Berkshire Hathaway 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

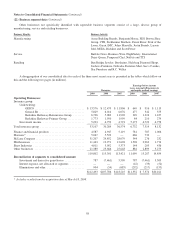

Insurance—Investment Income

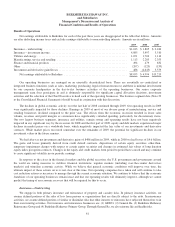

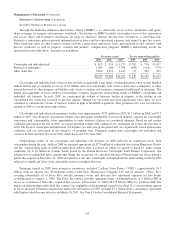

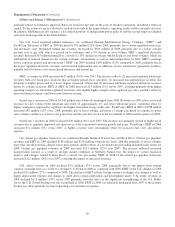

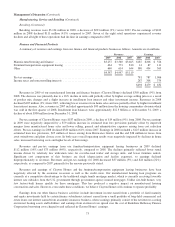

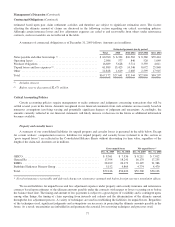

A summary of net investment income of our insurance operations follows. Amounts are in millions.

2009 2008 2007

Investment income before taxes, noncontrolling interests and equity method earnings ............ $5,173 $4,722 $4,758

Income taxes and noncontrolling interests ............................................... 1,515 1,225 1,248

Net investment income before equity method earnings ..................................... 3,658 3,497 3,510

Equity method earnings ............................................................. 427 — —

Net investment income .............................................................. $4,085 $3,497 $3,510

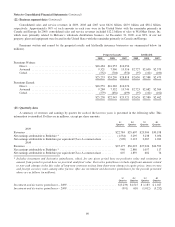

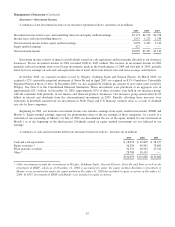

Investment income consists of interest and dividends earned on cash equivalents and investments allocable to our insurance

businesses. Pre-tax investment income in 2009 exceeded 2008 by $451 million. The increase in investment income in 2009

primarily reflected earnings from several large investments made in the fourth quarter of 2008 and first half of 2009, partially

offset by lower earnings on cash and cash equivalents due to lower short-term interest rates and lower average cash balances.

In October 2008, we acquired securities issued by Wrigley, Goldman Sachs and General Electric. In March 2009, we

acquired a 12% convertible perpetual instrument of Swiss Re and in April 2009, we acquired an 8.5% Cumulative Convertible

Perpetual Preferred Stock of Dow. In December 2009, we also acquired $1.0 billion par amount of new senior notes issued by

Wrigley. See Note 6 to the Consolidated Financial Statements. These investments were purchased at an aggregate cost of

approximately $21.1 billion. At December 31, 2009, approximately 85% of these securities were held in our insurance group,

with the remainder held primarily in our finance and financial products businesses. Our insurance group earned about $1.65

billion in interest and dividends from the aforementioned investments in 2009. Partially offsetting these increases were

reductions in dividends earned from our investments in Wells Fargo and U.S. Bancorp common stock as a result of dividend

rate cuts by those companies.

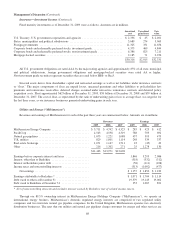

Beginning in 2009, our insurance investment income also includes earnings from equity method investments (BNSF and

Moody’s). Equity method earnings represent our proportionate share of the net earnings of these companies. As a result of a

reduction of our ownership of Moody’s in July of 2009, we discontinued the use of the equity method for our investment in

Moody’s as of the beginning of the third quarter. Dividends earned on equity method investments are not reflected in our

earnings.

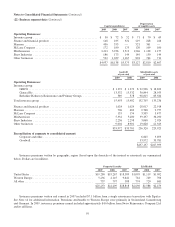

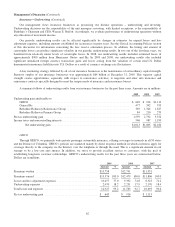

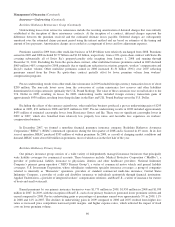

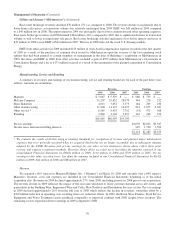

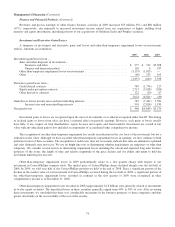

A summary of cash and investments held in our insurance businesses follows. Amounts are in millions.

2009 2008 2007

Cash and cash equivalents ..................................................... $ 18,655 $ 18,845 $ 28,257

Equity securities * ........................................................... 56,289 48,892 74,681

Fixed maturity securities ...................................................... 32,331 26,932 27,922

Other * .................................................................... 28,780 18,419 —

$136,055 $113,088 $130,860

*Other investments include the investments in Wrigley, Goldman Sachs, General Electric, Swiss Re and Dow as well as the

investment in BNSF, which as of December 31, 2008 is accounted for under the equity method. Berkshire’s investment in

Moody’s was accounted for under the equity method at December 31, 2008 but included in equity securities at December 31,

2009. In 2007, investments in BNSF and Moody’s are included in equity securities.

67