BP 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The chairman and senior independent director

BP’s board governance principles require that neither the chairman nor

the deputy chairman is employed as an executive of the group. During

2007, the posts were held by Mr Sutherland and Sir Ian Prosser

respectively. Sir Ian also acts as BP’s senior independent director and is

available to shareholders who have concerns that cannot be addressed

through normal channels.

The chairman is responsible for leading the board and facilitating its

work. He ensures that the governance principles and processes of the

board are maintained and encourages debate and discussion. The

chairman also leads board performance appraisals. He represents the

views of the board to shareholders on key issues, not least in succession

planning for both executive and non-executive appointments.

Shareholders’ views are fed back to the board by the chairman.

The company secretary reports to the chairman and has no executive

functions. His remuneration is determined by the remuneration

committee.

Between board meetings, the chairman has responsibility for ensuring

the integrity and effectiveness of the relationship with executive

management. This requires his interaction with the group chief executive

between board meetings, as well as his contact with other board

members and shareholders.

The chairman and all the non-executive directors meet periodically as

the chairman’s committee. The performance of the chairman is evaluated

each year, with the evaluation discussion taking place when the chairman

is not present. The BP board governance principles require that the board

develop and maintain a plan for the succession of both the chairman and

the deputy chairman.

Board committees

The board governance principles allocate the tasks of monitoring

executive actions and assessing performance to certain board

committees. These tasks prescribe the authority and role of the board

committees.

Reports for each of the main board committees follow. In common

with the board, each committee has access to independent advice and

counsel as required and each is supported by the company secretary’s

office, which is independent of the executive management of the group.

Audit committee report

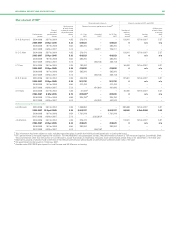

Membership

The audit committee consists solely of independent non-executive

directors who have been selected to provide a wide range of financial,

international and commercial expertise appropriate to fulfil the

committee’s duties.

Members of the audit committee throughout the year were Sir Ian

Prosser (chairman), Douglas Flint, Erroll Davis, Jr and Sir William Castell.

John Bryan was a member until his retirement in April 2007. Support is

provided by the committee secretary, David Pearl (deputy company

secretary).

The board has determined that Douglas Flint possesses the financial

and audit committee experience, as defined by the Combined Code

guidance and the SEC, and has nominated him as the audit committee’s

financial expert.

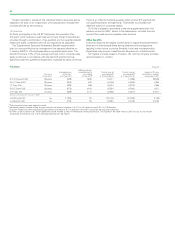

Meetings and attendance

The audit committee met 14 times during 2007.

At the request of the audit committee chairman, each meeting is

attended by the lead partner of the external auditors (Ernst & Young).

From BP, the group chief financial officer, the general auditor (head of

internal audit), the chief accounting officer and the deputy chief financial

officer also attend each meeting by invitation. Private sessions without

executive management present are held regularly.

Role and authority of the audit committee

The audit committee monitors the observance of the executive

limitations relating to financial matters and does this on behalf of

the board.

BP’s board governance principles set out the main tasks and

requirements for each of the board committees. Key tasks for the audit

committee include gaining assurance on the integrity of the group’s

reports, accounts and financial processes and reviewing the

management of financial risks and the internal controls designed to

address them. The audit committee believes that the tasks outlined

in the board governance principles meet each of the tasks and

activities outlined by the Combined Code as falling within the remit

of an audit committee.

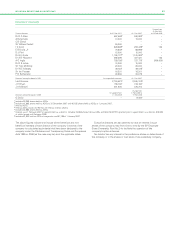

Agendas

The audit committee uses a forward agenda at the start of each

year to establish an initial work programme. This is compiled using a

combination of regular items (including those required by regulation) and

items that reflect a current review of the group’s risks. The forward

agenda also includes regular meetings during the year with both the

external and internal auditors in private sessions where members of

executive management are not present.

During the year, the committee chairman reviews any issues that

may arise with the group chief financial officer, the external auditors and

the BP general auditor and will add items to the next meeting

agenda where appropriate.

Information

Information on audit committee agenda items are received from both

internal and external sources, including Ernst & Young, the general

auditor and the chief financial officer. The committee receives

presentations from a wide cross-section of BP’s business and financial

control management, with the attendance of additional Ernst & Young

partners, if appropriate, to a particular business or functional review.

The audit committee is able to access independent advice and counsel

when needed, on an unrestricted basis. Further support is provided to

the committee by the company secretary’s office and during 2007

external specialist legal and regulatory advice was provided by Sullivan &

Cromwell LLP.

The board is kept informed of the activities of the committee and any

issues that have arisen through the regular report given by the audit

committee chairman after each meeting. Minutes of the committee are

circulated to all board members.

Training

A programme has been developed with the committee to enable

committee members to update their skills and knowledge with regard to

the financial issues that may impact BP, for example on developments in

financial reporting and changes to financial standards.

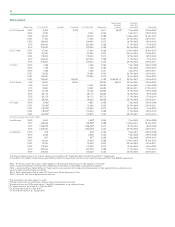

Committee activities in 2007

Financial reports

During the year, the committee reviewed all financial reports before

recommending their publication to the board.

Internal controls and risk management

In 2007, the audit committee reviewed reports on risks, controls and

assurance for the BP business segments (Exploration and Production and

Refining and Marketing), together with gas, shipping, BP Alternative

Energy and BP’s trading function. A monitoring review was also carried

out on the performance of major BP projects against their original

sanctioned investment.

A joint meeting with SEEAC was held in early 2007 to review

the general auditor’s report on internal controls and risk management;

a further joint meeting took place in early 2008 on the same theme.

The committee discussed key regulatory issues during the year as

part of its standing agenda items, including a quarterly review of the

company’s evaluation of its internal controls systems as part of the

requirement of Section 404 of the Sarbanes-Oxley Act. The effectiveness

BP ANNUAL REPORT AND ACCOUNTS 2007 77