BP 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP ANNUAL REPORT AND ACCOUNTS 2007 47

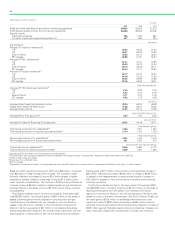

Profit attributable to BP shareholders for the year ended 31 December

2005 included net gains of $1,429 million on the disposal of assets; and

was after net fair value losses of $2,047 million on embedded

derivatives, a charge of $700 million in respect of the March 2005 Texas

City refinery incident, a charge of $412 million in respect of new, and

revisions to existing, environmental and other provisions, an impairment

charge of $359 million and a charge of $134 million relating to the

separation of the Olefins and Derivatives business.

(See Environmental expenditure on page 53 for more information on

environmental charges.)

The primary additional factors reflected in profit for 2007, compared

with 2006, were higher liquids realizations, stronger refining and

marketing margins and improved NGLs performance; however, these

were more than offset by lower gas realizations, lower reported

production volumes, higher production taxes in Alaska, higher costs

(primarily reflecting the impact of sector-specific inflation and higher

integrity spend), the impact of outages and recommissioning costs at the

Texas City and Whiting refineries, reduced supply optimization benefits

and a lower contribution from the marketing and trading business in the

Gas, Power and Renewables segment.

The primary additional factors reflected in profit attributable to BP

shareholders for the year ended 31 December 2006 compared with 2005

were higher oil realizations, higher refining margins (including the benefit

of supply optimization), higher retail margins (although this was partially

offset by a deterioration in other marketing margins) and higher

contributions from the operating businesses in the Gas, Power and

Renewables segment; these were offset by the ongoing impact

following the Texas City refinery shutdown, lower gas realizations, lower

production volumes and higher costs.

Profits and margins for the group and for individual business segments

can vary significantly from period to period as a result of changes in such

factors as oil prices, natural gas prices and refining margins. Accordingly,

the results for the current and prior periods do not necessarily reflect

trends, nor do they provide indicators of results for future periods.

Employee numbers were approximately 97,600 at 31 December 2007,

97,000 at 31 December 2006 and 96,200 at 31 December 2005.

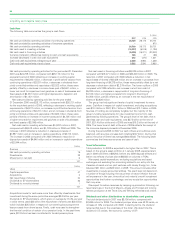

aInventory holding gains and losses represent the difference between the cost of

sales calculated using the average cost of supplies incurred during the year and the

cost of sales calculated on the first-in first-out (FIFO) method. Under the FIFO

method, which we use for IFRS reporting, the cost of inventory charged to the

income statement is based on the historic cost of acquisition or manufacture rather

than the current replacement cost. In volatile energy markets, this can have a

significant distorting effect on reported income. The amounts disclosed represent

the difference between the charge to the income statement on a FIFO basis and

the charge that would arise using average cost of supplies incurred during the

period. For this purpose average cost of supplies incurred during the period is

calculated by dividing the total cost of inventory purchased in the period by the

number of barrels acquired. The amounts disclosed are not separately reflected in

the financial statements as a gain or loss.

BP’s management believes this information is useful to illustrate to investors the

fact that crude oil and product prices can vary significantly from period to period and

that the impact on our reported result under IFRS can be significant. Inventory

holding gains and losses vary from period to period due principally to changes in oil

prices as well as changes to underlying inventory levels. In order for investors to

understand the operating performance of the group excluding the impact of oil price

changes on the replacement of inventories, and to make comparisons of operating

performance between reporting periods, BP’s management believes it is helpful to

disclose this information.

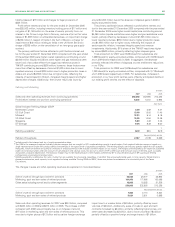

Capital expenditure and acquisitions

$ million

------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------

Exploration and Production 13,661 13,075 10,149

Refining and Marketing 4,447 3,122 2,757

Gas, Power and Renewables 811 432 235

Other businesses and corporate 275 281 797

------------------------------------------------------------------------------------------------------------------------------------------------

Capital expenditure 19,194 16,910 13,938

Acquisitions and asset exchanges 1,447 321 211

------------------------------------------------------------------------------------------------------------------------------------------------

20,641 17,231 14,149

Disposals (4,267) (6,254) (11,200)

------------------------------------------------------------------------------------------------------------------------------------------------

Net investment 16,374 10,977 2,949

Capital expenditure and acquisitions in 2007, 2006 and 2005 amounted to

$20,641 million, $17,231 million and $14,149 million respectively.

Acquisitions in 2007 included the remaining 31% of the Rotterdam

(Nerefco) refinery from Chevron’s Netherlands manufacturing company.

There were no significant acquisitions in 2006 or 2005.

Excluding acquisitions and asset exchanges, capital expenditure for

2007 was $19,194 million compared with $16,910 million in 2006 and

$13,938 million in 2005. In 2006, this included $1 billion in respect of our

investment in Rosneft.

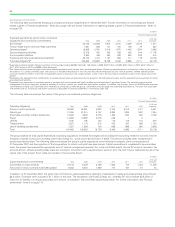

Finance costs and other finance income/expense

Finance costs comprises group interest less amounts capitalized. Finance

costs for continuing operations in 2007 were $1,110 million compared

with $718 million in 2006 and $616 million in 2005. The charge in 2007

reflected a higher average gross debt balance than in prior years, and

lower capitalized interest than in 2006 as capital construction projects

concluded. The increase for 2006 compared with 2005 reflected higher

interest rates, partially offset by increased capitalized interest. Finance

costs in 2005 included a charge of $57 million arising from early

redemption of finance leases.

Other finance income/expense included net pension finance costs, the

interest accretion on provisions and, for 2005 and 2006, the interest

accretion on the deferred consideration for the acquisition of our

investment in TNK-BP. Other finance income for continuing operations in

2007 was $369 million compared with $202 million in 2006 and a net

expense of $145 million in 2005. The increase in income year on year

largely reflects the higher return on pension assets as the pension asset

base applicable to each year increased, reflecting rising asset market

valuations.

Taxation

The charge for corporate taxes for continuing operations in 2007

was $10,442 million, compared with $12,331 million in 2006 and

$9,473 million in 2005. The effective rate was 33% in 2007, 36% in 2006

and 30% in 2005. The reduction in the effective rate in 2007 compared

with 2006 primarily reflects the reduction in the UK tax rate and a

higher proportion of income arising in countries bearing a lower tax

rate and other factors. The increase in the effective rate in 2006

compared with 2005 reflected the impact of the increase in the North

Sea tax rate enacted by the UK government in July 2006 and the

absence of non-recurring benefits that were present in 2005.

Business results

Profit before interest and taxation from continuing operations, which is

before finance costs, other finance expense, taxation and minority

interests, was $32,352 million in 2007, $35,158 million in 2006 and

$32,682 million in 2005.