BP 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

shares will be paid in pounds sterling and on BP ADSs in US dollars. The

rate of exchange used to determine the sterling amount equivalent is the

average of the forward exchange rate in London over the five business

days prior to the announcement date. The directors may choose to

declare dividends in any currency provided that a sterling equivalent is

announced, but it is not the company’s intention to change its current

policy of announcing dividends on ordinary shares in US dollars.

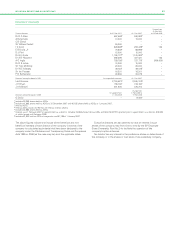

The following table shows dividends announced and paid by the

company per ADS for each of the past five years. In the case of

dividends paid before 1 May 2004, the dividends shown are before the

deemed credit allowed to shareholders resident in the US under the

former income tax convention between the US and the UK and the

associated withholding tax in respect thereof equal to the amount of

such credit. (This deemed credit and associated withholding tax do not

apply to dividends paid after 30 April 2004 to shareholders resident in

the US.)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

March June September December Total

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Dividends per American depositary share

2003 UK pence 22.9 23.7 24.2 23.1 93.9

US cents 37.5 37.5 39.0 39.0 153.0

Canadian cents 57.4 54.3 54.0 51.1 216.8

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2004 UK pence 22.0 22.8 23.2 23.5 91.5

US cents 40.5 40.5 42.6 42.6 166.2

Canadian cents 53.7 54.8 56.7 52.2 217.4

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2005 UK pence 27.1 26.7 30.7 30.4 114.9

US cents 51.0 51.0 53.55 53.55 209.1

Canadian cents 64.0 63.2 65.3 63.7 256.2

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 UK pence 31.7 31.5 31.9 31.4 126.5

US cents 56.25 56.25 58.95 58.95 230.40

Canadian cents 64.5 64.1 67.4 66.5 262.5

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 UK pence 31.5 30.9 31.7 31.8 125.9

US cents 61.95 61.95 64.95 64.95 253.8

Canadian cents 73.3 69.5 67.80 63.60 274.2

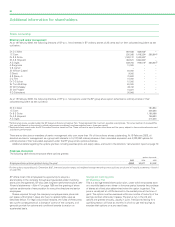

A dividend reinvestment plan is in place whereby holders of BP ordinary shares can elect to reinvest the net cash dividend in shares purchased on the

London Stock Exchange. This plan is not available to any person resident in the US or Canada or in any jurisdiction outside the UK where such an offer

requires compliance by the company with any governmental or regulatory procedures or any similar formalities. A dividend reinvestment plan is,

however, available for holders of ADSs through JPMorgan Chase Bank.

Future dividends will be dependent on future earnings, the financial condition of the group, the Risk factors set out on pages 9-10 and other matters

that may affect the business of the group set out in Financial and operating performance on page 46.

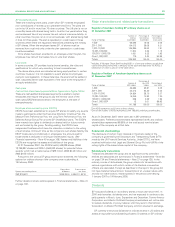

Legal proceedings

Save as disclosed in the following paragraphs, no member of the group is

a party to, and no property of a member of the group is subject to, any

pending legal proceedings that are significant to the group.

On 28 June 2006, the US Commodity Futures Trading Commission

(CFTC) filed a civil enforcement action in the US District Court for the

Northern District of Illinois against BP Products North America Inc. (BP

Products), a wholly owned subsidiary of BP, alleging that BP Products

manipulated the price of February 2004 TET physical propane. The CFTC

also charged BP Products with attempting to manipulate the price of

February 2004 and April 2003 TET physical propane. On 28 June 2006,

the US Department of Justice (DOJ) filed a criminal charge against a

former BP Products propane trader, who entered a guilty plea, and on

8 November 2007, four additional former BP Products traders were

indicted on charges of conspiracy and market corner and commodity

price manipulation. Private class action complaints have also been filed

against BP Products that have been consolidated in the US District Court

for the Northern District of Illinois. The complaints contain allegations

similar to those in the CFTC action as well as of violations of federal and

state antitrust and unfair competition laws and state consumer protection

statutes and unjust enrichment. The complaints seek actual and punitive

damages and injunctive relief.

On 25 October 2007, BP America Inc. (BP America) entered into a

deferred prosecution agreement (DPA) with the DOJ relating to

allegations that BP America manipulated the price of February 2004 TET

physical propane and attempted to manipulate the price of TET propane

in April 2003. The DPA requires BP America’s and certain of its affiliates’

continued co-operation with the US government investigations of the

trades in question, as well as other trading matters that may arise.

Pursuant to the DPA, an independent monitor has been appointed to

oversee compliance with the DPA. The independent monitor has

authority to investigate and report alleged violations of the US

Commodity Exchange Act or CFTC regulations and to recommend

corrective action. The DPA has a term of three years and contemplates

dismissal of all charges at the end of the term following the DOJ’s

determination that BP America has complied with the terms of the DPA.

BP America understands that its entry into the DPA concludes the

pending criminal investigations of it and its affiliates relating to trading in

various commodities, including propane, unleaded gasoline and crude oil.

On 25 October 2007, BP Products also entered a companion consent

order with the CFTC resolving all civil enforcement matters concerning

BP Products’ propane trading. The remit of the independent monitor

includes overseeing compliance with the Consent Order. BP Products

understands that with its entry into the Consent Order, the CFTC closed

its investigation of trading in unleaded gasoline without the filing of any

charges against BP Products. In connection with the DPA and the

Consent Order, BP America and BP Products agreed to pay fines,

penalties and restitution totaling just over $303.5 million, including

$53.5 million to a victim restitution fund, a criminal penalty of $100

million, a civil penalty of $125 million and a $25 million payment to the

US Postal Inspection Service Consumer Fraud Fund. Investigations into

BP’s trading activities continue to be conducted from time to time.

On 23 March 2005, an explosion and fire occurred in the isomerization

unit of BP Products’ Texas City refinery as the unit was coming out of

planned maintenance. Fifteen workers died in the incident and many

others were injured. BP Products has reached more than 2,000

settlements in respect of all the fatalities and many of the personal injury

claims arising from the incident and has set aside $2,125 million, in

aggregate, for the purpose. A number of claims remain to be resolved.

The US Occupational Safety and Health Administration (OSHA), the US

Chemical Safety and Hazard Investigation Board (CSB), the US

Environmental Protection Agency (EPA), the Texas Commission on

84