Berkshire Hathaway 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Insurance

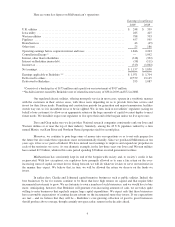

Our property-casualty (P/C) insurance business has been the engine behind Berkshire’s growth and will

continue to be. It has worked wonders for us. We carry our P/C companies on our books at $15.5 billion more

than their net tangible assets, an amount lodged in our “Goodwill” account. These companies, however, are

worth far more than their carrying value – and the following look at the economic model of the P/C industry will

tell you why.

Insurers receive premiums upfront and pay claims later. In extreme cases, such as those arising from

certain workers’ compensation accidents, payments can stretch over decades. This collect-now, pay-later model

leaves us holding large sums – money we call “float” – that will eventually go to others. Meanwhile, we get to

invest this float for Berkshire’s benefit. Though individual policies and claims come and go, the amount of float

we hold remains remarkably stable in relation to premium volume. Consequently, as our business grows, so does

our float.

If premiums exceed the total of expenses and eventual losses, we register an underwriting profit that

adds to the investment income produced from the float. This combination allows us to enjoy the use of free

money – and, better yet, get paid for holding it. Alas, the hope of this happy result attracts intense competition,

so vigorous in most years as to cause the P/C industry as a whole to operate at a significant underwriting loss.

This loss, in effect, is what the industry pays to hold its float. Usually this cost is fairly low, but in some

catastrophe-ridden years the cost from underwriting losses more than eats up the income derived from use of

float.

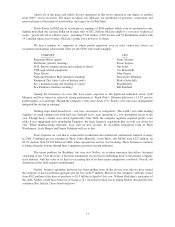

In my perhaps biased view, Berkshire has the best large insurance operation in the world. And I will

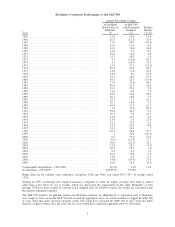

absolutely state that we have the best managers. Our float has grown from $16 million in 1967, when we entered

the business, to $62 billion at the end of 2009. Moreover, we have now operated at an underwriting profit for

seven consecutive years. I believe it likely that we will continue to underwrite profitably in most – though

certainly not all – future years. If we do so, our float will be cost-free, much as if someone deposited $62 billion

with us that we could invest for our own benefit without the payment of interest.

Let me emphasize again that cost-free float is not a result to be expected for the P/C industry as a

whole: In most years, premiums have been inadequate to cover claims plus expenses. Consequently, the

industry’s overall return on tangible equity has for many decades fallen far short of that achieved by the S&P

500. Outstanding economics exist at Berkshire only because we have some outstanding managers running some

unusual businesses. Our insurance CEOs deserve your thanks, having added many billions of dollars to

Berkshire’s value. It’s a pleasure for me to tell you about these all-stars.

************

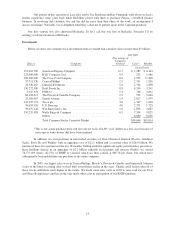

Let’s start at GEICO, which is known to all of you because of its $800 million annual advertising

budget (close to twice that of the runner-up advertiser in the auto insurance field). GEICO is managed by Tony

Nicely, who joined the company at 18. Now 66, Tony still tap-dances to the office every day, just as I do at 79.

We both feel lucky to work at a business we love.

GEICO’s customers have warm feelings toward the company as well. Here’s proof: Since Berkshire

acquired control of GEICO in 1996, its market share has increased from 2.5% to 8.1%, a gain reflecting the net

addition of seven million policyholders. Perhaps they contacted us because they thought our gecko was cute, but

they bought from us to save important money. (Maybe you can as well; call 1-800-847-7536 or go to

www.GEICO.com.) And they’ve stayed with us because they like our service as well as our price.

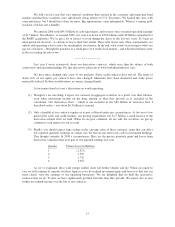

Berkshire acquired GEICO in two stages. In 1976-80 we bought about one-third of the company’s

stock for $47 million. Over the years, large repurchases by the company of its own shares caused our position to

grow to about 50% without our having bought any more shares. Then, on January 2, 1996, we acquired the

remaining 50% of GEICO for $2.3 billion in cash, about 50 times the cost of our original purchase.

6