BP 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP ANNUAL REPORT AND ACCOUNTS 2007 33

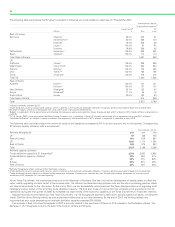

The following table shows BP’s Aromatics & Acetyls production capacity at 31 December 2007. This production capacity is based on the original

design capacity of the plants plus expansions.

thousand tonnes per year

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total – BP

Acetic share of

Geographic area PTA PX acid Other capacity

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

UK

Hull – – 549 616 1,165

Rest of Europe

Belgium

Geel 1,075 597 – – 1,672

USA

Cooper River 1,309 – – – 1,309

Decatur 1,046 1,109 – 29 2,184

Texas City – 1,302 550a123 1,975

Rest of World

China

Chongqing – – 211b52 263 (51% of YARACO)b

Zhuhai 1,496c– – – 1,496c

Indonesia

Merak 255 – – – 255 (50% of PT Ami)

Korea

Ulsan – – 245d59e304 (51% of SS-BP)d

(34% of ASACCO)e

Malaysia

Kertih – – 549 – 549

Kuantan 697 – – – 697

Taiwan

Kaohsiung 832f– – – 832 (61% of CAPCO)f

Taichung 469f– – – 469 (61% of CAPCO)f

Mai Liao – – 167g– 167 (50% of FBPC)g

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

7,179 3,008 2,271 879 13,337

aSterling Chemicals plant, the output of which is marketed by BP.

bYangtze River Acetyls Company.

cInclusive of 900ktepa capacity from the second BP Zhuhai PTA plant, which commenced commissioning at end of 2007.

dSamsung-BP Chemicals Ltd.

eAsian Acetyls Company Ltd.

fChina American Petrochemical Company Ltd.

gFormosa BP Chemicals Corporation.

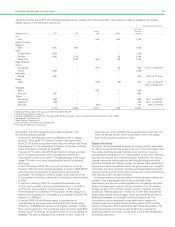

During 2007, the following significant activities took place in the

Aromatics & Acetyls business:

– Construction commenced on the new 500ktepa plant, in Jiangsu

province, China, by BP YPC Acetyls Company (Nanjing) Limited

(BYACO), BP’s 50% equity-share acetic acid joint venture with Yangzi

Petrochemical Co. Ltd (a subsidiary of Sinopec Corporation in China),

and is scheduled to complete by mid-2009.

– The second PTA plant at the BP Zhuhai Chemical Company Limited

site in Guangdong province, China, successfully commenced

commissioning at the end of 2007. The 900ktepa plant is the single

largest PTA train in the world, employing the latest BP proprietary

technology.

– In the first quarter of 2007, BP announced its intention to sell its

European VAM and ethyl acetate businesses. In January 2008, INEOS

announced that it had reached an agreement to acquire these

businesses. The transaction, which is subject to the approval of the

EU competition authorities, is expected to complete in the first quarter

of 2008.

– In the fourth quarter of 2007, BP completed the disposal of its

47.41% equity interest in Samsung Petrochemical Co. Ltd (SPC) to

our PTA joint venture partner, Samsung Group, in South Korea.

– The development of a 350ktepa PTA expansion at Geel, Belgium, is

expected to be operational in mid-2008 and to increase the site’s PTA

capacity to 1,425ktepa.

– In January 2008, BP and Sinopec signed a memorandum of

understanding to add a new acetic acid plant at their Yangtze River

Acetyls Co. (YARACO) joint venture in Chongqing, upstream Yangtze

River, south-west China. This world-scale acetic acid plant, using BP’s

leading Cativa

2

technology, is expected to have an annual capacity of

650ktepa. The plant is expected to be onstream in 2011, when the

total production at the YARACO site is expected to be well over one

million tonnes per annum, which would make it one of the largest

acetic acid production locations in China.

Supply and trading

The group has a long-established supply and trading activity responsible

for delivering value across the overall crude and oil products supply chain.

This activity identifies the best markets and prices for our crude oil,

sources optimal feedstock for our refining assets and sources marketing

activities with flexible and competitive supply. Additionally, the function

creates incremental trading opportunities through holding commodity

derivative contracts and trading inventory. To achieve these objectives in

a liquid and volatile international market, the group enters into a range of

commodity derivative contracts, including exchange-traded futures and

options, over-the-counter (OTC) options, swaps and forward contracts as

well as physical term and spot contracts.

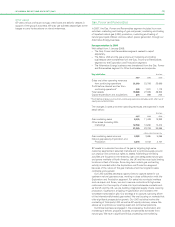

Exchange-traded contracts are traded on liquid regulated markets that

transact in key crude grades, such as Brent and West Texas

Intermediate, and the main product grades, such as gasoline and gasoil.

These exchanges exist in each of the key markets in the US, western

Europe and Asia. OTC contracts include a variety of options, forwards

and swaps. These swaps price in relation to a wider set of grades than

those traded through the exchanges, where counterparties contract for

differences between, for example, fixed and floating prices. The

contracts we use are described in more detail below. Additionally,

physical crude can be traded forward by using specific OTC contracts

pricing in reference to Brent and West Texas Intermediate grades. OTC

crude forward sales contracts are used by BP to buy and sell the

underlying physical commodity, as well as to act as a risk management

and trading instrument.