BP 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

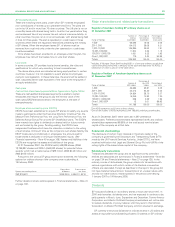

that company’s shares in the order book to allow the market to re- are also traded on the Chicago and Toronto Stock Exchanges. ADSs are

establish equilibrium. Dealings in ordinary shares may also take place evidenced by American depositary receipts (ADRs), which may be issued

between an investor and a market-maker, via a member firm, outside the in either certificated or book entry form.

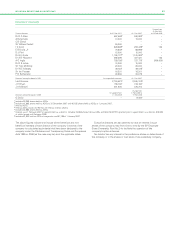

electronic order book. The following table sets forth for the periods indicated the highest and

In the US and Canada, the company’s securities are traded in the form lowest middle market quotations for BP’s ordinary shares for the periods

of ADSs, for which JPMorgan Chase Bank is the depositary (the shown. These are derived from the Daily Official List of the LSE and the

Depositary) and transfer agent. The Depositary’s principal office is 4 New highest and lowest sales prices of ADSs as reported on the New York

York Plaza, Floor 13, New York, NY 10004, US. Each ADS represents six Stock Exchange (NYSE) composite tape.

ordinary shares. ADSs are listed on the New York Stock Exchange and

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Pence Dollars

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

American

depositarya

Ordinary shares shares

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

High Low High Low

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Year ended 31 December

2003 458.00 348.75 49.59 34.67

2004 561.00 407.75 62.10 46.65

2005 686.00 499.00 72.75 56.60

2006 723.00 558.50 76.85 63.52

2007 640.00 504.50 79.77 58.62

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Year ended 31 December

2006: First quarter 693.00 623.00 72.88 65.35

Second quarter 723.00 581.00 76.85 64.19

Third quarter 653.00 560.00 73.28 63.81

Fourth quarter 619.00 558.50 69.49 63.52

2007: First quarter 574.50 504.50 67.27 58.62

Second quarter 606.50 542.50 72.49 64.42

Third quarter 617.00 516.00 75.25 61.10

Fourth quarter 640.00 548.00 79.77 67.24

2008: First quarter (to 19 February) 648.00 498.00 75.87 57.85

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Month of

September 2007 600.00 548.00 72.11 66.76

October 2007 639.50 548.00 78.58 67.24

November 2007 640.00 564.00 79.77 69.81

December 2007 624.00 585.00 76.50 72.10

January 2008 648.00 498.00 75.87 57.85

February 2008 (to 19 February) 576.50 529.50 67.50 62.38

------------------------------------------------------------------------------------------------------------------------------------

aAn ADS is equivalent to six 25 cent ordinary shares.

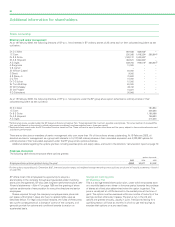

Market prices for the ordinary shares on the LSE and in after-hours had registered addresses in the US at that date. One of the registered

trading off the LSE, in each case while the NYSE is open, and the market holders of ADSs represents some 800,000 underlying holders.

prices for ADSs on the NYSE and other North American stock exchanges On 19 February 2008, there were approximately 328,855 holders of

are closely related due to arbitrage among the various markets, although record of ordinary shares. Of these holders, around 1,487 had registered

differences may exist from time to time due to various factors, including addresses in the US and held a total of some 4,238,685 ordinary shares.

UK stamp duty reserve tax. Trading in ADSs began on the LSE on Since certain of the ordinary shares and ADSs were held by brokers

3 August 1987. and other nominees, the number of holders of record in the US may not

On 19 February 2008, 899,270,264 ADSs (equivalent to 5,395,621,585 be representative of the number of beneficial holders or of their country

ordinary shares or some 28.34% of the total) were outstanding and were of residence.

held by approximately 140,195 ADR holders. Of these, about 138,696

86