BP 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

Notes on financial statements

1 Significant accounting policies

Authorization of financial statements and statement of compliance with International Financial Reporting Standards

The consolidated financial statements of the BP group for the year ended 31 December 2007 were authorized for issue by the board of directors on

22 February 2008 and the balance sheet was signed on the board’s behalf by P D Sutherland and Dr A B Hayward. BP p.l.c. is a public limited

company incorporated and domiciled in England and Wales. The company’s ordinary shares are traded on the London Stock Exchange. The

consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board (IASB), IFRS as adopted by the European Union (EU) and in accordance with the provisions of the

Companies Act 1985. IFRS as adopted by the EU differs in certain respects from IFRS as issued by the IASB, however, the differences have no

impact on the group’s consolidated financial statements for the years presented. The significant accounting policies of the group are set out below.

Basis of preparation

The consolidated financial statements have been prepared in accordance with IFRS and International Financial Reporting Interpretations Committee

(IFRIC) interpretations issued and effective for the year ended 31 December 2007, or issued and early adopted.

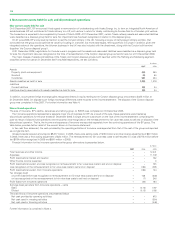

In preparing the consolidated financial statements for the current year, the group has adopted the following new IFRS, amendment to IFRS and

IFRIC interpretations:

– IFRS 7 ‘Financial Instruments: Disclosures’.

– Amendment to IAS 1 ‘Presentation of Financial Statements’ – Capital Disclosures.

– IFRIC 10 ‘Interim Financial Reporting and Impairment’.

– IFRIC 11 ‘IFRS 2 – Group and Treasury Share Transactions’.

Further information regarding the impact of adoption is given below.

The accounting policies that follow have been consistently applied to all years presented with the exception of those relating to financial instruments

under IAS 32 ‘Financial Instruments: Presentation’ (IAS 32) and IAS 39 ‘Financial Instruments: Recognition and Measurement’ (IAS 39) which have

been applied with effect from 1 January 2005. The standards in force at the time of BP’s first time adoption of IFRS in 2005 were applied

retrospectively to 1 January 2003, BP’s date of transition to IFRS. However, BP elected to take advantage of the exemption allowing comparative

information on financial instruments to be prepared in accordance with the group’s previous accounting policies under UK generally accepted

accounting practice (UK GAAP). The effect on shareholders’ equity of this change on 1 January 2005 is shown in the group statement of recognized

income and expense and related mainly to all derivative financial instruments being brought on to the group balance sheet at fair value and available-

for-sale investments being measured at fair value rather than at cost.

The consolidated financial statements are presented in US dollars and all values are rounded to the nearest million dollars ($ million), except where

otherwise indicated.

For further information regarding the key judgements and estimates made by management in applying the group’s accounting policies, refer to

Critical accounting policies on pages 57 to 58, which forms part of these financial statements.

Basis of consolidation

The group financial statements consolidate the financial statements of BP p.l.c. and the entities it controls (its subsidiaries) drawn up to 31 December

each year. Control comprises the power to govern the financial and operating policies of the investee so as to obtain benefit from its activities and is

achieved through direct and indirect ownership of voting rights; currently exercisable or convertible potential voting rights; or by way of contractual

agreement. Subsidiaries are consolidated from the date of their acquisition, being the date on which the group obtains control, and continue to be

consolidated until the date that such control ceases. The financial statements of subsidiaries are prepared for the same reporting year as the parent

company, using consistent accounting policies. All intercompany balances and transactions, including unrealized profits arising from intragroup

transactions, have been eliminated in full. Unrealized losses are eliminated unless the transaction provides evidence of an impairment of the asset

transferred. Minority interests represent the portion of profit or loss and net assets in subsidiaries that is not held by the group.

Interests in joint ventures

A joint venture is a contractual arrangement whereby two or more parties (venturers) undertake an economic activity that is subject to joint control.

Joint control exists only when the strategic financial and operating decisions relating to the activity require the unanimous consent of the venturers.

A jointly controlled entity is a joint venture that involves the establishment of a company, partnership or other entity to engage in economic activitythat

the group jointly controls with its fellow venturers.

The results, assets and liabilities of a jointly controlled entity are incorporated in these financial statements using the equity method of accounting.

Under the equity method, the investment in a jointly controlled entity is carried in the balance sheet at cost, plus post-acquisition changes in the

group’s share of net assets of the jointly controlled entity, less distributions received and less any impairment in value of the investment. Loans

advanced to jointly controlled entities are also included in the investment on the group balance sheet. The group income statement reflects the

group’s share of the results after tax of the jointly controlled entity. The group statement of recognized income and expense reflects the group’s share

of any income and expense recognized by the jointly controlled entity outside profit and loss.

Financial statements of jointly controlled entities are prepared for the same reporting year as the group. Where necessary, adjustments are made to

those financial statements to bring the accounting policies used into line with those of the group.

Unrealized gains on transactions between the group and its jointly controlled entities are eliminated to the extent of the group’s interest in the jointly

controlled entities. Unrealized losses are also eliminated unless the transaction provides evidence of an impairment of the asset transferred.

The group assesses investments in jointly controlled entities for impairment whenever events or changes in circumstances indicate that the carrying

value may not be recoverable. If any such indication of impairment exists, the carrying amount of the investment is compared with its recoverable

amount, being the higher of its fair value less costs to sell and value in use. Where the carrying amount exceeds the recoverable amount, the

investment is written down to its recoverable amount.