Berkshire Hathaway 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

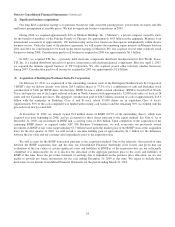

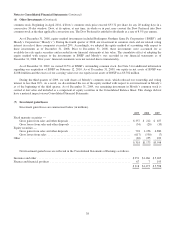

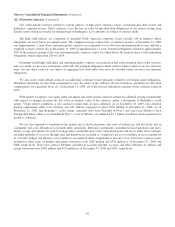

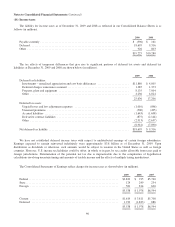

(8) Receivables

Receivables of insurance and other businesses are comprised of the following (in millions).

2009 2008

Insurance premiums receivable ............................................................. $ 5,295 $ 4,961

Reinsurance recoverables ................................................................. 2,922 3,235

Trade and other receivables ................................................................ 6,977 7,141

Allowances for uncollectible accounts ....................................................... (402) (412)

$14,792 $14,925

Loans and finance receivables of finance and financial products businesses are comprised of the following (in millions).

2009 2008

Consumer installment loans and finance receivables ............................................ $12,779 $13,190

Commercial loans and finance receivables .................................................... 1,558 1,050

Allowances for uncollectible loans .......................................................... (348) (298)

$13,989 $13,942

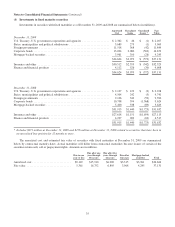

Allowances for uncollectible loans primarily relate to consumer installment loans. Provisions for consumer loan losses

were $380 million in 2009 and $305 million in 2008. Loan charge-offs were $335 million in 2009 and $215 million in 2008.

Consumer loan amounts are net of acquisition discounts of $594 million at December 31, 2009 and $684 million at

December 31, 2008.

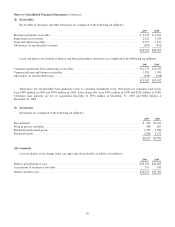

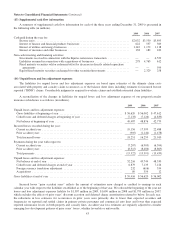

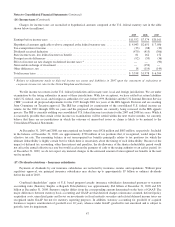

(9) Inventories

Inventories are comprised of the following (in millions).

2009 2008

Raw materials ............................................................................ $ 924 $1,161

Work in process and other ................................................................... 438 607

Finished manufactured goods ................................................................ 1,959 2,580

Purchased goods .......................................................................... 2,826 3,152

$6,147 $7,500

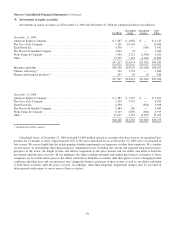

(10) Goodwill

A reconciliation of the change in the carrying value of goodwill is as follows (in millions).

2009 2008

Balance at beginning of year ............................................................... $33,781 $32,862

Acquisitions of businesses and other ........................................................ 191 919

Balance at end of year .................................................................... $33,972 $33,781

39