BP 2007 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP ANNUAL REPORT AND ACCOUNTS 2007 157

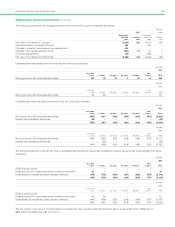

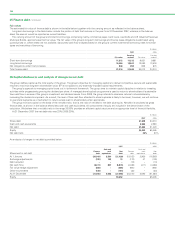

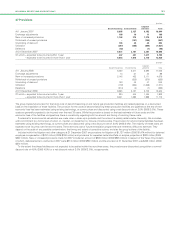

39 Called up share capital

The allotted, called up and fully paid share capital at 31 December was as follows:

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Issued Shares (thousand) $ million Shares (thousand) $ million Shares (thousand) $ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

8% cumulative first preference shares of £1 each 7,233 12 7,233 12 7,233 12

9% cumulative second preference shares of £1 each 5,473 9 5,473 9 5,473 9

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

21 21 21

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Ordinary shares of 25 cents each

At 1 January 21,457,301 5,364 20,657,045 5,164 21,525,978 5,382

Issue of new shares for employee share schemes 69,273 18 64,854 16 82,144 20

Issue of ordinary share capital for TNK-BP ––111,151 28 108,629 27

Repurchase of ordinary share capital (663,150) (166) (358,374) (90) (1,059,706) (265)

Othera––982,625 246 – –

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 31 December 20,863,424 5,216 21,457,301 5,364 20,657,045 5,164

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

5,237 5,385 5,185

Authorized

8% cumulative first preference shares of £1 each 7,250 12 7,250 12 7,250 12

9% cumulative second preference shares of £1 each 5,500 9 5,500 9 5,500 9

Ordinary shares of 25 cents each 36,000,000 9,000 36,000,000 9,000 36,000,000 9,000

aReclassification in respect of share repurchases in 2005.

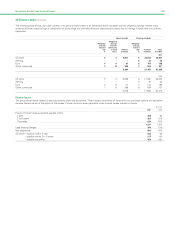

Voting on substantive resolutions tabled at a general meeting is on a poll. On a poll, shareholders present in person or by proxy have two votes for

every £5 in nominal amount of the first and second preference shares held and one vote for every ordinary share held. On a show-of-hands vote on

other resolutions (procedural matters) at a general meeting, shareholders present in person or by proxy have one vote each.

In the event of the winding up of the company, preference shareholders would be entitled to a sum equal to the capital paid up on the preference

shares, plus an amount in respect of accrued and unpaid dividends and a premium equal to the higher of (i) 10% of the capital paid up on the

preference shares and (ii) the excess of the average market price of such shares on the London Stock Exchange during the previous six months over

par value.

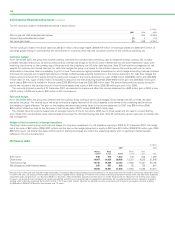

Repurchase of ordinary share capital

The company purchased 663,149,528 ordinary shares (2006 1,334,362,750 and 2005 1,059,706,481 ordinary shares) for a total consideration of

$7,497 million (2006 $15,481 million and 2005 $11,597 million), of which all were for cancellation. At 31 December 2007 150,966,096 (2006

99,045,000 and 2005 nil) ordinary shares bought back were awaiting cancellation. These shares have been excluded from ordinary shares in issue

shown above. At 31 December 2007, 1,940,638,808 shares of nominal value $485 million were held in treasury (2006 1,946,804,533 shares of

nominal value $487 million). The maximum number of shares held in treasury during the year was 1,946,804,533 shares of nominal value $487 million,

representing 9.1% of the called up ordinary share capital of the company. During 2007, 1,700,000 treasury shares were gifted to the ESOP trust and

4,465,725 treasury shares were re-issued in relation to employee share schemes, in total representing less than 0.1% of the ordinary share capital of

the company. The nominal value of these shares was $2 million and the total proceeds received were $35 million.

Transaction costs of share repurchases amounted to $40 million (2006 $83 million and 2005 $63 million).