BP 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

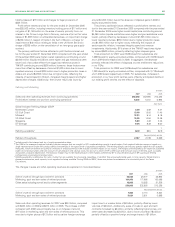

BP ANNUAL REPORT AND ACCOUNTS 2007 51

$47 million on embedded derivatives, impairment charges of $40 million in the UK, and was after net fair value losses of $346 million on

and restructuring charges of $22 million. embedded derivatives and a credit of $6 million related to new, and

Profit before interest and tax for the year ended 31 December 2006 revisions to existing, environmental and other provisions.

was $1,321 million, including net gains of $193 million, primarily on the The primary additional factors reflected in profit before interest and tax

disposal of our interest in Enagas, and net fair value gains of $88 million for the year ended 31 December 2007, compared with the equivalent

on embedded derivatives, and was after inventory holding losses of period in 2006, were lower contributions from the marketing and trading

$55 million and a charge $100 million for the impairment of a North businesses of around $700 million partially offset by improved NGL’s

American NGLs asset. performance contributing around $250 million.

Profit before interest and tax for the year ended 31 December 2005 The primary additional factors reflected in profit before interest and tax

was $1,172 million, including inventory holding gains of $95 million, for the year ended 31 December 2006, compared with the equivalent

compensation of $265 million received on the cancellation of an intra- period in 2005, were higher contributions from the operating businesses

group gas supply contract and net gains of $55 million primarily on the of around $100 million.

disposal of BP’s interest in the Interconnector pipeline and a power plant

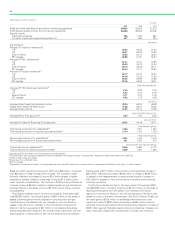

Other businesses and corporate

$ million

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Sales and other operating revenues from continuing operations 843 1,009 668

Profit (loss) before interest and tax from continuing operationsa(1,128) (885) (1,237)

aIncludes profit after interest and tax of equity-accounted entities.

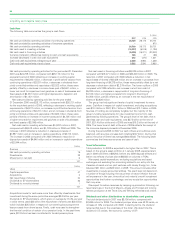

Other businesses and corporate comprises treasury (which includes all of $94 million in relation to new, and revisions to existing, environmental

the group’s cash, cash equivalents and finance debt balances and and other provisions, a net gain on disposal of $95 million and a net fair

associated interest income and finance costs), the group’s aluminium value gain of $5 million on embedded derivatives; and was after a charge

asset, and corporate activities worldwide. of $200 million relating to the reassessment of certain provisions and an

The loss before interest and tax for the year ended 31 December 2007 impairment charge of $69 million.

was $1,128 million, including a net gain on disposal of $62 million; and The loss before interest and tax for the year ended 31 December 2005

was after inventory holding losses of $24 million, a charge of $35 million was $1,237 million, including a net gain on disposal of $38 million; and

in relation to new, and revisions to existing, environmental and other was after a net charge of $278 million relating to new, and revisions to

provisions, a charge of $32 million in respect of restructuring costs, an existing, environmental and other provisions and the reversal of

impairment charge of $43 million, a net fair value loss of $7 million on environmental provisions no longer required, a charge of $134 million in

embedded derivatives and a charge of $172 million relating to the respect of the separation of the Olefins and Derivatives business and net

reassessment of certain provisions. fair value losses of $13 million on embedded derivatives.

The loss before interest and tax for the year ended 31 December 2006

was $885 million, including inventory holding gains of $62 million, a credit