BP 2007 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

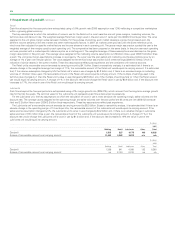

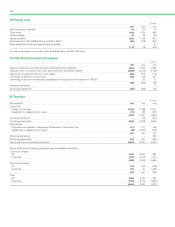

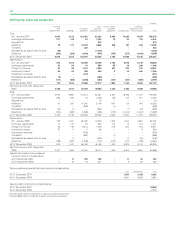

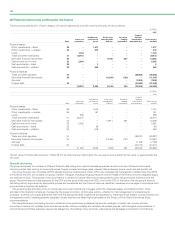

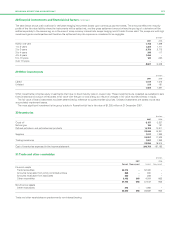

26 Investments in jointly controlled entities

The significant jointly controlled entities of the BP group at 31 December 2007 are shown in Note 46. The principal joint venture is the TNK-BP joint

venture. Summarized financial information for the group’s share of jointly controlled entities is shown below.

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

TNK-BP Other Total TNK-BP Other Total TNK-BP Other Total

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Sales and other operating revenues 19,463 7,245 26,708 17,863 6,119 23,982 15,122 4,255 19,377

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit before interest and taxation 3,743 1,299 5,042 4,616 1,218 5,834 3,817 779 4,596

Finance costs and other finance expense 264 176 440 192 169 361 128 104 232

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit before taxation 3,479 1,123 4,602 4,424 1,049 5,473 3,689 675 4,364

Taxation 993 259 1,252 1,467 260 1,727 976 220 1,196

Minority interest 215 – 215 193 – 193 104 – 104

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit for the yeara2,271 864 3,135 2,764 789 3,553 2,609 455 3,064

Innovene operations –––––––19

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Continuing operations 2,271 864 3,135 2,764 789 3,553 2,609 474 3,083

Non-current assets 12,433 9,841 22,274 11,243 7,612 18,855

Current assets 6,073 2,642 8,715 5,403 2,184 7,587

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total assets 18,506 12,483 30,989 16,646 9,796 26,442

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Current liabilities 3,547 1,552 5,099 3,594 1,272 4,866

Non-current liabilities 5,562 3,620 9,182 4,226 3,370 7,596

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total liabilities 9,109 5,172 14,281 7,820 4,642 12,462

Minority interest 580 – 580 473 – 473

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

8,817 7,311 16,128 8,353 5,154 13,507

Group investment in jointly controlled

entities

Group share of net assets (as above) 8,817 7,311 16,128 8,353 5,154 13,507

Loans made by group companies to jointly

controlled entities – 1,985 1,985 – 1,567 1,567

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

8,817 9,296 18,113 8,353 6,721 15,074

aBP’s share of the profit of TNK-BP in 2006 includes a net gain of $892 million (2005 $270 million) on the disposal of certain assets.

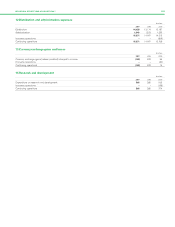

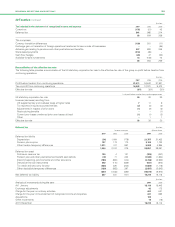

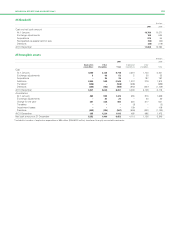

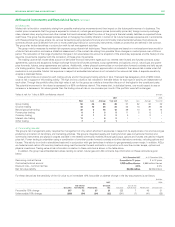

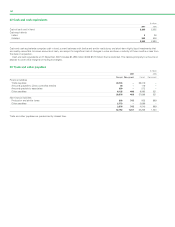

Transactions between the significant jointly controlled entities and the group are summarized below. In addition to the amount receivable at

31 December 2005 shown below, a further $771 million was receivable from TNK-BP in respect of dividends: there was no dividend receivable at

31 December 2007 or at 31 December 2006.

Sales to jointly controlled entities $ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Amount Amount Amount

receivable at receivable at receivable at

Product Sales 31 December Sales 31 December Sales 31 December

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Atlantic 4 Holdings LNG 583 142 227 35 – –

Atlantic LNG 2/3 Company of Trinidad and Tobago LNG 989 137 1,123 99 1,157 –

Pan American Energy Crude oil 240 1 389 – 75 2

Ruhr Oel Employee services 374 539 330 597 169 527

TNK-BP Employee services 150 69 189 99 125 14

Purchases from jointly controlled entities $ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Amount Amount Amount

payable at payable at payable at

Product Purchases 31 December Purchases 31 December Purchases 31 December

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Atlantic LNG 2/3 Company of Trinidad and Tobago Plant processing

fee/natural gas 241 – 254 – 190 –

Pan American Energy Crude oil 624 2 661 81

Ruhr Oel Refinery operating

costs 902 18 758 32 384 134

TNK-BP Crude oil and oil

products 918 46 2,662 85 908 17

The terms of the outstanding balances receivable from jointly controlled entities are typically 30 to 45 days, except for the receivable from Ruhr Oel,

which will be paid over several years as it relates partly to pension payments. The balances are unsecured and will be settled in cash. There are no

significant provisions for doubtful debts relating to these balances and no significant expense recognized in the income statement in respect of bad or

doubtful debts.

19