Berkshire Hathaway 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

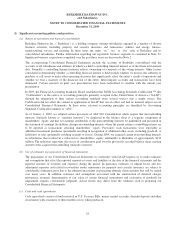

(1) Significant accounting policies and practices (Continued)

(d) Investments

We determine the appropriate classification of investments in fixed maturity and equity securities at the acquisition

date and re-evaluate the classification at each balance sheet date. Held-to-maturity investments are carried at

amortized cost, reflecting the ability and intent to hold the securities to maturity. Trading investments are carried at

fair value and include securities acquired with the intent to sell in the near term. All other securities are classified as

available-for-sale and are carried at fair value with net unrealized gains or losses reported as a component of

accumulated other comprehensive income.

We utilize the equity method of accounting with respect to investments when we possess the ability to exercise

significant influence, but not control, over the operating and financial policies of the investee. The ability to exercise

significant influence is presumed when an investor possesses more than 20% of the voting interests of the investee.

This presumption may be overcome based on specific facts and circumstances that demonstrate that the ability to

exercise significant influence is restricted. We apply the equity method to investments in common stock and to other

investments when such other investments possess substantially identical subordinated interests to common stock. In

applying the equity method with respect to investments previously accounted for at cost or fair value, the carrying

value of the investment is adjusted on a step-by-step basis as if the equity method had been applied from the time the

investment was first acquired.

In applying the equity method, we record our investment at cost and subsequently increase or decrease the carrying

amount of investment by our proportionate share of the net earnings or losses and other comprehensive income of the

investee. We record dividends or other equity distributions as reductions in the carrying value of the investment. In the

event that net losses of the investee reduce the carrying amount to zero, additional net losses may be recorded if other

investments in the investee are at-risk even if we have not committed to provide financial support to the investee.

Such additional equity method losses, if any, are based upon the change in our claim on the investee’s book value.

Investment gains and losses arise when investments are sold (as determined on a specific identification basis) or are

other-than-temporarily impaired. If a decline in the value of an investment below cost is deemed other than temporary,

the cost of the investment is written down to fair value, with a corresponding charge to earnings. Factors considered in

judging whether an impairment is other than temporary include: the financial condition, business prospects and

creditworthiness of the issuer, the length of time that fair value has been less than cost, the relative amount of the

decline and our ability and intent to hold the investment until the fair value recovers.

Effective April 1, 2009, the FASB amended the provisions of ASC 320 Investments – Debt and Equity Securities

relating to the recognition, measurement and presentation for other-than-temporary impairments of debt securities and

changed certain disclosure requirements. With respect to an investment in a debt security, an other-than-temporary

impairment is recognized if the investor (a) intends to sell or expects to be required to sell the debt security before

amortized cost is recovered or (b) does not expect to ultimately recover the amortized cost basis even if it does not

intend to sell the security. Losses under (a) are recognized in earnings. Under (b) the credit loss component is

recognized in earnings and any difference between fair value and the amortized cost basis net of the credit loss is

reflected in other comprehensive income. The adoption of this amendment did not have a material impact on our

Consolidated Financial Statements.

(e) Loans and finance receivables

Loans and finance receivables consist of commercial and consumer loans originated or purchased. Loans and finance

receivables are stated at amortized cost based on our ability and intent to hold such loans and receivables to maturity

and are net of allowances for uncollectible accounts. Amortized cost represents acquisition cost, plus or minus

origination and commitment costs paid or fees received, which together with acquisition premiums or discounts are

deferred and amortized as yield adjustments over the life of the loan.

Allowances for estimated losses from uncollectible loans are recorded when it is probable that the counterparty will be

unable to pay all amounts due according to the terms of the loan. Allowances are provided on aggregations of

consumer loans with similar characteristics and terms based upon historical loss and recovery experience, delinquency

rates and current economic conditions. Provisions for loan losses are charged to earnings.

29