Berkshire Hathaway 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

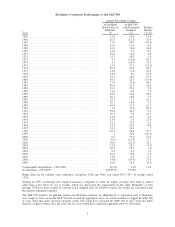

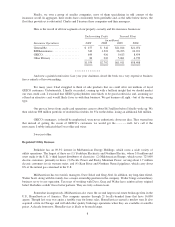

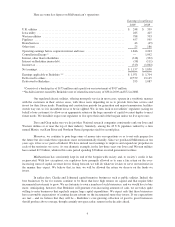

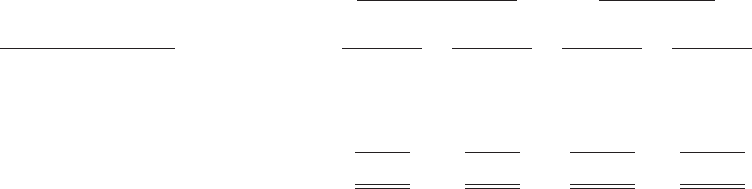

Finally, we own a group of smaller companies, most of them specializing in odd corners of the

insurance world. In aggregate, their results have consistently been profitable and, as the table below shows, the

float they provide us is substantial. Charlie and I treasure these companies and their managers.

Here is the record of all four segments of our property-casualty and life insurance businesses:

Underwriting Profit Yearend Float

(in millions)

Insurance Operations 2009 2008 2009 2008

General Re ...................... $ 477 $ 342 $21,014 $21,074

BH Reinsurance .................. 349 1,324 26,223 24,221

GEICO ......................... 649 916 9,613 8,454

Other Primary ................... 84 210 5,061 4,739

$1,559 $2,792 $61,911 $58,488

************

And now a painful confession: Last year your chairman closed the book on a very expensive business

fiasco entirely of his own making.

For many years I had struggled to think of side products that we could offer our millions of loyal

GEICO customers. Unfortunately, I finally succeeded, coming up with a brilliant insight that we should market

our own credit card. I reasoned that GEICO policyholders were likely to be good credit risks and, assuming we

offered an attractive card, would likely favor us with their business. We got business all right – but of the wrong

type.

Our pre-tax losses from credit-card operations came to about $6.3 million before I finally woke up. We

then sold our $98 million portfolio of troubled receivables for 55¢ on the dollar, losing an additional $44 million.

GEICO’s managers, it should be emphasized, were never enthusiastic about my idea. They warned me

that instead of getting the cream of GEICO’s customers we would get the –––––well, let’s call it the

non-cream. I subtly indicated that I was older and wiser.

I was just older.

Regulated Utility Business

Berkshire has an 89.5% interest in MidAmerican Energy Holdings, which owns a wide variety of

utility operations. The largest of these are (1) Yorkshire Electricity and Northern Electric, whose 3.8 million end

users make it the U.K.’s third largest distributor of electricity; (2) MidAmerican Energy, which serves 725,000

electric customers, primarily in Iowa; (3) Pacific Power and Rocky Mountain Power, serving about 1.7 million

electric customers in six western states; and (4) Kern River and Northern Natural pipelines, which carry about

8% of the natural gas consumed in the U.S.

MidAmerican has two terrific managers, Dave Sokol and Greg Abel. In addition, my long-time friend,

Walter Scott, along with his family, has a major ownership position in the company. Walter brings extraordinary

business savvy to any operation. Ten years of working with Dave, Greg and Walter have reinforced my original

belief: Berkshire couldn’t have better partners. They are truly a dream team.

Somewhat incongruously, MidAmerican also owns the second largest real estate brokerage firm in the

U.S., HomeServices of America. This company operates through 21 locally-branded firms that have 16,000

agents. Though last year was again a terrible year for home sales, HomeServices earned a modest sum. It also

acquired a firm in Chicago and will add other quality brokerage operations when they are available at sensible

prices. A decade from now, HomeServices is likely to be much larger.

8