BP 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

We are developing a new silicon growth process named Mono

22

,

which significantly increases cell efficiency over traditional

multicrystalline-based solar cells, making our first pilot shipment in 2007.

Solar cells made with these wafers, in combination with other BP Solar

advances in cell process technology, are expected to be able to produce

between 5% and 8% more power than solar cells made with

conventional processes. We are working with a number of research

universities and institutes including the California Institute of Technology

in the US where we are pursuing nanotube solar installations. This

represents another step improvement in cost and efficiency. In Germany,

we signed a co-operation agreement with the Institute of Crystal Growth

(IKZ) in September 2006 to develop a technique to deposit silicon in very

thin layers directly on glass instead of growing crystals. The programme

has demonstrated this ability and work continues to improve the growth

process and crystal structure. We are participating in a $40-million

research and development programme (of which $20 million is provided

by BP Solar) aimed at decreasing the cost of solar cells and increasing

their efficiency. The programme is sponsored by the US Department of

Energy.

Wind

Since 2005, we have increased our wind capacity from 32MW to more

than 370MW, with an aim to grow that to more than 1,000MW by the

end of 2008. We operate wind farms in the Netherlands, Maharashtra in

India and Colorado in the US.

In the US, we have a long-term supply agreement with Clipper

Windpower plc, with options to purchase Clipper turbines with a total

capacity of 2,250MW. During 2006, we also acquired Orion Energy, LLC,

and Greenlight Energy, Inc. With the acquisition of these large-scale wind

energy developers, our North American wind portfolio includes projects

with potential total generating capacity of some 15,000MW. During

2007, we commenced construction on the Silver Star I project (60MW) in

Texas and commenced full commercial operation of our 300MW Cedar

Creek project in Colorado.

In India, we commenced full commercial operations at our 40MW

wind farm in Dhule, Maharashtra, India using 32 turbines supplied and

installed by Suzlon, each with the capacity to generate 1.25MW of

electricity.

Gas-fired power

Gas-fired power stations typically emit around half as much CO

2

as

conventional coal-fired plants. We have interests in a 785MW gas-fired

power generation facility and an associated LNG re-gasification facility at

Bilbao, Spain (BP 25% share in each), a 1,074MW gas-fired combined

cycle power (CCGT) plant at Kwangyang, South Korea (BP 35%), a

724MW CCGT facility at Phu My, Vietnam (BP 33.3%), a 1,378MW gas

turbine (BP 10%) in Trinidad & Tobago, a 392MW co-generation plant

(BP 51%) in California, US and a 744MW co-generation plant at Texas

City, US (BP 50%), which supplies power and steam to BP’s largest

refining and petrochemicals complex. Also, a 50MW combined heat and

power plant near Southampton, UK (BP 100%) has been in operation

since the first half of 2005. Construction continues on the 250MW steam

turbine power generating plant at the Texas City refinery site, which is

expected to bring the total capacity of the site to around 1,000MW when

completed in 2008.

Hydrogen power

In May 2007, BP and Rio Tinto announced the formation of a new jointly

owned company, Hydrogen Energy, which will develop decarbonized

energy projects around the world. The venture will initially focus on

hydrogen-fuelled power generation, using fossil fuels and CCS

technology to produce new large-scale supplies of clean electricity.

We are developing industrial-scale hydrogen power projects with CCS

technology.

General Electric and BP have formed a global alliance to jointly develop

and deploy technology for hydrogen power plants that could significantly

reduce emissions of the greenhouse gas CO

2

from electricity generation.

Other businesses and corporate

Other businesses and corporate comprises Treasury (which includes all

the group’s cash, cash equivalents and associated interest income), the

group’s aluminium asset and corporate activities worldwide.

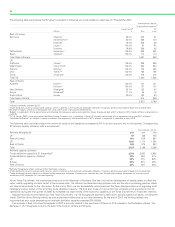

Key statistics $ million

------------------------------------------------------------------------------------------------------------------------------------------------

2007 2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------

Sales and other operating revenues

for continuing operations 843 1,009 668

Profit (loss) before interest and tax

from continuing operationsa(1,128) (885) (1,237)

Total assets 17,188 14,184 12,144

Capital expenditure and acquisitions 275 281 817

aIncludes profit after interest and tax of equity-accounted entities.

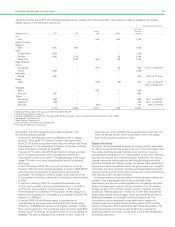

Resegmentation in 2008

With effect from 1 January 2008:

– The Alternative Energy business was transferred from the Gas, Power

and Renewables segment to Other businesses and corporate.

– The Emerging Consumers Marketing Unit was transferred from

Refining and Marketing to Alternative Energy (which is reported in

Other businesses and corporate).

– The Biofuels business was transferred from Refining and Marketing to

Alternative Energy (which is reported in Other businesses and

corporate).

– The Shipping business was transferred from Refining and Marketing

to Other businesses and corporate.

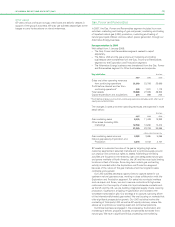

Treasury

Treasury co-ordinates the management of the group’s major financial

assets and liabilities. From locations in the UK, the US and the Asia

Pacific region, it provides the link between BP and the international

financial markets and makes available a range of financial services to the

group, including supporting the financing of BP’s projects around the

world.

Aluminium

Our aluminium business is a non-integrated producer and marketer of

rolled aluminium products, headquartered in Louisville, Kentucky, US.

Production facilities are located in Logan County, Kentucky, and are

jointly owned with Novelis. The primary activity of our aluminium

business is the supply of aluminium coil to the beverage can business,

which it manufactures primarily from recycled aluminium.

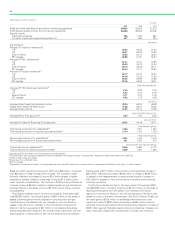

Research, technology and engineering

Research, technology and engineering activities are carried out by each

of the major business segments on the basis of a distributed programme

co-ordinated by a technology co-ordination group. This body provides

leadership for scientific, technical and engineering activities throughout

the group and in particular promotes cross-business initiatives and the

transfer of best practice between businesses. In addition, a group of

eminent industrialists and academics forms the Technology Advisory

Council, which advises senior management on the state of technology

within the group and helps to identify current trends and future

developments in technology.

Research and development is carried out using a balance of internal

and external resources. Involving third parties in the various steps of

technology development and application enables a wider range of

technology solutions to be considered and implemented, improving the

productivity of research and development activities. External resources

includes investing in technology ventures as a platform for promoting

collaborative research. These ventures are not subsidiaries and, as a

result, their expenditure on research and development is not included

directly in the research and development expenditure stated below.

Across the group, expenditure on research and development for 2007

was $566 million, compared with $395 million in 2006 and $502 million in