BP 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advice

Advice is provided to the committee by the company secretary’s office,

which is independent of executive management and reports to the

chairman of the board. Mr Aronson, an independent consultant, is the

committee’s secretary and special adviser. Advice was also received

from Mr Jackson, the company secretary.

The committee also appoints external advisers to provide specialist

advice and services on particular remuneration matters. The

independence of the advice is subject to annual review.

In 2007, the committee continued to engage Towers Perrin as its

principal external adviser. Towers Perrin also provided limited ad-hoc

remuneration and benefits advice to parts of the group, principally

changes in employee share plans and some market information on

pay structures.

Freshfields Bruckhaus Deringer provided legal advice on specific

matters to the committee, as well as providing some legal advice to

the group.

Ernst & Young reviewed the calculations on the financial-based

targets that form the basis of the performance-related pay for executive

directors, that is, the annual bonus and share element awards described

on page 66, to ensure they met an independent, objective standard. They

also provided audit, audit-related and taxation services for the group.

Part 3: Non-executive directors’ remuneration

Policy

The board sets the level of remuneration for all non-executive directors

within a limit approved from time to time by shareholders. In accordance

with BP’s board governance principles, the remuneration of the chairman

is set by the board rather than by the remuneration committee, as the

performance of the chairman is seen as a matter for the board as a

whole rather than any one committee.

Key elements of BP’s non-executive director remuneration policy

include:

– Remuneration should be sufficient to attract and retain world-class

non-executive talent.

– Remuneration of non-executive directors is set by the board and

should be proportional to their contribution towards the interests

of the company.

– Remuneration practice should be consistent with recognized best

practice standards for non-executive directors’ remuneration.

– Remuneration should be in the form of cash fees, payable monthly.

– Non-executive directors should not receive share options from the

company.

– Non-executive directors are encouraged to establish a holding in BP

shares of the equivalent value of one year’s base fee.

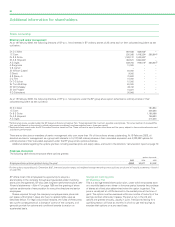

Remuneration review

In 2007, an ad-hoc board committee was formed to review the structure

and quantum of BP non-executive directors’ remuneration (having

previously been reviewed in 2004).

The committee considered the existing BP policy on non-executive

directors’ remuneration and concluded that it should remain unchanged.

The committee evaluated non-executive director remuneration levels and

trends in both the UK and internationally, using a number of external data

sources. Outside the UK, particular focus was given to the remuneration

practices for non-executive directors in the US. The committee also

examined how the time commitment and workload for the board and its

committees had changed in the three years since the previous review.

Following the review, the committee proposed a revised structure

and level of remuneration for BP non-executive directors. Key changes

included:

– Increases to the fees for the chairman and deputy chairman/senior

independent director to reflect the market rates paid for those

positions in companies of comparable size to BP.

– The introduction of a flat fee for membership of the audit, the safety,

ethics and environment assurance, the remuneration and the

nomination committees (but not the chairman’s committee) to reflect

the increased time commitment for board committees over the past

three years.

– An increase in the fee for the chairmen of the audit committee and

SEEAC to reflect the increase in time commitment and market rates

for those committees.

Consideration was also given to abolishing the transatlantic attendance

allowance, but the committee concluded that this would be to the

detriment of non-executives based outside Europe, who would not

otherwise be compensated for the additional travel time required for

UK meetings.

Changes to the structure and an increase to the level of non-executive

directors’ fees were approved by the board and became effective

1 November 2007.

72