Berkshire Hathaway 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

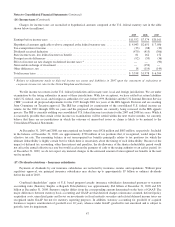

(15) Notes payable and other borrowings (Continued)

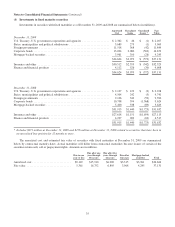

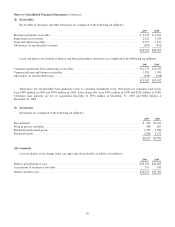

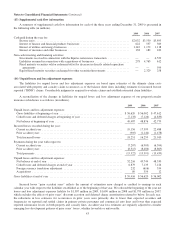

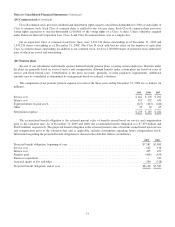

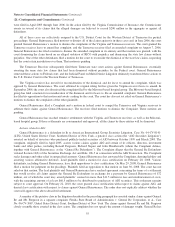

2009 2008

Utilities and energy:

Issued by MidAmerican Energy Holdings Company (“MidAmerican”) and its subsidiaries and not

guaranteed by Berkshire:

MidAmerican senior unsecured debt due 2012-2037 .................................... $ 5,371 $ 5,121

Subsidiary and other debt due 2010-2039 ............................................. 14,208 14,024

$19,579 $19,145

MidAmerican senior debt is unsecured and has a weighted average interest rate of about 6.2% as of December 31, 2009.

Subsidiary debt of utilities and energy businesses represents amounts issued by subsidiaries of MidAmerican pursuant to

separate financing agreements and has a weighted average interest rate of about 6% as of December 31, 2009. All or

substantially all of the assets of certain MidAmerican subsidiaries are or may be pledged or encumbered to support or otherwise

secure the debt. These borrowing arrangements generally contain various covenants including, but not limited to, leverage

ratios, interest coverage ratios and debt service coverage ratios. As of December 31, 2009, MidAmerican and its subsidiaries

were in compliance with all applicable covenants.

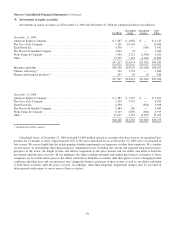

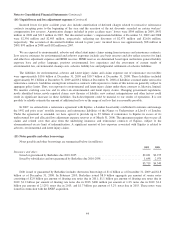

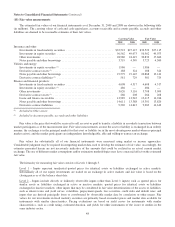

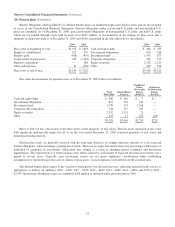

2009 2008

Finance and financial products:

Issued by Berkshire Hathaway Finance Corporation (“BHFC”) and guaranteed by Berkshire ........ $12,051 $10,778

Issued by other subsidiaries and guaranteed by Berkshire due 2010-2027 ....................... 776 706

Issued by other subsidiaries and not guaranteed by Berkshire 2010-2036 ........................ 1,784 1,904

$14,611 $13,388

BHFC is a 100% owned finance subsidiary of Berkshire, which has fully and unconditionally guaranteed its securities.

Debt issued by BHFC matures between 2010 and 2018 and has a weighted average interest rate of approximately 4.2% as of

December 31, 2009. In January 2010, BHFC issued $1 billion par amount of senior notes consisting of $750 million par of

5.75% notes due in 2040 and $250 million par of floating rate notes due in 2012. In January 2010, BHFC repaid $1.5 billion par

amount of senior notes that matured.

Our subsidiaries have approximately $4.7 billion of available unused lines of credit and commercial paper capacity in the

aggregate to support our short-term borrowing programs and provide additional liquidity. Generally, Berkshire’s guarantee of a

subsidiary’s debt obligation is an absolute, unconditional and irrevocable guarantee for the full and prompt payment when due

of all present and future payment obligations of the issuer.

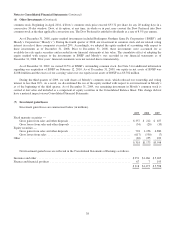

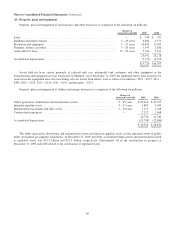

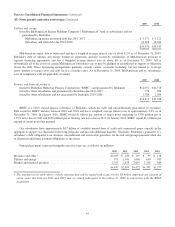

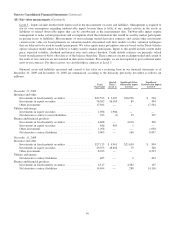

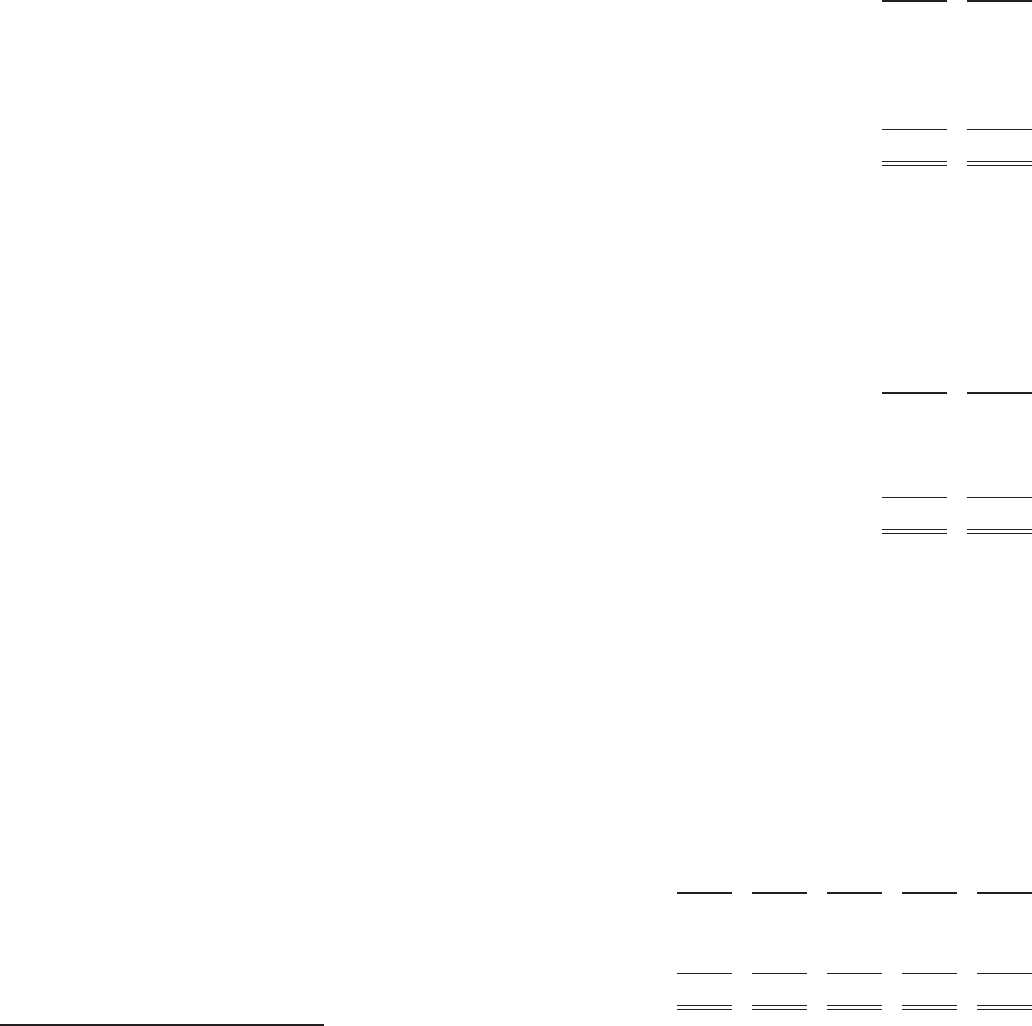

Principal payments expected during the next five years are as follows (in millions).

2010 2011 2012 2013 2014

Insurance and other * ................................................ $2,015 $ 120 $ 107 $ 99 $ 118

Utilities and energy ................................................. 371 1,141 1,666 650 970

Finance and financial products ......................................... 2,251 1,638 2,649 3,556 489

$4,637 $2,899 $4,422 $4,305 $1,577

*The amounts in the table above exclude amounts that will be repaid with respect to the $8 billion aggregate par amount of

senior notes due between 2011 and 2015 that we issued subsequent to December 31, 2009 in connection with the BNSF

acquisition.

45