Berkshire Hathaway 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Financial Condition (Continued)

Notes payable and other borrowings of our insurance and other businesses declined $630 million in 2009 to approximately

$3.7 billion at December 31. The decline was primarily due to a combination of term debt maturities and a reduction in short-

term borrowings.

On February 12, 2010, we completed the acquisition of BNSF by acquiring the outstanding shares of BNSF that we did not

already own for aggregate consideration of approximately $26.5 billion ($100 per BNSF share). The aggregate consideration

consisted of a combination of $15.9 billion in cash and about 95,000 equivalent Class A shares of Berkshire common stock. In

connection with the BNSF acquisition, we issued $8.0 billion aggregate par amount of senior notes consisting of $2.0 billion par

amount of notes due in 2011; $1.7 billion par amount of notes due in 2012; $2.6 billion par amount of notes due in 2013; and

$1.7 billion par amount of notes due in 2015. In connection with its railroad operations, BNSF regularly issues debt to finance

capital expenditures and for other corporate purposes. We expect this practice to continue after our acquisition. As of

December 31, 2009, BNSF had debt outstanding of about $10.3 billion. We do not intend to provide guarantees on BNSF debt

outstanding at the acquisition date or issued in the future.

Capital expenditures of our utilities and energy businesses in 2009 were approximately $3.4 billion and are currently

forecasted to be approximately $2.6 billion in 2010. We expect MidAmerican and its operating subsidiaries to fund future

capital expenditures with cash flows from operations and debt proceeds. MidAmerican’s borrowings were $19.6 billion at

December 31, 2009, an increase of $434 million from December 31, 2008. MidAmerican and its operating subsidiaries currently

have no significant debt maturities until 2011, when about $1.1 billion matures. We have committed until February 28, 2011 to

provide up to $3.5 billion of additional capital to MidAmerican to permit the repayment of its debt obligations or to fund its

regulated utility subsidiaries. Berkshire does not intend to guarantee the repayment of debt by MidAmerican or any of its

subsidiaries.

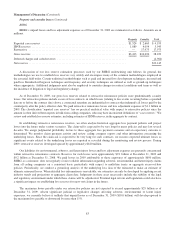

Assets of the finance and financial products businesses, which consisted primarily of loans and finance receivables, fixed

maturity securities, other investments and cash and cash equivalents, were approximately $29.0 billion as of December 31, 2009

and $27.1 billion at December 31, 2008. Our finance and financial products liabilities were $26.4 billion as of December 31,

2009 and $30.7 billion at December 31, 2008. The decline in liabilities was primarily attributable to a decrease of $5.3 billion in

derivative contract liabilities. As of December 31, 2009, notes payable and other borrowings of $14.6 billion included

approximately $12.1 billion par amount of medium-term notes issued by Berkshire Hathaway Finance Corporation (“BHFC”), a

wholly-owned finance subsidiary of Berkshire. The BHFC notes that were outstanding at December 31, 2009, are unsecured and

mature at various dates between 2010 and 2018. The proceeds from the medium-term notes were used to finance originated and

acquired loans of Clayton Homes. The full and timely payment of principal and interest on the notes is guaranteed by Berkshire.

In January 2010, BHFC repaid $1.5 billion of its maturing notes and issued new notes consisting of $250 million par amount

due in 2012 and $750 million par amount due in 2040.

During 2008 and continuing into the first part of 2009, access to credit markets became limited as a consequence of the

worldwide credit crisis. As a result, interest rates for investment grade corporate issuers increased relative to government

obligations, even for companies with strong credit histories and ratings. However, we believe that the credit crisis has abated

and interest rates for investment grade issuers relative to government obligations have declined. Nevertheless, restricted access

to credit markets at affordable rates in the future could have a significant negative impact on our operations, particularly the

utilities and energy and the finance and financial products operations. We believe we currently maintain ample liquidity to cover

our existing contractual obligations and provide for contingent liquidity needs.

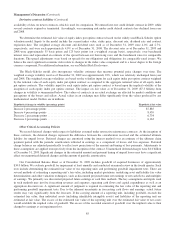

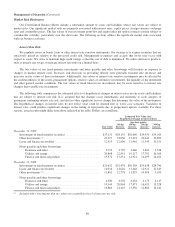

Contractual Obligations

We regularly enter into contracts, which obligate us to make cash payments to counterparties in future periods. Contractual

obligations arise under financing and other agreements, which are reflected in our Consolidated Financial Statements and other

long-term contracts to acquire goods or services in the future, which are not currently reflected in our financial statements. Such

obligations, including future minimum rentals under operating leases, will be reflected in future periods as the goods are

delivered or services provided. Amounts due as of the balance sheet date for purchases where the goods and services have been

received and a liability incurred are not included to the extent that such amounts are due within one year of the balance sheet

date.

The obligations of our insurance businesses to make payments of losses and loss adjustment expenses arising under

property and casualty insurance contracts are estimates. The timing and amount of such payments are contingent upon the

outcome of claim settlement activities that will occur over many years. The amounts presented in the following table were

76