BP 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual bonus awards for 2008 will be based on a mix of demanding

financial targets, based on the annual plan and the leadership objectives

set at the beginning of the year. The target-level bonus of 120% of base

salary is split as follows:

– 50% financial metrics from the annual plan, principally EBITDA, cash

costs and capital expenditure.

– 25% safety performance, including satisfactory and improving key

metrics as well as progress on OMS implementation.

– 25% people, including behaviour, values and culture.

– 20% individual performance, principally on relevant operating results

and personal leadership.

The remuneration committee will also review carefully the underlying

performance of the group in light of company business plans and will

look at competitors’ results, analysts’ reports and the views of the

chairmen of other BP board committees when assessing results.

In exceptional circumstances, the remuneration committee can decide

to award bonuses moderately above the maximum level. The committee

can also decide to reduce bonuses where this is warranted and, in

exceptional circumstances, bonuses could be reduced to zero. We

have a duty to shareholders to use our discretion in a reasonable and

informed manner, acting to promote the success of the company, and

also to be accountable and transparent in our decisions. Any significant

exercise of discretion will be explained in the subsequent directors’

remuneration report.

Long-term incentives

Each executive director participates in the EDIP. It has three elements:

shares, share options and cash. The remuneration committee did not use

either share option or cash elements in 2007 and does not intend to do

so in 2008. We intend that executive directors will continue to receive

performance shares under the EDIP, barring unforeseen circumstances,

until it expires or is renewed in 2010.

Policy for performance share awards

The remuneration committee can award shares to executive directors

that will only vest to the extent that demanding performance conditions

are satisfied at the end of a three-year period. The maximum number of

these performance shares that can be awarded to an executive director

in any year is at the discretion of the remuneration committee, but will

not normally exceed 5.5 times base salary.

In exceptional circumstances, the committee also has an overriding

discretion to reduce the number of shares that vest or to decide that no

shares vest.

The compulsory retention period will also be decided by the

committee and will not normally be less than three years. Together with

the performance period, this gives executive directors a six-year incentive

structure, as shown in the timeline below, which is designed to ensure

their interests are aligned with those of shareholders.

TIMELINE FOR 2008-2010 EDIP SHARE ELEMENT

------------------------------------------------------------------------------------------------------------------------------------

2008 2009 2010 2011 2012 2013 2014

Performance period Retention period

ReleaseVestingAward

Where shares vest, the executive director will receive additional

shares representing the value of the reinvested dividends.

The committee’s policy continues to be that each executive director

build a significant personal shareholding, with a target of shares

equivalent in value to five times his or her base salary within a reasonable

timeframe from appointment as an executive director. This policy is

reflected in the terms of the EDIP, as shares awarded will normally only

be released at the end of the three-year retention period, described

above, if these minimum shareholding guidelines are met.

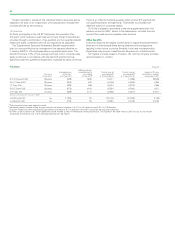

Performance conditions

For performance share awards in 2008, the performance conditions

will continue to relate to BP’s TSR compared with the other oil majors –

ExxonMobil, Shell, Total and Chevron – over three years. We have the

discretion to alter this comparison group if circumstances change – for

example, if there are significant consolidations in the industry.

We consider this relative TSR to be the most appropriate measure

of performance for the purpose of long-term incentives for executive

directors. It best reflects the creation of shareholder value while

minimizing the impact of sector-specific effects such as the oil price.

TSR is calculated as share price performance over the relevant period,

assuming dividends are reinvested. All share prices are averaged over

the three months before the beginning and end of the performance

period. They are measured in US dollars. At the end of the performance

period, the companies’ TSRs will be ranked. Executive directors’

performance shares will vest at 100%, 70% and 35% if BP is ranked

first, second or third respectively; none will vest if BP is in fourth or

fifth place.

As the comparator group is small and as the oil majors’ underlying

businesses are broadly similar, a simple ranking could sometimes distort

BP’s underlying business performance relative to the comparators. The

committee is therefore able to exercise discretion in a reasonable and

informed manner to adjust the vesting level upwards or downwards to

reflect better the underlying health of BP’s business. This would be

judged by reference to a range of measures including ROACE, growth

in EPS, reserves replacement and cash flow, as well as non-financial

reasons such as safety. The need to exercise discretion is most likely to

arise when the TSR of some companies is clustered, so that a relatively

small difference in TSR performance would produce a major difference

in vesting levels.

The remuneration committee will explain any adjustments in the next

directors’ remuneration report following the vesting, in line with its

commitment to transparency.

Special retention awards

The committee reviews on an ongoing basis the overall approriateness

of the long-term incentive arrangements in ensuring the retention of key

executives. After careful review, the committee considered that it was

appropriate to strengthen the retention element of remuneration for

Mr Inglis and Mr Conn. Accordingly, the committee in February 2008

granted, on a one-off basis, a restricted stock award to both Mr Inglis

and Mr Conn of shares worth £1,500,000 each. These awards recognize

the importance of these individuals’ leadership in re-establishing the

company’s competitive performance as well as their personal

attractiveness for top jobs externally. The shares will vest, subject to

continued service, in equal tranches after three and five years. Vesting

of each tranche is dependent on the committee being satisfied, at

each vesting date, with the performance of the individual.

These retention awards have been granted under the EDIP, which

permits awards to be made, on an exceptional basis, subject to a

requirement of continued service over a specified period.

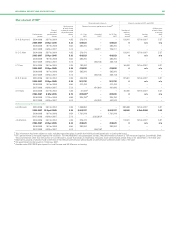

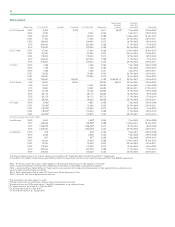

Pensions

Executive directors are eligible to participate in the appropriate pension

schemes applying in their home countries. Additional details are given

on page 68.

UK directors

UK directors are members of the regular BP Pension Scheme. The core

benefits under this scheme are non-contributory. They include a pension

accrualof1/60thofbasicsalaryforeachyearofservice,uptoa

maximum of two-thirds of final basic salary and a dependant’s benefit

of two-thirds of the member’s pension. The scheme pension is not

integrated with state pension benefits.

The rules of the BP Pension Scheme were amended in 2006 such

that the normal retirement age is 65. Prior to 1 December 2006, scheme

members could retire on or after age 60 without reduction. Special early

retirement terms apply to pre-1 December 2006 service for members

with long service as at 1 December 2006.

BP ANNUAL REPORT AND ACCOUNTS 2007 67