consideration paid for all businesses acquired in 2007 was approximately $1.6 billion.

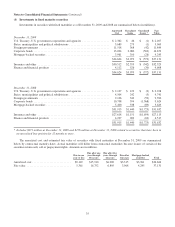

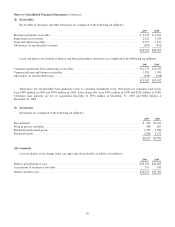

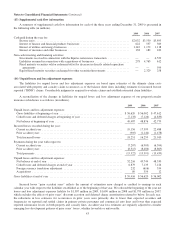

(3) Acquisition of Burlington Northern Santa Fe Corporation

On February 12, 2010, we acquired all of the outstanding common stock of the Burlington Northern Santa Fe Corporation

(“BNSF”) that we did not already own (about 264.5 million shares or 77.5%) for a combination of cash and Berkshire stock

consideration of $100 per BNSF share. On that date, BNSF became a wholly-owned subsidiary. BNSF is based in Fort Worth,

Texas and operates one of the largest railroad systems in North America with approximately 32,000 route miles of track in 28

states and two Canadian provinces. The aggregate consideration paid of $26.5 billion consisted of cash of approximately $15.9

billion with the remainder in Berkshire Class A and B stock (about 95,000 shares on an equivalent Class A basis).

Approximately 50% of the cash component was funded with existing cash balances and the remaining 50% was funded with the

proceeds from newly issued debt.

At December 31, 2009, we already owned 76.8 million shares of BNSF (22.5% of the outstanding shares), which were

acquired over time beginning in 2006, and we accounted for those shares pursuant to the equity method. See Note 6. As of

December 31, 2009, our investment in BNSF had a carrying value of $6.6 billion. Upon completion of the acquisition of the

remaining BNSF shares, as required under ASC 805 Business Combinations, we will re-measure our previously owned

investment in BNSF at fair value (approximately $7.7 billion based upon the market price of the BNSF stock at the acquisition

date). In the first quarter of 2010, we will record a one-time holding gain of approximately $1.1 billion for the difference

between the fair value and our carrying value immediately prior to the acquisition date.

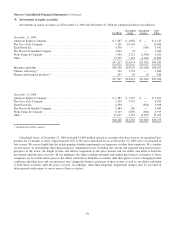

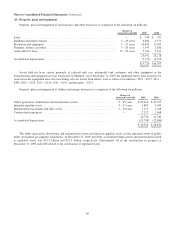

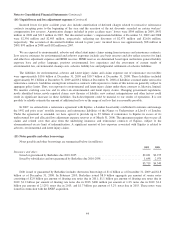

We will account for the BNSF transaction pursuant to the acquisition method. Due to the relatively short period of time

between the BNSF acquisition date and the date our Consolidated Financial Statements were issued, and given that our

evaluations of the fair values of certain significant assets and liabilities of BNSF as of the acquisition date are not sufficiently

completed, it is impracticable for us to disclose the allocation of the aggregate purchase price to the assets and liabilities of

BNSF at this time. Since the pro forma statement of earnings data is dependent on the purchase price allocation, we are also

unable to provide pro forma information for the year ending December 31, 2009 at this time. We expect to include these

disclosures in our interim Consolidated Financial Statements for the period ending March 31, 2010.

34