Berkshire Hathaway 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

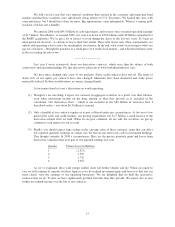

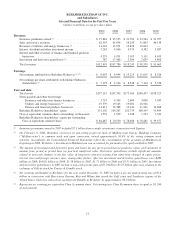

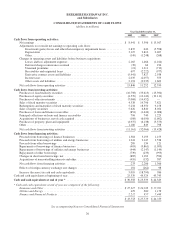

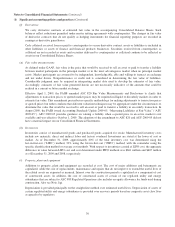

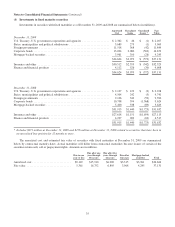

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED STATEMENTS OF EARNINGS

(dollars in millions except per share amounts)

Year Ended December 31,

2009 2008 2007

Revenues:

Insurance and Other:

Insurance premiums earned ...................................................... $ 27,884 $ 25,525 $ 31,783

Sales and service revenues ....................................................... 62,555 65,854 58,243

Interest, dividend and other investment income ....................................... 5,245 4,966 4,979

Investment gains/losses .......................................................... 251 1,166 5,405

Other-than-temporary impairment losses on investments ............................... (3,155) (1,813) —

92,780 95,698 100,410

Utilities and Energy:

Operating revenues ............................................................. 11,204 12,668 12,376

Other ........................................................................ 239 1,303 252

11,443 13,971 12,628

Finance and Financial Products:

Interest, dividend and other investment income ....................................... 1,886 1,790 1,717

Investment gains/losses .......................................................... 67 7 193

Derivative gains/losses .......................................................... 3,624 (6,821) (89)

Other ........................................................................ 2,693 3,141 3,386

8,270 (1,883) 5,207

112,493 107,786 118,245

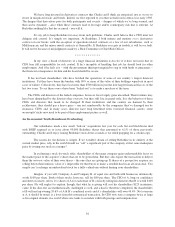

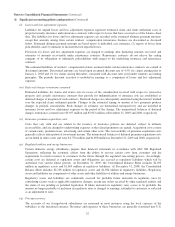

Costs and expenses:

Insurance and Other:

Insurance losses and loss adjustment expenses ....................................... 18,251 16,259 21,010

Life and health insurance benefits ................................................. 1,838 1,840 1,786

Insurance underwriting expenses .................................................. 6,236 4,634 5,613

Cost of sales and services ........................................................ 52,647 54,103 47,477

Selling, general and administrative expenses ......................................... 8,117 8,052 7,098

Interest expense ................................................................ 130 156 164

87,219 85,044 83,148

Utilities and Energy:

Cost of sales and operating expenses ............................................... 8,739 9,840 9,696

Interest expense ................................................................ 1,176 1,168 1,158

9,915 11,008 10,854

Finance and Financial Products:

Interest expense ................................................................ 686 639 588

Other ........................................................................ 3,121 3,521 3,494

3,807 4,160 4,082

100,941 100,212 98,084

Earnings before income taxes and equity method earnings ............................... 11,552 7,574 20,161

Income tax expense ............................................................. 3,538 1,978 6,594

Earnings from equity method investments ........................................... 427 — —

Net earnings ...................................................................... 8,441 5,596 13,567

Less: Earnings attributable to noncontrolling interests .................................. 386 602 354

Net earnings attributable to Berkshire Hathaway ....................................... $ 8,055 $ 4,994 $ 13,213

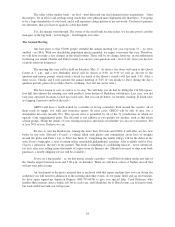

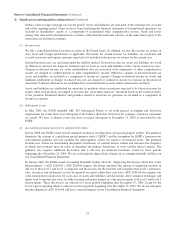

Average common shares outstanding * ............................................. 1,551,174 1,548,960 1,545,751

Net earnings per share attributable to Berkshire Hathaway shareholders * ................. $ 5,193 $ 3,224 $ 8,548

* Average shares outstanding include average Class A common shares and average Class B common shares determined on an equivalent

Class A common stock basis. Net earnings per share attributable to Berkshire Hathaway shareholders shown above represents net earnings

per equivalent Class A common share. Net earnings per Class B common share is equal to one-fifteen-hundredth (1/1,500) of such amount

or $3.46 per share for 2009, $2.15 per share for 2008 and $5.70 per share for 2007 after giving effect to the 50-for-1 Class B stock split

that became effective on January 21, 2010. See Note 19.

See accompanying Notes to Consolidated Financial Statements

25