Berkshire Hathaway 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Investment and Derivative Gains/Losses (Continued)

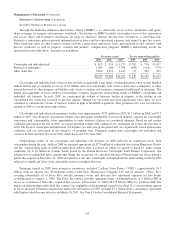

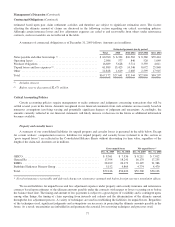

With respect to equity securities with gross unrealized losses at December 31, 2009 and where other-than-temporary

impairments were not recorded at December 31, 2009, approximately 90% of the losses were concentrated in four issuers.

Unrealized losses were no greater than 30% of cost. In our judgment, the future earnings potential and underlying business

economics of these companies are favorable and as of December 31, 2009, we possessed the ability and intent to hold these

securities until their prices recover. Changing market conditions and other facts and circumstances may change the business

prospects of these issuers as well as our ability and intent to hold these securities until the prices recover. Accordingly, we may

record other-than-temporary impairment charges in future periods with respect to one or more of these securities.

Derivative gains/losses primarily represent the changes in fair value of our credit default and equity index put option

contracts. Changes in the fair values of these contracts are reflected in earnings and can be significant, reflecting the volatility of

equity and credit markets. We do not view the periodic gains or losses from the changes in fair value as meaningful given the

volatile nature of equity and credit markets over short periods of time, particularly with respect to equity index put option

contracts.

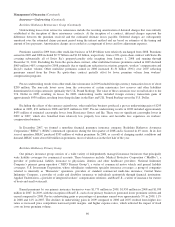

The fair values of our credit default contracts are impacted by changes in credit default spreads, which have been volatile

in recent periods. In the first quarter of 2009, we increased our estimates of credit default liabilities, which produced a pre-tax

loss of approximately $1.35 billion. This loss resulted from several corporate defaults and the widening of credit default

spreads, primarily with respect to the underlying non-investment grade issuers included in our high yield contracts. These

non-investment grade issuers are typically highly leveraged and therefore dependent on having ongoing access to the capital

markets. The freezing of the credit markets in late 2008 and early 2009 was particularly detrimental to these issuers. As a result,

there were a number of defaults in 2009 and we made loss payments of approximately $1.9 billion. Over the last nine months of

2009, credit default spreads narrowed significantly and the estimated values of our liabilities declined resulting in pre-tax gains

of approximately $2.14 billion.

The losses from our credit default contracts in 2008 derived primarily from increases in the fair value of our liabilities due

to a significant widening of credit default spreads during the fourth quarter of 2008. The estimated fair value of credit default

contracts at December 31, 2008 was $4.1 billion, an increase of $2.3 billion from December 31, 2007. The year-to-date increase

included fair value pre-tax losses of $1.8 billion and premiums from contracts entered into in 2008 of $633 million, partially

offset by loss payments of $152 million.

In 2009, our gains on equity index put option contracts were $2.7 billion, compared to losses of $5.0 billion in 2008. The

gains in 2009 reflected increases in the underlying equity indexes ranging from approximately 19% to 23%, partially offset by

the impact of a weaker U.S. Dollar on non-U.S. contracts and lower interest rates. These factors combined to produce a decrease

in our estimated liabilities. The losses in 2008 reflected declines of between 30% and 45% in underlying indexes. During the

fourth quarter of 2008, these indexes declined between 10% and 22%. Our ultimate payment obligations, if any, under equity

index put option contracts will be determined as of the contract expiration dates, which begin in 2018. As previously noted, we

do not believe that the gains or losses reflected in earnings in the past two years to be meaningful relative to evaluating our

ultimate payment obligations, if any. There have been no loss payments to date.

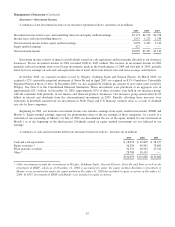

Financial Condition

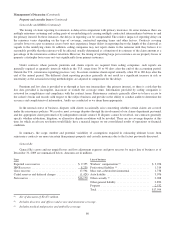

Our balance sheet continues to reflect significant liquidity and financial strength. Our consolidated shareholders’ equity

increased $21.8 billion during 2009 to $131.1 billion at December 31, 2009. Our consolidated cash and invested assets,

excluding assets of utilities and energy and finance and financial products businesses, was approximately $146.0 billion at

December 31, 2009 (including cash and cash equivalents of $27.9 billion) and $118.9 billion at December 31, 2008 (including

cash and cash equivalents of $24.3 billion). Our invested assets are held predominantly in our insurance businesses.

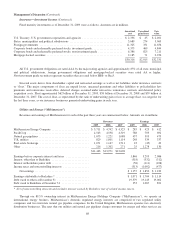

In 2009, we acquired a 12% convertible perpetual security issued by Swiss Re for $2.7 billion, an 8.5% Cumulative

Convertible Perpetual Preferred Stock of Dow for $3 billion and senior notes of Wrigley due in 2013 and 2014 for $1.0 billion.

Investment income generated by these investments will greatly exceed income currently earned on short-term investments.

75