BP 2007 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154

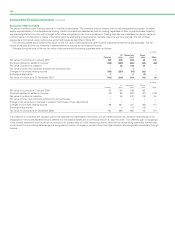

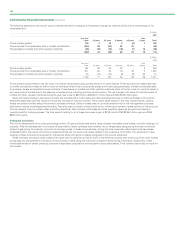

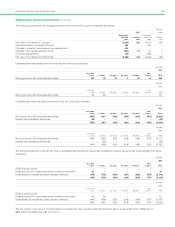

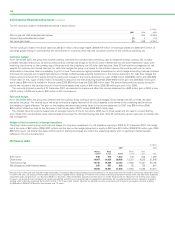

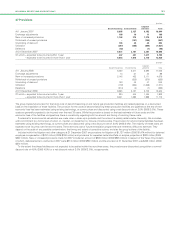

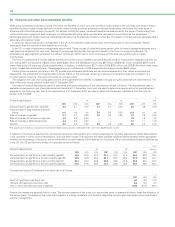

38 Pensions and other post-retirement benefits continued

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

US

UK US other post-

pension pension retirement

Analysis of the amount charged to profit before interest and taxation plans plans benefit plans Other plans Total

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Current service costa492 227 43 132 894

Past service cost 510 – –15

Settlement, curtailment and special termination benefits 36 – – 2 38

Payments to defined contribution plans – 184 – 25 209

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total operating chargeb533 421 43 159 1,156

Analysis of the amount credited (charged) to other finance expense

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Expected return on plan assets 2,075 613 2 165 2,855

Interest on plan liabilities (1,198) (425) (190) (390) (2,203)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Other finance income (expense) 877 188 (188) (225) 652

Analysis of the amount recognized in the statement of recognized

income and expense

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Actual return less expected return on pension plan assets 406 (28) – (76) 302

Change in assumptions underlying the present value of the plan liabilities 513 358 137 607 1,615

Experience gains and losses arising on the plan liabilities (162) (27) 29 (40) (200)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Actuarial gain recognized in statement of recognized income and expense 757 303 166 491 1,717

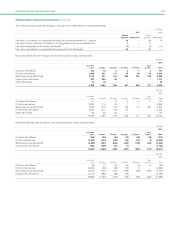

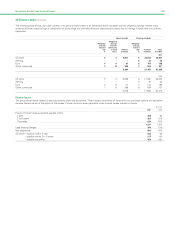

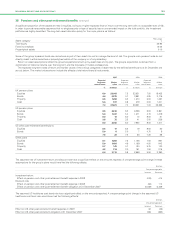

Movements in benefit obligation during the year

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Benefit obligation at 1 January 23,289 7,695 3,300 8,149 42,433

Exchange adjustments 394 – – 917 1,311

Current service costa492 227 43 132 894

Past service cost 510 – –15

Interest cost 1,198 425 190 390 2,203

Curtailment (7) – – – (7)

Settlement (3) – – – (3)

Special termination benefitsc46 – – 2 48

Contributions by plan participants 43 – – 12 55

Benefit payments (funded plans)d(1,085) (580) (5) (182) (1,852)

Benefit payments (unfunded plans)d(3) (37) (184) (379) (603)

Acquisitions – – – 141 141

Disposals (91) – – (29) (120)

Actuarial gain on obligation (351) (331) (166) (567) (1,415)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Benefit obligation at 31 Decembera23,927 7,409 3,178 8,586 43,100

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Movements in fair value of plan assets during the year

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fair value of plan assets at 1 January 29,261 7,955 26 2,668 39,910

Exchange adjustments 488 – – 316 804

Expected return on plan assetsa, e 2,075 613 2 165 2,855

Contributions by plan participants 43 – – 12 55

Contributions by employers (funded plans) 524 97 – 127 748

Benefit payments (funded plans)d(1,085) (580) (5) (182) (1,852)

Acquisitions – – – 101 101

Disposals (91) (12) – (21) (124)

Actuarial gain on plan assetse406 (28) – (76) 302

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fair value of plan assets at 31 December 31,621 8,045 23 3,110 42,799

Surplus (deficit) at 31 December 7,694 636 (3,155) (5,476) (301)

Represented by

Asset recognized 7,818 989 – 107 8,914

Liability recognized (124) (353) (3,155) (5,583) (9,215)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

7,694 636 (3,155) (5,476) (301)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

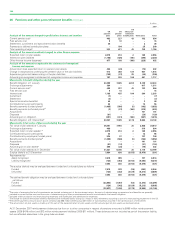

The surplus (deficit) may be analysed between funded and unfunded plans as follows

Funded 7,818 978 (29) (263) 8,504

Unfunded (124) (342) (3,126) (5,213) (8,805)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

7,694 636 (3,155) (5,476) (301)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

The defined benefit obligation may be analysed between funded and unfunded plans

as follows

Funded (23,803) (7,067) (52) (3,373) (34,295)

Unfunded (124) (342) (3,126) (5,213) (8,805)

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(23,927) (7,409) (3,178) (8,586) (43,100)

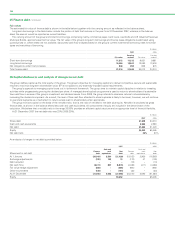

aThe costs of managing the fund’s investments are treated as being part of the investment return, the costs of administering our pensions fund benefits are generally

included in current service cost and the costs of administering our other post-retirement benefits are included in the benefit obligation.

bIncluded within production and manufacturing expenses and distribution and administration expenses.

cThe charge for special termination benefits represents the increased liability arising as a result of early retirements occurring as part of a restructuring programme in the UK.

dThe benefit payments amount shown above comprises $2,398 million benefits plus $57 million of fund expenses incurred in the administration of the benefit.

eThe actual return on plan assets is made up of the sum of the expected return on plan assets and the actuarial gain on plan assets as disclosed above.

At 31 December 2007 reimbursement balances due from or to other companies in respect of pensions amounted to $496 million reimbursement

assets (2006 $479 million) and $72 million reimbursement liabilities (2006 $71 million). These balances are not included as part of the pension liability,

but are reflected elsewhere in the group balance sheet.