Berkshire Hathaway 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our BNSF operation, it should be noted, has certain important economic characteristics that resemble

those of our electric utilities. In both cases we provide fundamental services that are, and will remain, essential to

the economic well-being of our customers, the communities we serve, and indeed the nation. Both will require

heavy investment that greatly exceeds depreciation allowances for decades to come. Both must also plan far

ahead to satisfy demand that is expected to outstrip the needs of the past. Finally, both require wise regulators

who will provide certainty about allowable returns so that we can confidently make the huge investments

required to maintain, replace and expand the plant.

We see a “social compact” existing between the public and our railroad business, just as is the case

with our utilities. If either side shirks its obligations, both sides will inevitably suffer. Therefore, both parties to

the compact should – and we believe will – understand the benefit of behaving in a way that encourages good

behavior by the other. It is inconceivable that our country will realize anything close to its full economic

potential without its possessing first-class electricity and railroad systems. We will do our part to see that they

exist.

In the future, BNSF results will be included in this “regulated utility” section. Aside from the two

businesses having similar underlying economic characteristics, both are logical users of substantial amounts of

debt that is not guaranteed by Berkshire. Both will retain most of their earnings. Both will earn and invest large

sums in good times or bad, though the railroad will display the greater cyclicality. Overall, we expect this

regulated sector to deliver significantly increased earnings over time, albeit at the cost of our investing many tens

– yes, tens – of billions of dollars of incremental equity capital.

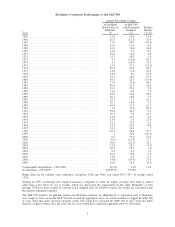

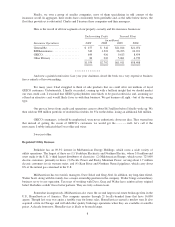

Manufacturing, Service and Retailing Operations

Our activities in this part of Berkshire cover the waterfront. Let’s look, though, at a summary balance

sheet and earnings statement for the entire group.

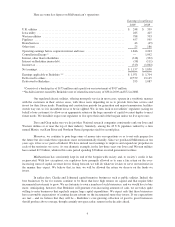

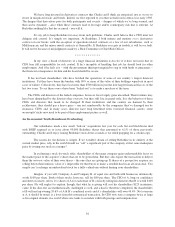

Balance Sheet 12/31/09 (in millions)

Assets

Cash and equivalents ................. $ 3,018

Accounts and notes receivable .......... 5,066

Inventory .......................... 6,147

Other current assets .................. 625

Total current assets ................... 14,856

Goodwill and other intangibles ......... 16,499

Fixed assets ........................ 15,374

Other assets ........................ 2,070

$48,799

Liabilities and Equity

Notes payable ....................... $ 1,842

Other current liabilities ............... 7,414

Total current liabilities ................ 9,256

Deferred taxes ...................... 2,834

Term debt and other liabilities .......... 6,240

Equity ............................. 30,469

$48,799

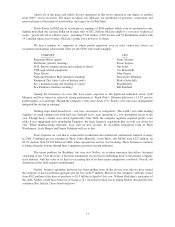

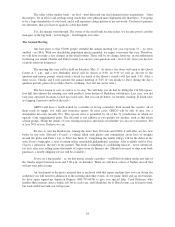

Earnings Statement (in millions)

2009 2008 2007

Revenues ......................................................... $61,665 $66,099 $59,100

Operating expenses (including depreciation of $1,422 in 2009, $1,280 in 2008

and $955 in 2007) ................................................. 59,509 61,937 55,026

Interest expense .................................................... 98 139 127

Pre-tax earnings .................................................... 2,058* 4,023* 3,947*

Income taxes and minority interests ..................................... 945 1,740 1,594

Net income ........................................................ $ 1,113 $ 2,283 $ 2,353

*Does not include purchase-accounting adjustments.

10