Berkshire Hathaway 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

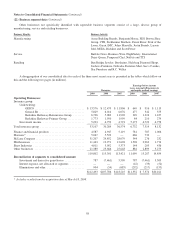

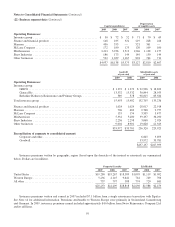

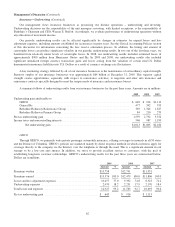

Notes to Consolidated Financial Statements (Continued)

(21) Contingencies and Commitments (Continued)

answered the Complaint, denying liability and asserting various affirmative defenses. No trial date has been established. The parties

are coordinating discovery and other proceedings among this action, a similar action filed by the same plaintiff against AIG and others,

the class action described in the preceding paragraph, and the shareholder derivative actions described in the next two paragraphs.

On July 27, 2005, General Reinsurance received a Summons and a Verified and Amended Shareholder Derivative

Complaint in In re American International Group, Inc. Derivative Litigation, Case No. 04-CV-08406, United States District

Court, Southern District of New York. The complaint, brought by several alleged shareholders of AIG, seeks damages,

injunctive and declaratory relief against various officers and directors of AIG as well as a variety of individuals and entities with

whom AIG did business, relating to a wide variety of allegedly wrongful practices by AIG. The allegations relating to General

Reinsurance focus on the AIG Transaction, and the complaint purports to assert causes of action in connection with that

transaction for aiding and abetting other defendants’ breaches of fiduciary duty and for unjust enrichment. The complaint does

not specify the amount of damages or the nature of any other relief sought. This derivative litigation was stayed by stipulation

between the plaintiffs and AIG. That stay remains in place.

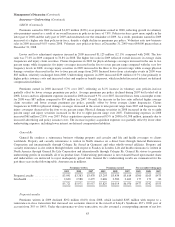

In August 2005, General Reinsurance received a Summons and First Amended Consolidated Shareholders’ Derivative

Complaint in In re American International Group, Inc. Consolidated Derivative Litigation, Case No. 769-N, Delaware Chancery

Court. In June 2007, AIG filed an Amended Complaint in the Delaware Derivative Litigation asserting claims against two of its

former officers, but not against General Reinsurance. On September 28, 2007, AIG and the shareholder plaintiffs filed a Second

Combined Amended Complaint, in which AIG asserted claims against certain of its former officers and the shareholder

plaintiffs asserted claims against a number of other defendants, including General Reinsurance and General Re. The claims

asserted in the Delaware complaint are substantially similar to those asserted in the New York derivative complaint, except that

the Delaware complaint makes clear that the plaintiffs are asserting claims against both General Reinsurance and General Re.

General Reinsurance and General Re filed a motion to dismiss on November 30, 2007. On July 13, 2009, the Delaware

Chancery Court entered judgment dismissing with prejudice the claims asserted against General Re, General Reinsurance and

certain other defendants in the matter. Plaintiffs have appealed the judgment. General Re and General Reinsurance are

vigorously opposing that appeal.

FAI/HIH Matter

In December 2003, the Liquidators of both FAI Insurance Limited (“FAI”) and HIH Insurance Limited (“HIH”) advised General

Reinsurance Australia Limited (“GRA”) and Kölnische Rückversicherungs-Gesellschaft AG (“Cologne Re”) that they intended to

assert claims arising from insurance transactions GRA entered into with FAI in May and June 1998. In August 2004, the Liquidators

filed claims in the Supreme Court of New South Wales in order to avoid the expiration of a statute of limitations for certain plaintiffs.

The focus of the Liquidators’ allegations against GRA and Cologne Re are the 1998 transactions GRA entered into with FAI (which

was acquired by HIH in 1999). The Liquidators contend, among other things, that GRA and Cologne Re engaged in deceptive conduct

that assisted FAI in improperly accounting for such transactions as reinsurance, and that such deception led to HIH’s acquisition of

FAI and caused various losses to FAI and HIH. The Liquidator of HIH served its Complaint on GRA and Cologne Re in June 2006

and discovery has been ongoing. The FAI Liquidator dismissed his complaint against GRA and Cologne Re. GRA and Cologne Re

have entered into a settlement in principle with the HIH Liquidator, which remains subject to court approval.

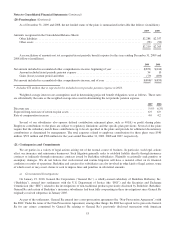

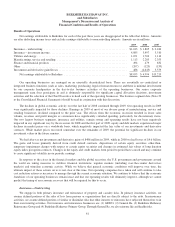

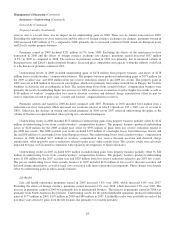

We have established reserves for certain of the legal proceedings discussed above where we have concluded that the

likelihood of an unfavorable outcome is probable and the amount of the loss can be reasonably estimated. For other legal

proceedings discussed above, either we have determined that an unfavorable outcome is reasonably possible but we are unable

to estimate a range of possible losses or we are unable to predict the outcome of the matter. We believe that any liability that

may arise as a result of current pending civil litigation, including the matters discussed above, will not have a material effect on

our financial condition or results of operations.

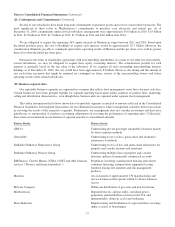

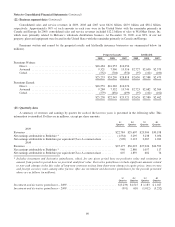

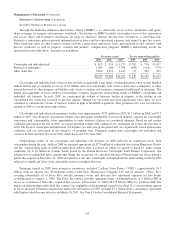

c) Commitments

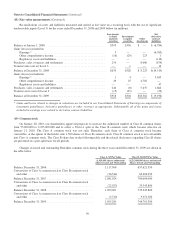

We lease certain manufacturing, warehouse, retail and office facilities as well as certain equipment. Rent expense for all

leases was $701 million in 2009, $725 million in 2008 and $648 million in 2007. Minimum rental payments for operating leases

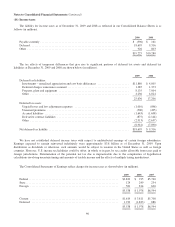

having initial or remaining non-cancelable terms in excess of one year are as follows. Amounts are in millions.

2010 2011 2012 2013 2014

After

2014 Total

$577 $461 $379 $290 $230 $1,049 $2,986

56