BP 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

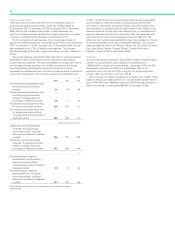

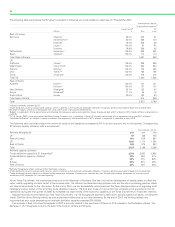

United States

2007 liquids production at 513mb/d decreased 6% from 2006,

while natural gas production at 2,174mmcf/d decreased 8% compared

with 2006.

Crude oil production showed a moderate decline of 18mb/d from

2006, with production from new projects (Gulf of Mexico) being offset by

divestments and natural reservoir decline. The NGLs component of

liquids production decreased by 15mb/d, driven mainly by commercial

changes in NGL processing contracts, natural reservoir decline and

divestments. Gas production was lower (201mmcf/d) because of

divestments and natural reservoir decline.

Development expenditure in the US (excluding midstream) during

2007 was $3,861 million, compared with $3,579 million in 2006 and

$2,965 million in 2005. The annual increase is the result of various

development projects in progress.

Our activities within the US take place in three main areas. Significant

events during 2007 within each of these are indicated below.

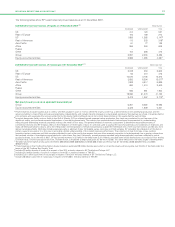

Deepwater Gulf of Mexico

Deepwater Gulf of Mexico is our largest area of growth in the US. In

2007, our deepwater Gulf of Mexico liquids production was 196mb/d and

gas production was 268mmcf/d.

Significant events were:

– The Atlantis platform (BP 56% and operator) was successfully

commissioned and started producing oil and gas during the fourth

quarter of 2007. Atlantis employs the deepest moored platform of its

kind in the world and a separate semi-submersible drilling and

construction rig. The versatile modular design of the platform provides

potential to add wells to increase recovery.

– At Thunder Horse (BP 75% and operator), as a result of a metallurgical

failure during pre-commissioning checks in 2006, the decision was

taken to repair all at-risk subsea components. All relevant components

have been removed from the sea floor and progress made in

reinstalling the repaired equipment. In 2007, the platform’s drilling rig

was commissioned and its first well successfully drilled and

completed. Thunder Horse is expected to start production by the end

of 2008. Designed to process 250,000 barrels of oil per day and 200

million cubic feet per day of natural gas, Thunder Horse is expected to

be the largest field in the Gulf of Mexico. The field will be supported

by a network of 25 subsea wells.

– In November, BP started production from two multi-phase subsea

pump stations in the King field (BP 100% and operator). At a depth of

1,700 metres and 15 miles away from the Marlin platform, this sets a

double world record for both depth and distance. The two pumps are

expected to enhance production from the King field by an average of

20% and to extend the production life of the field by five years

through improved recovery.

– BP was awarded 88 blocks in the western Gulf of Mexico lease sale

and 83 blocks in the central Gulf of Mexico lease sale

– On 6 June 2007, a discovery was made with the Isabela well (BP 67%

and operator), located on Mississippi Canyon Block 562 in

approximately 2,000 metres of water about 150 miles south-east of

New Orleans.

– During the second quarter, we increased our ownership in Horn

Mountain to 100% as part of an asset exchange agreement with

Occidental Petroleum Corporation (Occidental).

– In April 2007, BP disposed of its 80% interest in the Entrada field to

Callon Petroleum Company for a total price of $190 million.

Lower 48 states

In the Lower 48 states (onshore), our 2007 natural gas production was

1,850mmcf/d, which was down 4% compared with 2006. Liquids

production was 108mb/d, down 14% compared with 2006. The year-on-

year decrease in production is mainly attributed to normal field decline

and divestment activity. In 2007, we drilled approximately 400 wells as

operator and continued to maintain a stable programme of drilling activity

throughout the year.

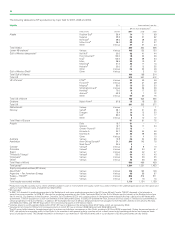

Production is derived primarily from two main areas:

– In the western basins (Colorado, New Mexico and Wyoming) our

assets produced 222mboe/d in 2007.

– In the Gulf Coast and mid-continental basins (Kansas, Louisiana,

Oklahoma and Texas) our assets produced 203mboe/d in 2007.

The development of recovery technology continues to be a

fundamental strategy in accessing our North America tight gas

resources. Through the use of horizontal drilling and advanced hydraulic

fracturing techniques, we are achieving well rates up to 10 times higher

than more conventional techniques and per-well recoveries some five

times higher.

Significant events were:

– In January 2007, we announced our investment of up to $2.4 billion

expected over 13 years in the coalbed methane field development

project in the San Juan basin in Colorado. The project includes the

drilling of more than 700 wells, nearly all from existing well sites, and

the installation of associated field facilities.

– Drilling continued during 2007 on the Wamsutter natural gas

expansion project. The multi-year drilling programme is expected to

increase production significantly by the end of 2010. We are currently

testing horizontal fracturing technology and carrying out wireless

seismic studies on the reservoir.

– Significant progress has been made on decommissioning the Gulf of

Mexico Shelf hurricane-damaged platforms, which is on track for

completion in 2010. This work has been carried out almost exclusively

using a diverless ‘access’ approach, significantly reducing exposure to

safety issues associated with diving. Late in 2007, we signed an

agreement with Wild Well Control, an affiliate of Superior Energy

Services, to sell seven damaged platforms and 59 associated wells

and consequentially to transfer the decommissioning liability to them.

They will assume responsibility for plugging and abandonment of all

wells, salvage and removal or reefing of the damaged platforms and

related facilities, and restoration of all sites.

– In 2007, BP divested its non-core Permian assets as part of the asset

exchange agreement with Occidental. In consideration, BP received

the remaining one-third interest in the Horn Mountain field in the Gulf

of Mexico and approximately $100 million cash.

– In the third quarter of 2007, we ceased operations at the Whitney

Canyon gas plant located near Evanston, Wyoming. By doing this we

expect to extend the economic life of the field by re-routing the

natural gas processed at the Whitney Canyon gas plant to Chevron’s

Carter Creek gas plant. BP intends to continue to operate the 28 wells

in the Whitney Canyon field and the inlet facility, as well as the nearby

Painter Complex gas plant.

Alaska

In Alaska, BP net oil production in 2007 was 209mboe/d, a decrease of

7% from 2006, due to normal decline in the large mature fields, partially

offset by lower downtime.

BP operates 13 North Slope oil fields (including Prudhoe Bay, Northstar

and Milne Point) and four North Slope pipelines and owns a significant

interest in six other producing fields. BP’s 26.4% interest in Prudhoe Bay

also includes a large undeveloped natural gas resource. Developing

viscous oil production and unlocking large undeveloped heavy oil

resources through the application of advanced technology are important

parts of the Alaska business strategy.

Significant events in 2007 were:

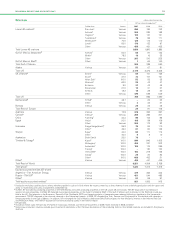

– On 20 June 2007, the Prudhoe Bay field and the Trans Alaska Pipeline

System (TAPS) celebrated the 30th anniversary of first production

from the North Slope of Alaska. The original expectations for Prudhoe

Bay were to drill 500 wells, produce for 20 years and recover 9 billion

boe of hydrocarbon resources. After 30 years, more than 2,500 wells

have been drilled, more than 11.5 billion boe have been recovered to

date, and the field is expected to continue to produce for another 50

years or more. Prudhoe Bay production averaged 400mboe/d (gross)

in 2007, with BP’s net share being 102mboe/d. Overall, downtime

during the year was consistent with plans for normal maintenance

activity and there were no large unplanned production disruptions.

20