BP 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP ANNUAL REPORT AND ACCOUNTS 2007 107

1 Significant accounting policies continued

Deferred tax liabilities are recognized for all taxable temporary differences:

– Except where the deferred tax liability arises on goodwill that is not tax deductible or the initial recognition of an asset or liability in a transaction that

is not a business combination and, at the time of the transaction, affects neither the accounting profit nor taxable profit or loss.

– In respect of taxable temporary differences associated with investments in subsidiaries, jointly controlled entities and associates, except where the

group is able to control the timing of the reversal of the temporary differences and it is probable that the temporary differences will not reverse in

the foreseeable future.

Deferred tax assets are recognized for all deductible temporary differences, carry-forward of unused tax assets and unused tax losses, to the extent

that it is probable that taxable profit will be available against which the deductible temporary differences and the carry-forward of unused tax assets

and unused tax losses can be utilized:

– Except where the deferred income tax asset relating to the deductible temporary difference arises from the initial recognition of an asset or liability

in a transaction that is not a business combination and, at the time of the transaction, affects neither the accounting profit nor taxable profit or loss.

– In respect of deductible temporary differences associated with investments in subsidiaries, jointly controlled entities and associates, deferred tax

assets are only recognized to the extent that it is probable that the temporary differences will reverse in the foreseeable future and taxable profit

will be available against which the temporary differences can be utilized.

The carrying amount of deferred income tax assets is reviewed at each balance sheet date and reduced to the extent that it is no longer probable

that sufficient taxable profit will be available to allow all or part of the deferred income tax asset to be utilized.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the year when the asset is realized or the liability is

settled, based on tax rates (and tax laws) that have been enacted or substantively enacted at the balance sheet date.

Tax relating to items recognized directly in equity is recognized in equity and not in the income statement.

Customs duties and sales taxes

Revenues, expenses and assets are recognized net of the amount of customs duties or sales tax except:

– Where the customs duty or sales tax incurred on a purchase of goods and services is not recoverable from the taxation authority, in which case the

customs duty or sales tax is recognized as part of the cost of acquisition of the asset or as part of the expense item as applicable.

– Receivables and payables are stated with the amount of customs duty or sales tax included.

The net amount of sales tax recoverable from, or payable to, the taxation authority is included as part of receivables or payables in the balance

sheet.

Own equity instruments

The group’s holding in its own equity instruments, including ordinary shares held by Employee Share Ownership Plans (ESOPs), are classified as

‘treasury shares’, and shown as deductions from shareholders’ equity at cost. Consideration received for the sale of such shares is also recognized in

equity, with any difference between the proceeds from sale and the original cost being taken to the profit and loss account reserve. No gain or loss is

recognized in the performance statements on the purchase, sale, issue or cancellation of equity shares.

Revenue

Revenue arising from the sale of goods is recognized when the significant risks and rewards of ownership have passed to the buyer and it can be

reliably measured.

Revenue is measured at the fair value of the consideration received or receivable and represents amounts receivable for goods provided in the

normal course of business, net of discounts, customs duties and sales taxes.

Revenues associated with the sale of oil, natural gas, natural gas liquids, liquefied natural gas, petroleum and chemicals products and all other items

are recognized when the title passes to the customer. Physical exchanges are reported net, as are sales and purchases made with a common

counterparty, as part of an arrangement similar to a physical exchange. Similarly, where the group acts as agent on behalf of a third party to procure or

market energy commodities, any associated fee income is recognized but no purchase or sale is recorded. Additionally, where forward sale and

purchase contracts for oil, natural gas or power have been determined to be for trading purposes, the associated sales and purchases are reported net

within sales and other operating revenues whether or not physical delivery has occurred.

Generally, revenues from the production of oil and natural gas properties in which the group has an interest with joint venture partners are

recognized on the basis of the group’s working interest in those properties (the entitlement method). Differences between the production sold and the

group’s share of production are not significant.

Interest income is recognized as the interest accrues (using the effective interest rate that is the rate that exactly discounts estimated future cash

receipts through the expected life of the financial instrument) to the net carrying amount of the financial asset.

Dividend income from investments is recognized when the shareholders’ right to receive the payment is established.

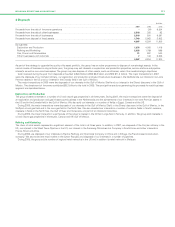

Research

Research costs are expensed as incurred.

Finance costs

Finance costs directly attributable to the acquisition, construction or production of qualifying assets, which are assets that necessarily take a

substantial period of time to get ready for their intended use, are added to the cost of those assets, until such time as the assets are substantially

ready for their intended use.

All other finance costs are recognized in the income statement in the period in which they are incurred.

Use of estimates

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities as well as the disclosure of contingent assets and liabilities at the balance sheet date and the reported amounts of revenues and expenses

during the reporting period. Actual outcomes could differ from those estimates.