Berkshire Hathaway 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

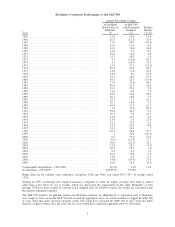

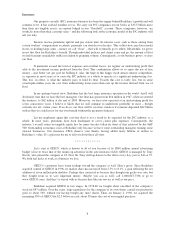

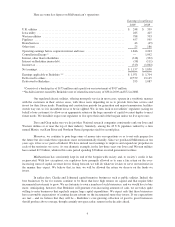

Here are some key figures on MidAmerican’s operations:

Earnings (in millions)

2009 2008

U.K. utilities ............................................................ $ 248 $ 339

Iowa utility ............................................................. 285 425

Western utilities ......................................................... 788 703

Pipelines ............................................................... 457 595

HomeServices ........................................................... 43 (45)

Other (net) .............................................................. 25 186

Operating earnings before corporate interest and taxes ........................... 1,846 2,203

Constellation Energy * .................................................... — 1,092

Interest, other than to Berkshire ............................................. (318) (332)

Interest on Berkshire junior debt ............................................. (58) (111)

Income tax .............................................................. (313) (1,002)

Net earnings ............................................................. $ 1,157 $ 1,850

Earnings applicable to Berkshire ** .......................................... $ 1,071 $ 1,704

Debt owed to others ....................................................... 19,579 19,145

Debt owed to Berkshire .................................................... 353 1,087

*Consists of a breakup fee of $175 million and a profit on our investment of $917 million.

**Includes interest earned by Berkshire (net of related income taxes) of $38 in 2009 and $72 in 2008.

Our regulated electric utilities, offering monopoly service in most cases, operate in a symbiotic manner

with the customers in their service areas, with those users depending on us to provide first-class service and

invest for their future needs. Permitting and construction periods for generation and major transmission facilities

stretch way out, so it is incumbent on us to be far-sighted. We, in turn, look to our utilities’ regulators (acting on

behalf of our customers) to allow us an appropriate return on the huge amounts of capital we must deploy to meet

future needs. We shouldn’t expect our regulators to live up to their end of the bargain unless we live up to ours.

Dave and Greg make sure we do just that. National research companies consistently rank our Iowa and

Western utilities at or near the top of their industry. Similarly, among the 43 U.S. pipelines ranked by a firm

named Mastio, our Kern River and Northern Natural properties tied for second place.

Moreover, we continue to pour huge sums of money into our operations so as to not only prepare for

the future but also make these operations more environmentally friendly. Since we purchased MidAmerican ten

years ago, it has never paid a dividend. We have instead used earnings to improve and expand our properties in

each of the territories we serve. As one dramatic example, in the last three years our Iowa and Western utilities

have earned $2.5 billion, while in this same period spending $3 billion on wind generation facilities.

MidAmerican has consistently kept its end of the bargain with society and, to society’s credit, it has

reciprocated: With few exceptions, our regulators have promptly allowed us to earn a fair return on the ever-

increasing sums of capital we must invest. Going forward, we will do whatever it takes to serve our territories in

the manner they expect. We believe that, in turn, we will be allowed the return we deserve on the funds we

invest.

In earlier days, Charlie and I shunned capital-intensive businesses such as public utilities. Indeed, the

best businesses by far for owners continue to be those that have high returns on capital and that require little

incremental investment to grow. We are fortunate to own a number of such businesses, and we would love to buy

more. Anticipating, however, that Berkshire will generate ever-increasing amounts of cash, we are today quite

willing to enter businesses that regularly require large capital expenditures. We expect only that these businesses

have reasonable expectations of earning decent returns on the incremental sums they invest. If our expectations

are met – and we believe that they will be – Berkshire’s ever-growing collection of good to great businesses

should produce above-average, though certainly not spectacular, returns in the decades ahead.

9