BP 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP ANNUAL REPORT AND ACCOUNTS 2007 27

Refining and Marketing

Our Refining and Marketing business is responsible for the supply and

trading, refining, manufacturing, marketing and transportation of crude

oil, petroleum and chemicals products to wholesale and retail customers.

BP markets its products in more than 100 countries. We operate

primarily in Europe and North America but also manufacture and market

our products across Australasia and in parts of Asia, Africa and Central

and South America.

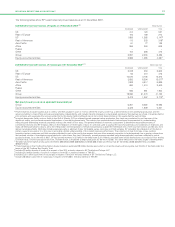

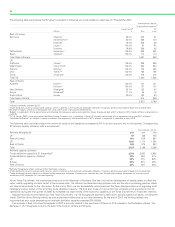

Key statistics $million

------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------

Sales and other operating revenues

for continuing operations 250,866 232,855 213,326

Profit before interest and tax from

continuing operationsa6,072 5,041 6,926

Total assets 95,691 80,964 77,485

Capital expenditure and acquisitions 5,586 3,144 2,860

$ per barrel

------------------------------------------------------------------------------------------------------------------------------------------------

Global Indicator Refining Marginb9.94 8.39 8.60

aProfit before interest and tax from continuing operations includes profit after

interest and tax of equity-accounted entities.

bThe Global Indicator Refining Margin (GIM) is the average of regional industry

indicator margins, which we weight for BP’s crude refining capacity in each region.

Each regional indicator margin is based on a single representative crude with

product yields characteristic of the typical level of upgrading complexity. The

refining margins are industry-specific rather than BP-specific measures, which we

believe are useful to investors in analyzing trends in the industry and their impact

on our results. The margins are calculated by BP based on published crude oil and

product prices and take account of fuel utilization and catalyst costs. No account is

taken of BP’s other cash and non-cash costs of refining, such as wages and salaries

and plant depreciation. The indicator margin may not be representative of the

margins achieved by BP in any period because of BP’s particular refining

configurations and crude and product slate.

The key components of sales and other operating revenues are explained

in more detail below.

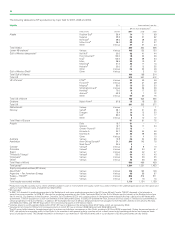

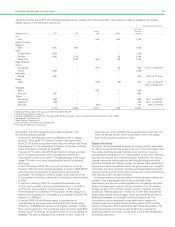

$million

------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------

Sale of crude oil through spot and

term contracts 43,004 38,577 36,992

Marketing, spot and term sales of

refined products 194,979 177,995 155,098

Other sales including non-oil and to

other segments 12,883 16,283 21,236

------------------------------------------------------------------------------------------------------------------------------------------------

250,866 232,855 213,326

thousand barrels per day

------------------------------------------------------------------------------------------------------------------------------------------------

Sale of crude oil through spot and

term contracts 1,885 2,110 2,464

Marketing, spot and term sales of

refined products 5,624 5,801 5,888

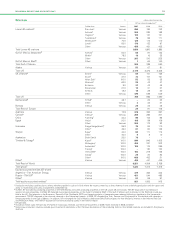

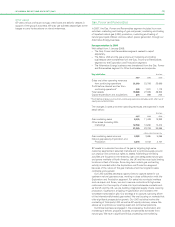

The Refining and Marketing segment includes Refining, Fuels Marketing,

Lubricants and Aromatics & Acetyls. Our strategy is to continue our

focused investment in key assets and market positions with an increased

focus on process safety, integrity and reliability following the operational

issues at the Texas City and Whiting refineries. We aim to improve the

quality and capability of our manufacturing portfolio. During the past five

years, this has been taking place through upgrades of existing conversion

units at several of our facilities and investment in new clean fuels units at

most of our refineries. In 2007, we completed a major upgrade to the

olefin cracker at the Gelsenkirchen refinery in Germany and an upgrade

of an existing diesel hydrotreater at the Rotterdam refinery in the

Netherlands. During the next five years, we expect to upgrade further

our refining portfolio through the construction of a new coker at the

Castello

´n refinery, a planned and announced investment in the Whiting

refinery to increase its ability to process Canadian heavy crude, upgrades

to diesel and gasoline desulphurization capability at the Rotterdam

refinery in the Netherlands, the installation of modern naphtha reforming

technology at several refineries globally, the site reconfiguration and

installation of a new hydrocracker at the Bayernoil refinery in Germany

and the full recommissioning of the Texas City refinery in the US.

Our marketing businesses generate customer value by providing

quality products and offers. Our retail network provides differentiated fuel

and convenience offers to some of the most attractive markets. Our

lubricants brands offer customers benefits through technology and

relationships and we focus on increasing brand and product loyalty in

Castrol lubricants. We continue to build deep customer relationships and

strategic partnerships in the business-to-business sector. Marketing also

includes the Aromatics & Acetyls business, which maintains world-class

manufacturing positions globally, with an emphasis on the Asian market,

particularly in China. At the end of 2007, the business increased its

capacity in China by successfully commencing the commissioning of a

new 900 thousand tonnes per annum (ktepa) worldscale purified

terephthalic acid (PTA) plant at Zhuhai.

The segment manages a portfolio of assets that we believe are

competitively advantaged across the chain of downstream activities.

Such advantage may derive from several factors, including location (such

as the proximity of manufacturing assets to markets), operating cost and

physical asset quality.

We are one of the major refiners of gasoline and hydrocarbon products

in the US, Europe and Australia. We have significant retail and business-

to-business market positions in the US, UK, Germany and the rest of

Europe, Australasia, Africa and Asia. We are enhancing our presence in

China and exploring opportunities in India.

During 2007, significant events were:

– BP continued recommissioning the Texas City refinery in the US. By

the end of 2007, we had successfully recommissioned the three

desulphurization and upgrading units necessary to allow restart of the

remaining crude distillation capacity. The final sour crude unit is

mechanically complete and is expected to be fully operational during

the first quarter of 2008. By mid-2008, we expect most of the

economic capability at the Texas City refinery to have been restored.

– On 23 March 2007, a fire at the Whiting refinery in the US caused

damage to the hydrogen compressors and limited the site’s

throughput and ability to make low-sulphur gasoline or diesel fuel from

sour crude oil. By the end of 2007, the Whiting refinery had

recommenced sour crude processing and available distillation capacity

exceeded 300,000b/d.

– On 1 February 2007, BP announced it had selected the University of

California Berkeley, and its partners the University of Illinois at Urbana-

Champaign and the Lawrence Berkeley National Laboratory, to join in

the previously announced $500-million research programme to explore

how bioscience can be used to increase energy production and reduce

the impact of energy consumption on the environment.

– On 31 March 2007, BP completed its acquisition of Chevron’s

Netherlands manufacturing company, Texaco Raffinaderij Pernis B.V.,

for $1.1 billion. The acquisition included Chevron’s 31% interest in the

Rotterdam (Nerefco) refinery.

– On 31 May 2007, BP completed the sale of its Coryton refinery in the

UK to Petroplus Holdings AG for consideration of $1.4 billion, plus

working capital.

– On 26 June 2007, BP, Associated British Foods and DuPont

announced an investment of $400 million in the construction of a

world-scale bioethanol plant with expected annual production capacity

of some 420 million litres from wheat feedstock, expected to be

commissioned in late 2009.

– On 29 June 2007, BP announced a joint venture with D1 Oils plc, a

UK-based global producer of biodiesel, for the development of

jatropha as a new energy crop.

– On 15 November 2007, BP announced that it would sell all of its

company-owned and company-operated convenience sites in the US.

The majority of sites will be sold to franchisees with the remaining

sites sold to dealers and large distributors (jobbers). The sale of the

sites is expected to be completed by the end of 2009. The sites will

continue to market BP-branded fuels in the eastern US and ARCO-

branded fuels in the western US. The franchise agreement is for 20