BP 2007 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP ANNUAL REPORT AND ACCOUNTS 2007 137

3

–

–

–

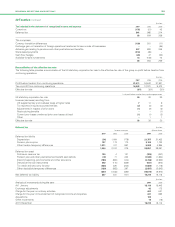

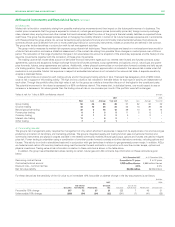

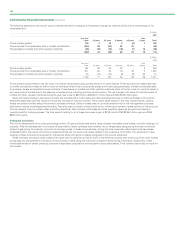

28 Financial instruments and financial risk factors continued

(a) Market risk

Market risk is the risk or uncertainty arising from possible market price movements and their impact on the future performance of a business. The

market price movements that the group is exposed to include oil, natural gas and power prices (commodity price risk), foreign currency exchange

rates, interest rates, equity prices and other indices that could adversely affect the value of the group’s financial assets, liabilities or expected future

cash flows. The group has developed policies aimed at managing the volatility inherent in certain of its natural business exposures and in accordance

with these policies the group enters into various transactions using derivative financial and commodity instruments (derivatives). Derivatives are

contracts whose value is derived from one or more underlying financial or commodity instruments, indices or prices that are defined in the contract.

The group also trades derivatives in conjunction with its risk management activities.

The group mainly measures its market risk exposure using value-at-risk techniques. These techniques are based on a variance/covariance model or

a Monte Carlo simulation and make a statistical assessment of the market risk arising from possible future changes in market prices over a 24-hour

period. The calculation of the range of potential changes in fair value takes into account a snapshot of the end-of-day exposures and the history of one-

day price movements, together with the correlation of these price movements.

The trading value-at-risk model takes account of derivative financial instrument types such as: interest rate forward and futures contracts, swap

agreements, options and swaptions; foreign exchange forward and futures contracts, swap agreements and options; and oil, natural gas and power

price forwards, futures, swap agreements and options. Additionally, where physical commodities or non-derivative forward contracts are held as part

of a trading position, they are also included in these calculations. For options, a linear approximation is included in the value-at-risk models when full

revaluation is not possible. Market risk exposure in respect of embedded derivatives is not included in the value-at-risk table. A separate sensitivity

analysis is disclosed below.

Value-at-risk limits are in place for each trading activity and for the group’s trading activity in total. The board has delegated a limit of $100 million

value at risk in support of this trading activity. The high and low values at risk indicated in the table below for each type of activity are independent of

each other. Through the portfolio effect the high value at risk for the group as a whole is lower than the sum of the highs for the constituent parts.

The potential movement in fair values is expressed to a 95% confidence interval. This means that, in statistical terms, one would expect to see an

increase or a decrease in fair values greater than the trading value at risk on one occasion per month if the portfolio were left unchanged.

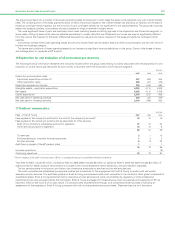

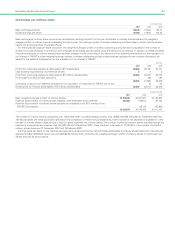

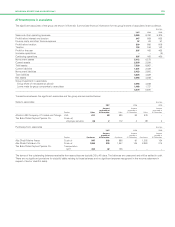

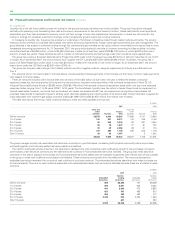

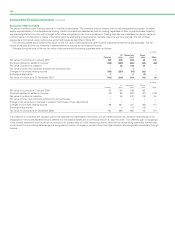

Value at risk for 1 day at 95% confidence interval $ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

High Low Average Year end High Low Average Year end

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Group trading 50 24 35 38 57 22 34 30

Oil price trading 46 16 26 34 56 16 29 22

Natural gas price trading 32 9 16 15 29 10 19 15

Power price trading 61351126

Currency trading 61325–2

Interest rate trading 11 – 5 2 1–1

Other trading 7–21–––

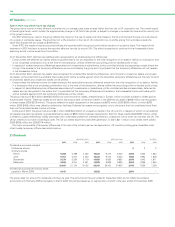

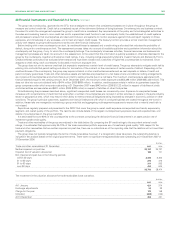

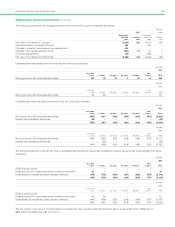

(i) Commodity price risk

The group’s risk management policy requires the management of only certain short-term exposures in respect of its equity share of oil and natural gas

production and certain of its refinery and marketing activities. The group’s integrated supply and trading function uses conventional financial and

commodity instruments and physical cargoes available in the related commodity markets. Natural gas swaps, options and futures are used to mitigate

price risk. Power trading is undertaken using a combination of over-the-counter forward contracts and other derivative contracts, including options and

futures. This activity is on both a standalone basis and in conjunction with gas derivatives in relation to gas-generated power margin. In addition, NGLs

are traded around certain US inventory locations using over-the-counter forward contracts in conjunction with over-the-counter swaps, options and

physical inventories. Trading value-at-risk information in relation to these activities is shown in the table above.

In addition, the group has embedded derivatives relating to certain natural gas and LNG contracts. Key information on these contracts is given

below.

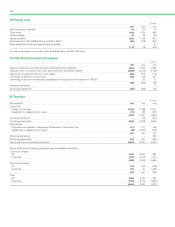

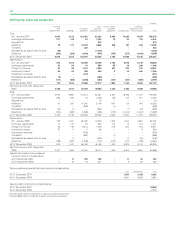

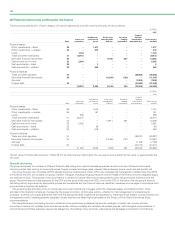

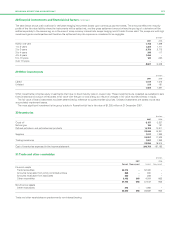

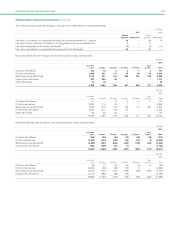

At 31 December 2007 At 31 December 2006

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Remaining contract terms 9monthsto11years 2 to 12 years

Contractual/notional amount 3,889 million therms 4,968 million therms

Discount rate – nominal risk free 4.5% 4.5%

Net fair value liability $2,085 million $2,064 million

For these derivatives the sensitivity of the fair value to an immediate 10% favourable or adverse change in the key assumptions is as follows.

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Gas oil and Discount Gas oil and

Gas price fuel oil price Power price rate Gas price fuel oil price Power price Discount rate

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Favourable 10% change 317 72 37 31 332 7 45 31

Unfavourable 10% change (368) (84) (34) (32) (341) (7) (41) (32)