Berkshire Hathaway 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

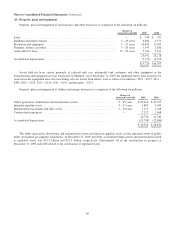

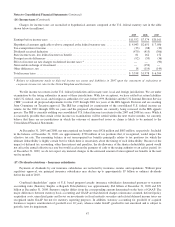

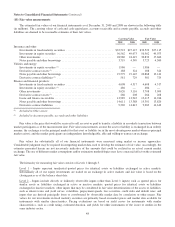

(12) Derivative contracts (Continued)

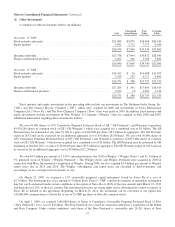

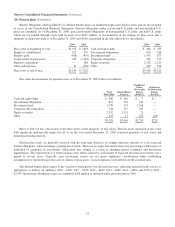

Our credit default contracts pertain to various indexes of high yield corporate issuers, state/municipal debt issuers and

individual corporate issuers. These contracts cover the loss in value of specified debt obligations of the issuers arising from

default events, which are usually for non-payment or bankruptcy. Loss amounts are subject to contract limits.

The high yield indexes are comprised of specified North American corporate issuers (usually 100 in number) whose

obligations are rated below investment grade. The weighted average contract life of contracts in-force at December 31, 2009

was approximately 2 years. State and municipality contracts are comprised of over 500 state and municipality issuers and had a

weighted average contract life at December 31, 2009 of approximately 11 years. Potential obligations related to approximately

50% of the notional amount of the state and municipality contracts cannot be settled before the maturity dates of the underlying

obligations, which range from 2019 to 2054.

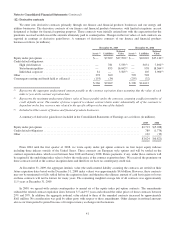

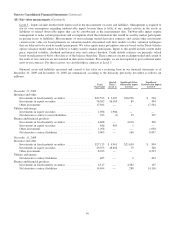

Premiums on the high yield index and state/municipality contracts are received in full at the inception dates of the contracts

and, as a result, we have no counterparty credit risk. Our payment obligations under certain of these contracts are on a first loss

basis. Several other contracts are subject to aggregate loss deductibles that must be satisfied before we have any payment

obligations.

We also wrote credit default contracts on individual corporate issuers primarily related to investment grade obligations.

Installment premiums are due from counterparties over the terms of the contracts. In most instances, premiums are due from

counterparties on a quarterly basis. As of December 31, 2009, all of the in-force individual corporate issuer contracts expire in

2013.

With limited exceptions, our equity index put option and credit default contracts contain no collateral posting requirements

with respect to changes in either the fair value or intrinsic value of the contracts and/or a downgrade of Berkshire’s credit

ratings. Under certain conditions, a few contracts require that we post collateral. As of December 31, 2009, our collateral

posting requirement under such contracts was $35 million compared to about $550 million at December 31, 2008. As of

December 31, 2009, had Berkshire’s credit ratings (currently AA+ from Standard & Poor’s and Aa2 from Moody’s) been

downgraded below either A- by Standard & Poor’s or A3 by Moody’s an additional $1.1 billion would have been required to be

posted as collateral.

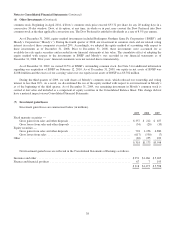

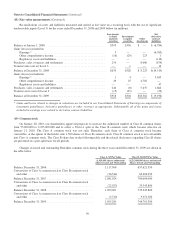

We are also exposed to variations in the market prices in the purchases and sales of natural gas and electricity and in

commodity fuel costs through our regulated utility operations. Derivative instruments, including forward purchases and sales,

futures, swaps and options are used to manage these commodity price risks. Unrealized gains and losses under these contracts

are either probable of recovery through rates and therefore are recorded as a regulatory net asset or liability or are accounted for

as cash flow hedges and therefore are recorded as accumulated other comprehensive income or loss. Derivative contract assets

included in other assets of utilities and energy businesses were $188 million and $324 million as of December 31, 2009 and

2008, respectively. Derivative contract liabilities included in accounts payable, accruals and other liabilities of utilities and

energy businesses were $581 million and $729 million as of December 31, 2009 and 2008, respectively.

42