BP 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

– The Yacheng offshore gas field (BP 34.3%) supplies, under a long-

term contract, 100% of the natural gas requirement of Castle Peak

Power Company, which provides around 50% of Hong Kong’s

electricity. Some natural gas is also piped to Hainan Island, where it is

sold to the Fuel and Chemical Company of Hainan, also under a long-

term contract.

– In March, the National People’s Congress reduced the rate of

corporation tax from 33% to 25% with effect from 1 January 2008.

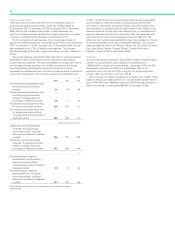

Australia

– In Australia, BP net gas production in 2007 was 376mmcf/d, an

increase of 3.3% from 2006 due to increased domestic gas demand in

Western Australia. BP net liquids production at 34mb/d remained

unchanged from 2006.

– BP is one of seven partners in the North West Shelf (NWS) venture.

Six partners (including BP) hold an equal 16.7% interest in the

infrastructure and oil reserves and an equal 15.8% interest in the gas

and condensate reserves with a seventh partner owning the

remaining 5.32% of gas and condensate reserves. The operation

covers offshore production platforms, an FPSO, trunklines and

onshore gas processing plants. The NWS venture is currently the

principal supplier to the domestic market in Western Australia. During

2007, progress continued on the construction of a fifth LNG train

(4.7 million tonnes per year design capacity), with first throughput

expected in the second half of 2008.

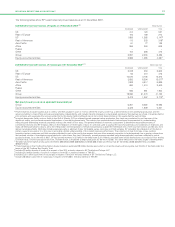

Russia

TNK-BP

– TNK-BP, a joint venture between BP (50%) and Alfa Group and

Access-Renova (AAR) (50%), is an integrated oil company operating in

Russia and the Ukraine. The TNK-BP group’s major assets are held in

OAO TNK-BP Holding. Other assets include the BP-branded retail

sites in Moscow and the Moscow region and interests in OAO Rusia

Petroleum and the OAO Slavneft group. The workforce comprises

more than 60,000 people.

– BP’s investment in TNK-BP is held by the Exploration and Production

segment and the results of TNK-BP are accounted for under the

equity method in this segment.

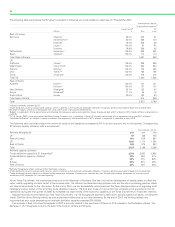

– TNK-BP has proved reserves of 6.9 billion barrels of oil equivalent

(including its 49.9% equity share of Slavneft), of which 4.5 billion are

developed. In 2007, TNK-BP’s average liquids production was

1.7mmboe/d, a decrease of just over 5% compared with 2006,

reflecting the disposal of the Udmurt asset in 2006. The production

base is largely centred in West Siberia (Samotlor, Nyagan and

Megion), which contributes about 1.2mmboe/d, together with Volga

Urals (Orenburg) contributing some 0.4mmboe/d. About 44% of total

oil production is currently exported as crude oil and 19% as refined

product.

– Downstream, TNK-BP has interests in six refineries in Russia and the

Ukraine (including Ryazan and Lisichansk and Slavneft’s Yaroslavl

refinery), with throughput of approximately 35 million tonnes per year.

During December 2007, TNK-BP agreed to purchase additional retail

and other downstream assets in Russia and the Ukraine from a

number of small companies with completion due in 2008. TNK-BP

supplies approximately 1,600 branded filling stations in Russia and the

Ukraine and, with the additional sites, is expected to have more than

20% market share of the Moscow retail market.

– In January 2007, TNK-BP announced the purchase of Occidental’s

50% interest in the West Siberian joint venture, Vanyoganneft, for

$485 million. The transaction closed during the first quarter of 2007

and TNK-BP now owns 100% of the Vanyoganneft asset.

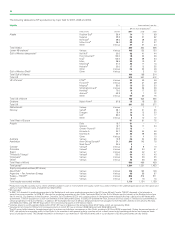

– On 22 June, BP and TNK-BP signed heads of terms to create strategic

business alliances with OAO Gazprom. Under the terms of this

agreement, TNK-BP agreed to sell to Gazprom its 62.89% stake in

OAO Rusia Petroleum, the company that owns the licence for the

Kovykta gas condensate field in East Siberia and its 50% interest in

East Siberia Gas Company (ESGCo). BP and TNK-BP have an option to

repurchase on market terms up to 25% + 1 share in OAO Rusia

Petroleum and up to 25% of ESGCo in the event that a strategic

business alliance is subsequently established with OAO Gazprom.

– In November 2006, following a review of the results of an inspection

by the licensing authorities that had resulted in a request for the

revocation of the two licences held by TNK-BP subsidiary Rospan

International, an agreed rectification plan was put in place. All the

Rospan licence compliance issues arising from the inspection by the

licensing authorities in 2006 are now substantially resolved.

Sakhalin

– BPparticipatesintheKVlicenceareainoffshoreSakhalinwhereit

conducts exploration activities through Elvaryneftegas (BP 49%), an

equity-accounted joint venture with Rosneft. Two discoveries have

been made to date in the KV licence area. BP also participates in joint

operations in two licence areas with Rosneft in East and West Shmidt

(BP 49%).

– Exploratory drilling continued in 2007 with the drilling of two wells in

the West Shmidt licence area. Both wells were found to be dry and,

as a result, BP wrote off all expenditures related to the West Shmidt

licence area.

– The 2008 work programme for the Sakhalin licence includes seismic

re-processing in the East Shmidt licence area and a 2D seismic

acquisition programme in the KV licence area. No drilling is planned

for 2008.

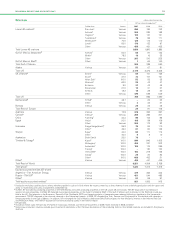

Other

Azerbaijan

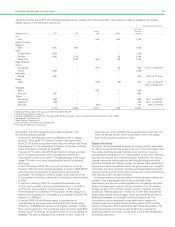

– In Azerbaijan, BP net production in 2007 was 218mboe/d, an increase

of 50% from 2006 due to the ramping up of three Azeri oil producing

platforms and the Shah Deniz condensate gas platform commencing

production in 2007.

– BP, as operator of the Azerbaijan International Operating Company

(AIOC), manages and has a 34.1% interest in the Azeri-Chirag-

Gunashli (ACG) oil fields in the Caspian Sea, offshore Azerbaijan.

Phase 3 of the project, which will develop the deepwater Gunashli

area of ACG, remains on schedule to begin production in 2008 with

platform topsides having been completed in September 2007.

– BP is the operator of Shah Deniz (BP 25.5%), which is in the

Azerbaijan sector of the Caspian Sea and will deliver gas to markets in

Azerbaijan, Georgia and Turkey. First gas to Turkey was achieved in

July 2007. Production from the field is expected to continue to ramp

up as further wells are brought onstream. Plateau production from

Stage 1 is expected to be 6.9 billion cubic metres of gas per annum

and approximately 30,000 barrels of condensate per day.

– In November, we announced a further major new gas-condensate

discovery in the Shah Deniz field in the Caspian Sea. The SDX-04

exploration and appraisal well, some 70 kilometres south-east of Baku,

discovered a new deeper structure below the currently producing

reservoir. Drilled to a Caspian-record depth of more than 7,300 metres

in the south-western part of Shah Deniz, the well encountered gas

condensate in the main target horizons extending the field to the

south. The well also discovered a new high pressure reservoir in a

deeper structure.

Middle East and south Asia

– Production in the Middle East consists principally of the production

entitlement of associates in Abu Dhabi, where we have equity

interests of 9.5% and 14.7% in onshore and offshore concessions

respectively. In 2007, BP’s share of production in Abu Dhabi was

192mb/d, down 3% from 2006 as a result of a major planned

maintenance shutdown in the offshore concession in the fourth

quarterof2007.

– In Pakistan, BP doubled its equity in the onshore Badin asset (BP

84%) as part of an international asset exchange with Occidental. As a

result of this transaction, BP net oil production in 2007 was

6.3mboe/d, an increase of 24% from 2006, and BP net gas production

was 122mmcf/d, an increase of 39.4% from 2006.

– In the third quarter of 2007, BP signed a farm-in agreement with

Petroleum Exploration (Private) Limited to obtain a 33% participating

24