BP 2007 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

160

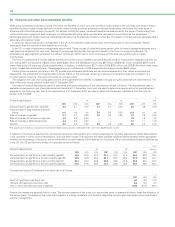

40 Capital and reserves continued

Share capital

The balance on the share capital account represents the aggregate nominal value of all ordinary and preference shares in issue, including treasury

shares.

Share premium account

The balance on the share premium account represents the amounts received in excess of the nominal value of the ordinary and preference shares.

Capital redemption reserve

The balance on the capital redemption reserve represents the aggregate nominal value of all the ordinary shares repurchased and cancelled.

Merger reserve

The balance on the merger reserve represents the fair value of the consideration given in excess of the nominal value of the ordinary shares issued in

an acquisition made by the issue of shares.

Other reserve

The balance on the other reserve represents the fair value of the consideration given in excess of the nominal value of the ordinary shares to be issued

in the ARCO acquisition on the exercise of ARCO share options.

Own shares

Own shares represent BP shares held in Employee Share Ownership Plans (ESOPs) to meet the future requirements of the employee share-based

payment arrangements.

Treasury shares

Treasury shares represent BP shares repurchased and available for re-issue.

Foreign currency translation reserve

The foreign currency translation reserve is used to record exchange differences arising from the translations of the financial statements of foreign

operations. Upon disposal of foreign operations, the related accumulated exchange differences are recycled to the income statement. This reserve is

also used to record the effect of hedging net investments in foreign operations.

Available-for-sale investments

This reserve records the changes in fair value on available-for-sale investments. On disposal, the cumulative changes in fair value are recycled to the

income statement.

Cash flow hedges

This reserve records the portion of the gain or loss on a hedging instrument in a cash flow hedge that is determined to be an effective hedge. When

the hedged transaction occurs, the gain or loss on the hedging instrument is transferred out of equity to either profit or loss or the carrying value of

assets, as appropriate. If the forecast transaction is no longer expected to occur the gain or loss recognized in equity is transferred to profit or loss.

Share-based payment reserve

This reserve represents cumulative amounts charged to profit in respect of employee share-based payment arrangements where the scheme has not

yet been settled by means of an award of shares to an individual.

Profit and loss account

The balance held on this reserve is the accumulated retained profits of the group.

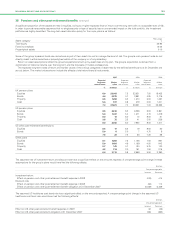

41 Share-based payments

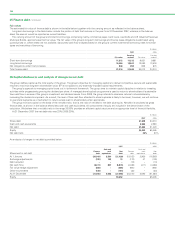

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

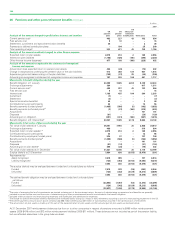

Effect of share-based payment transactions on the group’s result and financial position 2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total expense recognized for equity-settled share-based payment transactions 412 405 348

Total expense recognized for cash-settled share-based payment transactions 16 14 20

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total expense recognized for share-based payment transactions 428 419 368

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Closing balance of liability for cash-settled share-based payment transactions 40 38 48

Total intrinsic value for vested cash-settled share-based payments 22 23 41

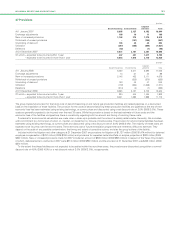

For ease of presentation, option and share holdings detailed in the tables within this note are stated as UK ordinary share equivalents in US dollars. US

employees are granted American depositary shares (ADSs) or options over the company’s ADSs (one ADS is equivalent to six ordinary shares). The

share-based payment plans that existed during the year are detailed below. All plans are ongoing unless otherwise stated.

Plans for executive directors

Executive Directors’ Incentive Plan (EDIP) – share element (2005 onwards)

An equity-settled incentive share plan for executive directors driven by one performance measure over a three-year performance period. The award of

shares is determined by comparing BP’s total shareholder return (TSR) against the other oil majors. In addition, for the group chief executive, 27% of

the grant is based on long-term leadership (LTL) measures. After the performance period, the shares that vest (net of tax) are then subject to a three-

year retention period. The director’s remuneration report on pages 63-73 includes full details of this plan.