BP 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

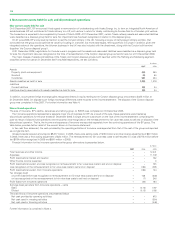

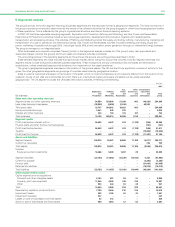

1 Significant accounting policies continued

A corresponding item of property, plant and equipment of an amount equivalent to the provision is also created. This is subsequently depreciated as

part of the asset.

Other than the unwinding discount on the provision, any change in the present value of the estimated expenditure is reflected as an adjustment to

the provision and the corresponding item of property, plant and equipment.

Employee benefits

Wages, salaries, bonuses, social security contributions, paid annual leave and sick leave are accrued in the period in which the associated services are

rendered by employees of the group. Deferred bonus arrangements that have a vesting date more than 12 months after the period end are valued on

an actuarial basis using the projected unit credit method and amortized on a straight-line basis over the service period until the award vests. The

accounting policy for pensions and other post-retirement benefits is described below.

Share-based payments

Equity-settled transactions

The cost of equity-settled transactions with employees is measured by reference to the fair value at the date at which equity instruments are granted

and is recognized as an expense over the vesting period, which ends on the date on which the relevant employees become fully entitled to the award.

Fair value is determined by using an appropriate valuation model. In valuing equity-settled transactions, no account is taken of any vesting conditions,

other than conditions linked to the price of the shares of the company (market conditions).

No expense is recognized for awards that do not ultimately vest, except for awards where vesting is conditional upon a market condition, which are

treated as vesting irrespective of whether or not the market condition is satisfied, provided that all other performance conditions are satisfied.

At each balance sheet date before vesting, the cumulative expense is calculated, representing the extent to which the vesting period has expired

and management’s best estimate of the achievement or otherwise of non-market conditions and the number of equity instruments that will ultimately

vest or, in the case of an instrument subject to a market condition, be treated as vesting as described above. The movement in cumulative expense

since the previous balance sheet date is recognized in the income statement, with a corresponding entry in equity.

Where the terms of an equity-settled award are modified or a new award is designated as replacing a cancelled or settled award, the cost based on

the original award terms continues to be recognized over the original vesting period. In addition, an expense is recognized over the remainder of the

new vesting period for the incremental fair value of any modification, based on the difference between the fair value of the original award and the fair

value of the modified award, both as measured on the date of the modification. No reduction is recognized if this difference is negative.

Where an equity-settled award is cancelled, it is treated as if it had vested on the date of cancellation and any cost not yet recognized in the income

statement for the award is expensed immediately. Any compensation paid up to the fair value of the award at the cancellation or settlement date is

deducted from equity, with any excess over fair value being treated as an expense in the income statement.

Cash-settled transactions

The cost of cash-settled transactions is measured at fair value using an appropriate option valuation model. Fair value is established initially at the grant

date and at each balance sheet date thereafter until the awards are settled. During the vesting period, a liability is recognized representing the product

of the fair value of the award and the portion of the vesting period expired as at the balance sheet date. From the end of the vesting period until

settlement, the liability represents the full fair value of the award as at the balance sheet date. Changes in the carrying amount of the liability are

recognized in profit or loss for the period.

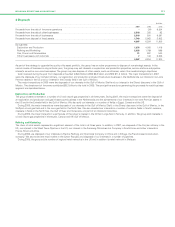

Pensions and other post-retirement benefits

The cost of providing benefits under the defined benefit plans is determined separately for each plan using the projected unit credit method, which

attributes entitlement to benefits to the current period (to determine current service cost) and to the current and prior periods (to determine the

present value of defined benefit obligation). Past service costs are recognized immediately when the company becomes committed to a change in

pension plan design. When a settlement (eliminating all obligations for benefits already accrued) or a curtailment (reducing future obligations as a result

of a material reduction in the scheme membership or a reduction in future entitlement) occurs, the obligation and related plan assets are remeasured

using current actuarial assumptions and the resultant gain or loss is recognized in the income statement during the period in which the settlement or

curtailment occurs.

The interest element of the defined benefit cost represents the change in present value of scheme obligations resulting from the passage of time,

and is determined by applying the discount rate to the opening present value of the benefit obligation, taking into account material changes in the

obligation during the year. The expected return on plan assets is based on an assessment made at the beginning of the year of long-term market

returns on scheme assets, adjusted for the effect on the fair value of plan assets of contributions received and benefits paid during the year. The

difference between the expected return on plan assets and the interest cost is recognized in the income statement as other finance income or

expense.

Actuarial gains and losses are recognized in full in the group statement of recognized income and expense in the period in which they occur.

The defined benefit pension asset or liability in the balance sheet comprises the total for each plan of the present value of the defined benefit

obligation (using a discount rate based on high quality corporate bonds), less the fair value of plan assets out of which the obligations are to be settled

directly. Fair value is based on market price information and, in the case of quoted securities, is the published bid price.

Contributions to defined contribution schemes are recognized in the income statement in the period in which they become payable.

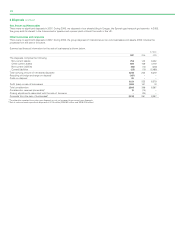

Corporate taxes

Income tax expense represents the sum of the tax currently payable and deferred tax. Interest and penalties relating to tax are also included in income

tax expense.

The tax currently payable is based on the taxable profits for the period. Taxable profit differs from net profit as reported in the income statement

because it excludes items of income or expense that are taxable or deductible in other periods and it further excludes items that are never taxable or

deductible. The group’s liability for current tax is calculated using tax rates that have been enacted or substantively enacted by the balance sheet date.

Any liability relating to unrecognized tax benefits is included in current tax payable on the group balance sheet.

Deferred tax is provided, using the liability method, on all temporary differences at the balance sheet date between the tax bases of assets and

liabilities and their carrying amounts for financial reporting purposes.