BP 2007 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP ANNUAL REPORT AND ACCOUNTS 2007 129

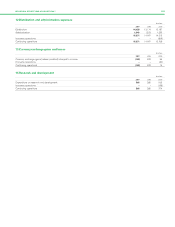

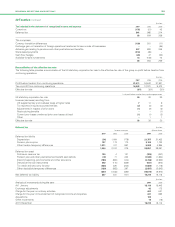

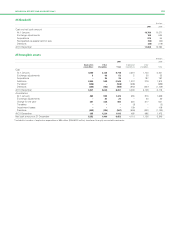

20 Taxation continued

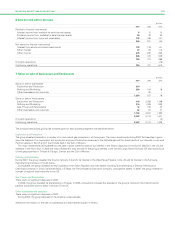

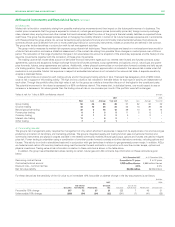

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Tax included in the statement of recognized income and expense 2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Current tax (178) (51) 45

Deferred tax 241 985 214

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

63 934 259

This comprises:

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Currency translation differences (139) 201 (11)

Exchange gain on translation of foreign operations transferred to loss on sale of businesses ––(

Actuarial gain relating to pensions and other post-retirement benefits 427 820 356

Share-based payments (213) (26) –

Cash flow hedges (26) 47 (63)

Available-for-sale investments 14 (108) 72

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

63 934 259

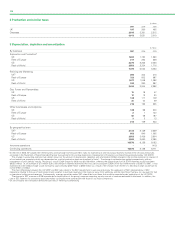

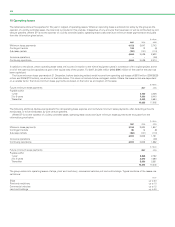

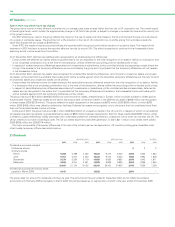

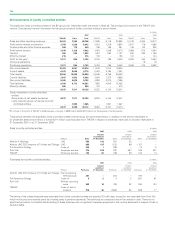

Reconciliation of the effective tax rate

The following table provides a reconciliation of the UK statutory corporation tax rate to the effective tax rate of the group on profit before taxation from

continuing operations.

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit before taxation from continuing operations 31,611 34,642 31,921

Tax on profit from continuing operations 10,442 12,331 9,473

Effective tax rate 33% 36% 30%

% of profit before taxation from continuing operations

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

UK statutory corporation tax rate 30 30 30

Increase (decrease) resulting from

UK supplementary and overseas taxes at higher rates 711 9

Tax reported in equity-accounted entities (2) (3) (3)

Adjustments in respect of prior years (1) (2) (3)

Restructuring benefits –– (1)

Current year losses unrelieved (prior year losses utilized) (1) (1) (3)

Other –1

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Effective tax rate 33 36 30

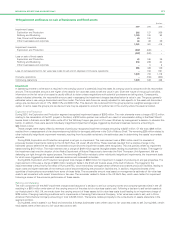

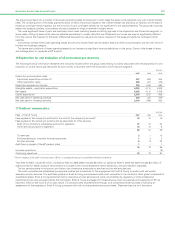

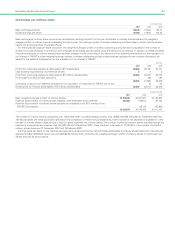

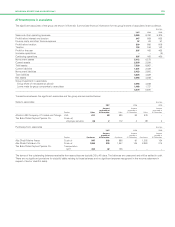

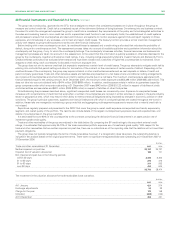

Deferred tax $ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Income statement Balance sheet

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005 2007 2006

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Deferred tax liability

Depreciation (54) 1,484 (778) 21,757 21,463

Pension plan surplus 127 173 170 2,136 1,733

Other taxable temporary differences 1,371 417 887 5,998 4,895

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1,444 2,074 279 29,891 28,091

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Deferred tax asset

Petroleum revenue tax 139 4121 (325) (457)

Pension plan and other post-retirement benefit plan deficits (72) 71 220 (1,545) (1,824)

Decommissioning, environmental and other provisions (759) (800) (144) (3,746) (2,960)

Derivative financial instruments 450 (115) (629) (541) (974)

Tax credit and loss carry forward (466) 220 (245) (1,822) (1,118)

Other deductible temporary differences (129) (923) 297 (2,697) (2,642)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(837) (1,543) (380) (10,676) (9,975)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net deferred tax liability 607 531 (101) 19,215 18,116

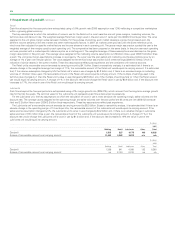

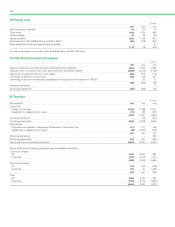

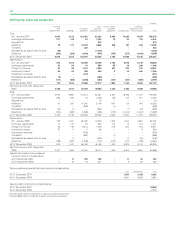

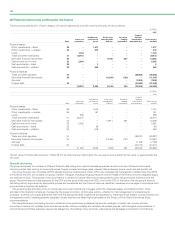

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Analysis of movements during the year 2007 2006

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 1 January 18,116 16,443

Exchange adjustments 42 175

Charge for the year on ordinary activities 607 531

Charge for the year in the statement of recognized income and expense 241 985

Acquisitions 199 –

Other movements 10 (18)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 31 December 19,215 18,116

95)

1