BP 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

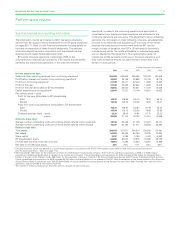

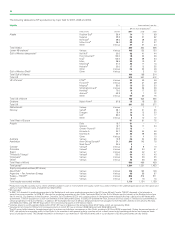

Reserve replacement

Total hydrocarbon proved reserves, on an oil equivalent basis and

excluding equity-accounted entities, comprised 12,583mmboe at

31 December 2007, a decrease of 4.4% compared with 31 December

2006. Natural gas represents about 56% of these reserves. The

reduction includes net sales of 58mmboe, largely comprising a number

of assets in the Netherlands, Pakistan, Canada and the US.

Total hydrocarbon proved reserves, on an oil equivalent basis for

equity-accounted entities alone, comprised 5,231mmboe at 31 December

2007, an increase of 15.3% compared with 31 December 2006. Natural

gas represents about 12% of these proved reserves. The increase

includes net sales of 3mmboe, largely comprising a number of assets in

Russia.

The proved reserves replacement ratio (also known as the production

replacement ratio) is the extent to which production is replaced by

proved reserves additions. This ratio is expressed in oil equivalent terms

and includes changes resulting from revisions to previous estimates,

improved recovery and extensions and discoveries, and may be

expressed as a replacement ratio excluding acquisitions and divestments

or as a total replacement ratio including acquisitions and divestments.

%

------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------

Proved reserves replacement ratio,

excluding equity-accounted

entities 44 34 68

Proved reserves replacement ratio,

excluding equity-accounted

entities, including sales and

purchases of reserves-in-place 38 11 40

Proved reserves replacement ratio,

for equity-accounted entities 248 272 151

Proved reserves replacement ratio,

for equity-accounted entities,

including sales and purchases of

reserves-in-place 248 239 141

million barrels of oil equivalent

------------------------------------------------------------------------------------------------------------------------------------------------

Additions to proved developed

reserves, excluding equity-

accounted entities, including

sales and purchases of reserves-

in-placea929 675 632

Additions to proved developed

reserves, for equity-accounted

entities, including sales and

purchases of reserves-in-placea473 936 474

%

------------------------------------------------------------------------------------------------------------------------------------------------

Proved developed reserves

replacement ratio, excluding

equity-accounted entities,

including sales and purchases of

reserves-in-place 99 70 63

Proved developed reserves

replacement ratio, for equity-

accounted entities, including

sales and purchases of reserves-

in-place 101 195 99

aThis includes some reserves that were previously classified as proved

undeveloped.

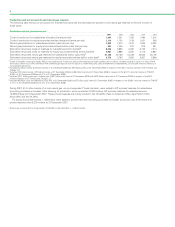

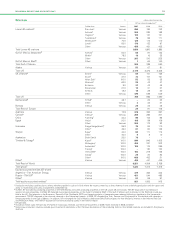

In 2007, net additions to the group’s proved reserves (excluding sales

and purchases of reserves-in-place and equity-accounted entities)

amounted to 414mmboe, principally through improved recovery from,

and extensions to, existing fields and discoveries of new fields. Of the

reserves additions through improved recovery from, and extensions to,

existing fields and discoveries of new fields, 64% are associated with

new projects and are proved undeveloped reserves additions. The

remainder are in existing developments where they represent a mixture

of proved developed and proved undeveloped reserves. The principal

reserves additions were in the Norway (Skarv), the US (Liberty, Prudhoe

Bay, Great White, Nakika, Thunder Horse), Trinidad (Immortelle,

Manakin), Angola (Pazflor) and Canada (Noel).

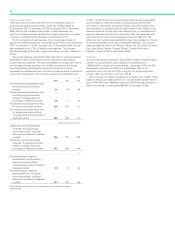

Production

Our total hydrocarbon production during 2007 averaged 2,549 thousand

barrels of oil equivalent per day (mboe/d) for subsidiaries and

1,269mboe/d for equity-accounted entities, a decrease of 3% and 2%

respectively compared with 2006. For subsidiaries, 35% of our

production was in the US and 13% in the UK. For equity-accounted

entities, 72% of production was from TNK-BP.

Total production for 2008 is expected to be higher than in 2007. This is

based on the group’s asset portfolio at 1 January 2008, expected start-

ups in 2008 and Brent at $60/bbl, before any 2008 disposal effects and

before any effects of prices above $60/bbl on volumes in PSAs.

16