BP 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

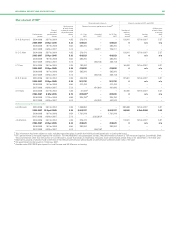

Part 2: Executive directors’ remuneration

2007 remuneration

Salary increases

During the year, salary increases were awarded reflecting promotions

and changed job responsibilities as well as regular market movement.

The remuneration committee seeks to position salaries competitively

relative to appropriate comparators in Europe and the US oil and gas

sectors, as well as to reflect the operating style of the ‘team at the

top’. At the end of 2007, annual salaries were as follows: Dr Hayward

£950,000, Dr Allen £510,000, Mr Conn £650,000, Dr Grote $1,300,000

and Mr Inglis £650,000.

Annual bonus result

Performance measures and targets were set at the beginning of the year

and formed the main basis for determining the 2007 bonus. Financial

measures accounted for 50% weighting and focused on EBITDA, cash

costs and capital expenditure. Non-financial measures carried 30%

weight and centred on HSE performance, growth and reputation.

Individual performance, including segment deliverables and living the

values of the group, made up the final 20%.

Financially, underlying EBITDA results reflected a favourable price

environment but also some performance shortfall, related largely to

reduced refining availability at Whiting and Texas City, as well as delays

in start-up of some major exploration and production projects. Overall it

was below expectation. Cash costs were marginally above plan, largely

due to higher expenditures in refining, especially Texas City. Capital

expenditure was near plan, despite higher than expected sector inflation.

On the non-financial side, safety was maintained as the highest priority

of the executive top team. Significant progress was made on many

aspects of process safety, ranging from development and testing of a

process safety index, addressing specific recommendations of the Baker

Panel, implementing a holistic operating management system (OMS) and

ensuring clear accountability. Personal safety metrics and greenhouse

gas emissions were also good.

Growth was led by upstream, which had the strongest year of

resource access since the early 1990s and reserves replacement in

excess of 100%. Refinery throughput was below target, due to reduced

availability at Texas City and Whiting. BP Alternative Energy met plan

targets, achieving some 40% growth compared with 2006.

External assessments indicate that significant progress has been

made to rebuild the company’s reputation.

In terms of individual performance during a transition year, the

committee recognized very high levels of personal and team effort

to produce results, resolve past issues and position the company

for future success.

The strong individual performances, combined with above-target

non-financial and near-target financial performance, led the committee to

award bonuses generally around or just above target, as set out in the

summary table on page 65.

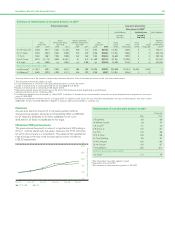

2005-2007 share element result

Performance for the 2005-2007 share element was assessed relative

to the TSR of the company compared with the other oil majors –

ExxonMobil, Shell, Total and Chevron. BP’s TSR result, reflecting past

operating problems, was last relative to the other majors. The committee

also reviewed the underlying business performance relative to

competitors, including financial (ROACE, EPS, cash flow etc.) and non-

financial (HSE etc.) indicators. While this showed some areas of strong

performance, the committee’s overall assessment, considering both the

TSR result and the underlying performance, was that performance failed

to meet satisfactory levels and consequently no shares will vest in the

Plan for 2005-2007.

Lord Browne also held an award under the 2005-2007 share element

related to long-term leadership measures. These focused on sustaining

BP’s financial, strategic and organizational health. Performance relative

to the award was assessed by the chairman’s committee and, based

on this assessment, 80,000 shares vested, representing about 15%

of the award.

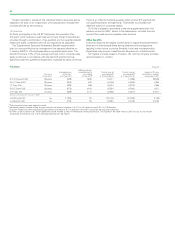

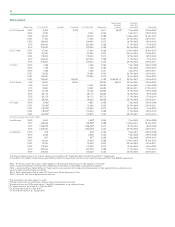

Remuneration policy

Our remuneration policy for executive directors aims to ensure there

is a clear link between the company’s purpose, its business plans and

executive reward, with pay varying with performance. In order to achieve

this, the policy is based on these key principles:

– The majority of executive remuneration will be linked to the

achievement of demanding performance targets, independently

set to support the creation of long-term shareholder value.

– The structure will reflect a fair system of reward for all the

participants.

– The remuneration committee will determine the overall amount of

each component of remuneration, taking into account the success

of BP and the competitive environment.

– There will be a quantitative and qualitative assessment of

performance, with the remuneration committee making an informed

judgement within a framework approved by shareholders.

– Remuneration policy and practice will be as transparent as possible.

– Executives will develop a significant personal shareholding in order

to align their interests with those of shareholders.

– Pay and employment conditions elsewhere in the group will be taken

into account, especially in setting annual salary increases.

– The remuneration policy for executive directors will be reviewed

regularly, independently of executive management, and will set

the tone for the remuneration of other senior executives.

– The remuneration committee will actively seek to understand

shareholder preferences.

Executive directors’ total remuneration consists of salary, annual

bonus, long-term incentives, pensions and other benefits. The

remuneration committee reviews this structure regularly to ensure

it is achieving its aims and did so in 2007.

The main part of the review centred on the share element of the EDIP.

The committee investigated alternative and additional measures to TSR,

in particular those representing underlying operational performance, and

also considered the inclusion of non-financial measures, most notably

those relating to HSE.

In the process of the review, input was sought from key institutional

investors and their representative bodies.

After thorough review, the committee concluded that, for the long-

term metrics, there was no ‘perfect’ measure and, on balance, no strong

reason for change. TSR remains an appropriate measure to reflect

long-term shareholder value. The detailed rationale behind the current

scoring system, as set out in the notes to the resolution in 2005 that

was approved by shareholders, still remained relevant and valid. The

committee felt that this system gives an optimal balance of quantitative

assessment relative to oil major performance as well as the ability of

the committee to make qualitative evaluation of underlying business

performance, including non-financial factors (such as HSE). Finally,

the committee felt that, in BP’s current circumstances, there is merit

in maintaining the stability of the plan.

Salary

The remuneration committee reviews salaries annually, taking into

account other large Europe-based global companies and companies in

the US oil and gas sector. These groups are each defined and analysed

by the committee’s independent remuneration advisers. The committee

makes a judgement on salary levels based on its assessment of market

conditions and the external advice.

Annual bonus

All executive directors are eligible to take part in an annual performance-

based bonus scheme. The remuneration committee sets bonus targets

and levels of eligibility each year.

The target level for 2008 is 120% of base salary. In normal

circumstances, the maximum payment for substantially exceeding

performance targets will continue to be 150% of base salary.

66