BP 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part 1: Summary

Dear Shareholder

This year has been a period of transition for the group and so the

long-standing principles that guide the remuneration committee have

been particularly in evidence. These centre on a demanding performance

link, for the majority of executive directors’ remuneration, to support

the creation of long-term shareholder value; and the application of

informed judgement by the committee, using both quantitative and

qualitative assessments, to ensure a fair and appropriate reward

for the executive directors.

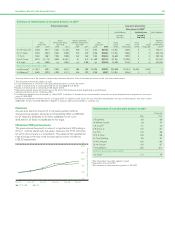

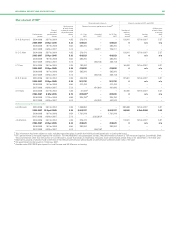

Executive changes

Key among the transitions was the appointment of Dr Hayward as

group chief executive. Mr Inglis was appointed chief executive of our

exploration and production business and Mr Conn assumed the role of

chief executive of our refining and marketing business. They, along with

Dr Grote in his continuing role as chief financial officer, make up the new

top team for the company. The committee considered both the scale and

importance of their roles as well as the operating style of the new team

in reviewing their remuneration during the year. Dr Hayward’s salary

was increased to £950,000 per annum and the salary of both Mr Inglis

and Mr Conn was set at £650,000 per annum. Dr Grote’s salary was

increased to $1,300,000 per annum. All will have a target bonus

opportunity of 120% of salary and long-term performance share awards

of 5.5 times salary. These performance shares only vest to the extent

that demanding performance conditions are met. In addition to these

ongoing plans, Mr Inglis and Mr Conn were each recently granted

one-off retention awards in the form of restricted shares to a value of

£1,500,000. These will vest in equal tranches after three and five years,

subject to their continued service and satisfactory performance.

Both Lord Browne and Mr Manzoni left the company during the year.

Lord Browne remained eligible for a lump sum ex gratia superannuation

payment equal to one year’s salary but, in light of his resignation,

received no other compensation on his retirement. Mr Manzoni received

one year’s salary in line with his contractual entitlement. Both were

eligible for a pro-rata bonus for 2007, reflecting the results achieved as

well as their time employed during the year. Both retain full participation

in the 2005-2007 and 2006-2008 share element but forfeit any

participation in the 2007-2009 plan. They both retain outstanding share

options granted in earlier years.

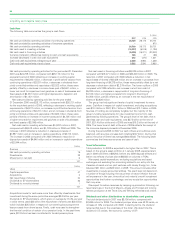

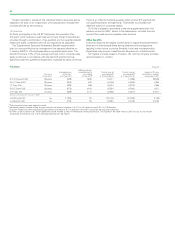

2007 performance

Overall performance for the year was constrained by the continuing

impact of past operating challenges. Bonuses awarded reflect the

balance of somewhat disappointing financial results coupled with

good progress on non-financial measures, including health, safety

and environment (HSE), and very committed efforts by the executive

directors to resolve past issues, advance the forward agenda and deliver

results. These are set out in the summary table opposite, along with

all remuneration paid to executive directors in 2007.

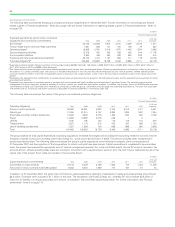

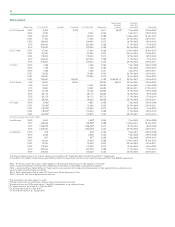

The impact of past operating problems affected the Executive

Directors’ Incentive Plan (EDIP) share element. Shares vest in this

element based principally on the total shareholder return (TSR) relative

to the oil majors over the three-year performance period. Performance

failed to meet satisfactory levels and consequently no shares will vest

in the 2005-2007 plan. Although Lord Browne similarly did not receive

shares under the main 2005-2007 plan, around 15% of the shares of

the separate leadership portion vested.

Review of policy

With a new top team in place and having come through a testing time

in terms of company performance, the committee decided to review

remuneration policy during the year. The key area of review was the

performance conditions applied to the EDIP share element. In particular,

the committee considered whether additional performance measures or

non-financial measures, such as health and safety indicators, should be

included. The review included consultation with major shareholders and

a comparison with other companies’ remuneration policies. The review

reinforced our confidence in the current plan, approved by shareholders

in 2005, in particular in the flexibility it gives us to exercise our judgement

with regard to underlying performance and non-financial indicators

without being formulaic. No changes to the policy are planned.

For 2008, therefore, our policy is as follows:

–Salary Salaries are reviewed annually, based on independent advice,

with regard to comparator companies and market conditions.

–Annual bonus ‘On-target’ bonus is set at 120% of salary. The normal

maximum bonus, also unchanged, is 150% of salary but, as in past

years, the committee may in exceptional circumstances award bonus

above that level if deemed justified by performance. Bonus for 2008

will reflect the business priorities of safety, people and performance

as articulated by Dr Hayward. Of the 120% ‘on-target’ bonus, 50 will

be measured on financial results, principally earnings before interest,

taxes, depreciation and amortization (EBITDA), return on average

capital employed and cash flow; 25 will be based on safety as

assessed by the safety, ethics and environment assurance committee

(SEEAC); 25 on people, behaviour and values; and 20 on individual

performance, which will primarily reflect relevant operating results

and leadership.

–EDIP The share element will provide the primary long-term

remuneration vehicle. Shares will be awarded to a level of 5.5 times

salary for each executive director. These will vest after three years to

the extent that performance relative to the other oil majors merits it.

Performance is measured principally on TSR versus ExxonMobil, Shell,

Total and Chevron. 100% of shares vest if first, 70% if second, 35%

if third and nothing if fourth or fifth. The committee will also apply

informed judgement, looking at overall performance in determining

the final vesting level. Shares that vest must be retained for a further

three years before being released to the executive director. In

addition, each executive director is expected to build a significant

personal shareholding in BP.

–Pensions Executive directors are eligible to participate in the

appropriate pension schemes applying to their home countries.

With this policy, the majority of executive directors’ target

remuneration is performance-based. Recognizing that unforeseen

developments mean no remuneration structure is perfect, the committee

will continue to apply its judgement in the implementation of the policy

so as to reflect shareholders’ interests and also engage and retain our

talented team of executives.

Dr D S Julius

Chairman, Remuneration Committee

22 February 2008

64