BP 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

and Accounts

2007

Table of contents

-

Page 1

Annual Report and Accounts 2007 -

Page 2

-

Page 3

... operations of the parent company and those of its subsidiaries. The term 'shareholder' in the Annual Report and Accounts means, unless the context otherwise requires, investors in the equity capital of BP p.l.c., both direct and/or indirect. BP Annual Report and Accounts 2007 and BP Annual Review... -

Page 4

...The US dollar. EU European Union. Gas Natural gas. PSA Production-sharing agreement. Hydrocarbons Crude oil and natural gas. SEC The United States Securities and Exchange Commission. IFRS International Financial Reporting Standards. Joint venture A contractual arrangement between the group and other... -

Page 5

... ANNUAL REPORT AND ACCOUNTS 2007 3 Contents 4 Chairman's letter 5 Group chief executive's review 6 Measuring our progress 7 Performance review 59 Directors, senior management and employees 63 Directors' remuneration report 74 BP board performance report 82 Additional information for shareholders... -

Page 6

... the focus that we need to have on technology, both for our existing business and for the supply of low-carbon energy in the future. Whatever the importance of short-term challenges, the rise in the oil price and trends in the world economy require the group to make big strategic choices for the... -

Page 7

... the business, which has added to costs. We are resolutely tackling both these issues. The fourth quarter saw the build-up of operational momentum, with the start-up of six new exploration and production projects, including Atlantis and King Subsea Pump in the Gulf of Mexico, Greater Plutonio in... -

Page 8

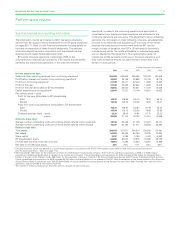

...06 05 91.41 90.20 111.10 RETURN ON AVERAGE CAPITAL EMPLOYED ON A REPLACEMENT COST BASIS (%) 07 06 05 20 16 22 CAPITAL EXPENDITURE ($ billion) 07 06 05 13.9 16.9 19.2 REPORTED RESERVES REPLACEMENT RATIO a b c (%) 07 06 05 a TOTAL SHAREHOLDER DIVIDENDS PAID PER SHARE 112 113 100 07 06 05 Cents Pence... -

Page 9

BP ANNUAL REPORT AND ACCOUNTS 2007 7 Performance review operations, on sales to the continuing operations be eliminated on consolidation from the discontinued operations and attributed to the continuing operations and vice versa. This adjustment has two offsetting elements: the net margin on crude... -

Page 10

...of Americas (19%), Asia Paciï¬c (10%), Africa (8%) and the UK (8%). For equity-accounted entities, 1,168mmboe were added to proved reserves (excluding purchases and sales), production was 470mmboe and proved reserves were 5,231mmboe at 31 December 2007. * Natural gas is converted to oil equivalent... -

Page 11

... of contract rights. We buy, sell and trade oil and gas products in certain regulated commodity markets. The oil industry is also subject to the payment of royalties and taxation, which tend to be high compared with those payable in respect of other commercial activities, and operates in certain tax... -

Page 12

...of customers. Drilling and production Exploration and production require high levels of investment and are subject to natural hazards and other uncertainties, including those relating to the physical characteristics of an oil or natural gas ï¬eld. The cost of drilling, completing or operating wells... -

Page 13

...; future levels of industry product supply, demand and pricing; operational problems; general economic conditions; political stability and economic growth in relevant areas of the world; changes in laws and governmental regulations; exchange rate ï¬,uctuations; development and use of new technology... -

Page 14

... US). The system of internal control is the complete set of management systems, organizational structures, processes, standards and behaviours that are employed to conduct the business of BP and deliver returns to shareholders. The design of the system of internal control addresses risks and how to... -

Page 15

...oil and gas. As a result, and with effect from 1 January 2008: - The Gas, Power and Renewables segment ceased to report separately. - The NGLs, LNG and gas and power marketing and trading businesses were transferred from the Gas, Power and Renewables segment to the Exploration and Production segment... -

Page 16

...the US, the UK, Angola, Azerbaijan, Canada, Egypt, Russia, Trinidad & Tobago (Trinidad) and locations within Asia Paciï¬c, Latin America, North Africa and the Middle East. Upstream activities involve oil and natural gas exploration and ï¬eld development and production. Our exploration programme is... -

Page 17

...reviewed every four years. For the executive directors and senior management, no speciï¬c portion of compensation bonuses is directly related to oil and gas reserves targets. Additions to proved reserves is one of several indicators by which the performance of the Exploration and Production segment... -

Page 18

... increase includes net sales of 3mmboe, largely comprising a number of assets in Russia. The proved reserves replacement ratio (also known as the production replacement ratio) is the extent to which production is replaced by proved reserves additions. This ratio is expressed in oil equivalent terms... -

Page 19

... fields in the Gulf of Mexico, BP has claimed proved reserves before production flow tests are conducted, in part because of the significant safety, cost and environmental implications of conducting these tests. The industry has made substantial technological improvements in understanding, measuring... -

Page 20

... with general industry practice and as a result have started reporting production and reserves there gross of production taxes. This change resulted in an increase in our reserves of 153 million barrels and in our production of 33 thousand barrels per day (mb/d). b BP-operated. c Production... -

Page 21

... region. c BP-operated. d Includes 4 million cubic feet per day (mmcf/d) of natural gas received as in-kind tariff payments in 2005. None received in 2006 and 2007. e Natural gas production volumes exclude gas consumed in operations within the lease boundaries of the producing field, but the related... -

Page 22

... central Gulf of Mexico lease sale - On 6 June 2007, a discovery was made with the Isabela well (BP 67% and operator), located on Mississippi Canyon Block 562 in approximately 2,000 metres of water about 150 miles south-east of New Orleans. - During the second quarter, we increased our ownership in... -

Page 23

... related to project costs, ï¬scal terms and pipeline tariffs. BP continues to develop and assess options for commercializing the major undeveloped gas resources on Alaska's North Slope. - On 16 November 2007, the Alaska State Legislature passed a new petroleum production tax law, which replaced... -

Page 24

... to access new investment opportunities. Argentina and Bolivia - In Argentina and Bolivia, activity is conducted through Pan American Energy (PAE), in which BP holds a 60% interest, and which is accounted for by the equity method since it is jointly controlled. In 2007, total PAE gross production of... -

Page 25

... full-year production from producing wells drilled in 2006. - In Egypt, the Gulf of Suez Petroleum Company (GUPCO) (BP 50%), a joint venture operating company between BP and the Egyptian General Petroleum Corporation (EGPC), carries out our operated oil and gas production operations. GUPCO operates... -

Page 26

... half of 2008. Russia TNK-BP - TNK-BP, a joint venture between BP (50%) and Alfa Group and Access-Renova (AAR) (50%), is an integrated oil company operating in Russia and the Ukraine. The TNK-BP group's major assets are held in OAO TNK-BP Holding. Other assets include the BP-branded retail sites in... -

Page 27

... Export Route Pipeline between Azerbaijan and Russia. Revenue is earned on pipelines through charging tariffs. BP's onshore US crude oil and product pipelines and related transportation assets are included under Reï¬ning and Marketing (see page 27). Assets and activity during 2007 included: Alaska... -

Page 28

...tonnes (388,000mmcf) per year. Tangguh has signed sales contracts for delivery to China, Korea and North America's west coast. - In Australia, we are one of seven partners in the NWS venture. Six partners (including BP) hold an equal 16.7% interest in the infrastructure and oil reserves and an equal... -

Page 29

... a joint venture with D1 Oils plc, a UK-based global producer of biodiesel, for the development of jatropha as a new energy crop. - On 15 November 2007, BP announced that it would sell all of its company-owned and company-operated convenience sites in the US. The majority of sites will be sold to... -

Page 30

..., a number of additional actions relating to safety and operations, atmospheric relief valves, operating procedures and training, control of work systems, and process safety culture and leadership. In the US, BP has committed to increase spending to an average of $1.7 billion per year through 2010... -

Page 31

... advantage of a reï¬nery relates to its location, scale and conï¬guration to produce fuels from lower-cost feedstocks in line with the demand of the region. Strategic investments in our reï¬neries are focused on securing the safety and reliability of our assets while improving our competitive... -

Page 32

... calendar day over the year after making allowances for average annual shutdowns at BP refineries (i.e. net rated capacity). At the Texas City reï¬nery, the recommissioning work in the aftermath of Hurricane Rita has involved the development of detailed plans to effect the repair, safety-upgrading... -

Page 33

... own networks of a number of service stations and small resellers). d Trading/supply sales are sales to large unbranded resellers and other oil companies. Number of retail sites The following table sets out marketing sales by major product group. thousand barrels per day Marketing sales by re... -

Page 34

... the power generation, offshore oil and aviation industries. BP's industrial lubricants business supplies lubricants and value-adding services to the transportation, automotive and metal sectors. Aromatics & Acetyls The Aromatics & Acetyls business manufactures and markets three main products lines... -

Page 35

... Chemical Company Limited site in Guangdong province, China, successfully commenced commissioning at the end of 2007. The 900ktepa plant is the single largest PTA train in the world, employing the latest BP proprietary technology. - In the ï¬rst quarter of 2007, BP announced its intention to sell... -

Page 36

...trading and risk management activities. Realized and unrealized gains and losses on OTC contracts are included in sales and other operating revenues for accounting purposes. The main grades of crude oil bought and sold forward using standard contracts are West Texas Intermediate and a standard North... -

Page 37

... North America, the UK and the most liquid trading locations in Rest of Europe. Some long-term natural gas contracting activity is included within the Exploration and Production segment because of the nature of the gas markets when the long-term sales contracts were agreed. Our LNG business develops... -

Page 38

...power, in addition to selling and risk managing production from the Texas City co-generation facility in the US. Our North American natural gas marketing and trading strategy seeks to provide unconstrained market access for BP's equity gas. Our marketing strategy targets high-value customer segments... -

Page 39

...terminal took delivery of an additional seven spot cargoes during the year, to meet rapidly growing local demand for gas. In the Atlantic and Mediterranean regions, BP is creating opportunities to supply LNG to North American and European gas markets. The fourth LNG train at Atlantic LNG in Trinidad... -

Page 40

... Energy (which is reported in Other businesses and corporate). - The Shipping business was transferred from Reï¬ning and Marketing to Other businesses and corporate. Treasury Treasury co-ordinates the management of the group's major ï¬nancial assets and liabilities. From locations in the UK... -

Page 41

..., levies and assessments, including special petroleum taxes and revenue taxes. The taxes imposed on oil and gas production proï¬ts and activities may be substantially higher than those imposed on other activities, particularly in Angola, Norway, the UK, Russia, South America and Trinidad & Tobago. -

Page 42

... Texas City reï¬nery incident of 2005, including facility siting, atmospheric relief systems, operating procedures and operator training, as well as control of work systems and process safety culture and leadership. The reï¬neries have engaged with employees on how to improve process safety. Each... -

Page 43

... reï¬neries, chemicals plants, natural gas processing plants, oil and natural gas ï¬elds, service stations, terminals and waste disposal sites. In addition, the group may have obligations relating to prior asset sales or closed facilities. Provisions for environmental restoration and remediation... -

Page 44

...with the development of mandatory GHG reporting and a Low Carbon Fuel Standard (LCFS). The LCFS will require all reï¬ners, producers, blenders and importers to reduce the carbon intensity of transport fuel sold in California by 10% by 2020. Since 1997, BP has been actively involved in policy debate... -

Page 45

...and operates four LNG carriers. Three further LNG carriers are on order for delivery in 2008. In addition to its own ï¬,eet, BP will continue to charter quality ships; all vessels will continue to be vetted prior to each use in accordance with the BP group ship vetting policy. US regional review The... -

Page 46

... a number of group operations. This is a developing area of the law that could affect the cost of addressing environmental conditions at some sites in the future. In the US, many environmental clean-ups are the result of strict groundwater protection standards at both the state and federal level... -

Page 47

... EU member states, industry, regulators, NGOs and trade unions. This group worked successfully on a consensus basis, to offer a range of recommendations to the EC intended to support energy and environmental policy objectives while advancing the competitiveness of the European economy. In early 2008... -

Page 48

... with IFRS 5 'Non-current Assets Held for Sale and Discontinued Operations'. See Financial statements - Note 3 on page 110. Business environment Crude oil prices reached new record highs in 2007 in nominal terms. The average dated Brent price rose to $72.39 per barrel, an increase of 11% over the... -

Page 49

... costs at the Texas City and Whiting reï¬neries, reduced supply optimization beneï¬ts and a lower contribution from the marketing and trading business in the Gas, Power and Renewables segment. The primary additional factors reï¬,ected in proï¬t attributable to BP shareholders for the year ended... -

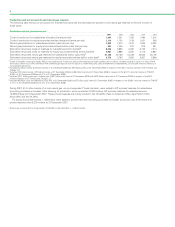

Page 50

... Texas Intermediate oil price Alaska North Slope US West Coast Average Brent oil price Average Henry Hub gas priced 56.58 53.55 54.48 8.65 $ per million British thermal units pence per therm Average UK National Balancing Point gas price 29.95 42.19 40.71 Total liquids production... -

Page 51

... in the industry and their impact on our results. The margins are calculated by BP based on published crude oil and product prices and take account of fuel utilization and catalyst costs. No account is taken of BP's other cash and non-cash costs of refining, such as wages and salaries and plant... -

Page 52

... to the BP Foundation and a charge of $33 million relating to new, and revisions to existing, environmental and other provisions. Proï¬t before interest and tax for the year ended 31 December 2005 was $6,926 million, including inventory holding gains of $2,532 million Gas, Power and Renewables... -

Page 53

... gas supply contract and net gains of $55 million primarily on the disposal of BP's interest in the Interconnector pipeline and a power plant Other businesses and corporate in the UK, and was after net fair value losses of $346 million on embedded derivatives and a credit of $6 million related... -

Page 54

...information on fair value accounting effects BP uses derivative instruments to manage the economic exposure relating to inventories above normal operating requirements of crude oil, natural gas and petroleum products as well as certain contracts to supply physical volumes at future dates. Under IFRS... -

Page 55

... existing provisions. These reviews take account of revised cost assumptions, changes in decommissioning requirements and any technological developments. The level of increase in the decommissioning provision varies with the number of new ï¬elds coming onstream in a particular year and the outcome... -

Page 56

...asset exchanges and excluding the accounting related to our entry into the Canadian oil sands via two joint ventures with Husky Energy Inc., to be between $21 billion and $22 billion in 2008. This amount includes other investments in equity-accounted entities. The exact level will depend on a number... -

Page 57

... 2008 annual general meeting. At 31 December 2007, gearing was 23%, towards the bottom of the targeted band. BP intends to continue the operation of the Dividend Reinvestment Plan (DRIP) for shareholders who wish to receive their dividend in the form of shares rather than cash. The BP Direct Access... -

Page 58

... shown for 2008 include purchase commitments existing at 31 December 2007 entered into principally to meet the group's short-term manufacturing and marketing requirements. The price risk associated with these crude oil, natural gas and power contracts is discussed in Financial statements - Note 28... -

Page 59

...the balance sheet for several years while additional appraisal drilling and seismic work on the potential oil and gas ï¬eld is performed or while the optimum development plans and timing are established. All such carried costs are subject to regular technical, commercial and management review on at... -

Page 60

... Accounting for pensions and other post-retirement beneï¬ts involves judgement about uncertain events, including estimated retirement dates, salary levels at retirement, mortality rates, rates of return on plan assets, determination of discount rates for measuring plan obligations, healthcare cost... -

Page 61

... Director (Chief Executive, Exploration and Production) Group General Counsel Executive Vice President, Human Resources Executive Vice President, Alternative Energy Executive Vice President (Chairman and President of BP America Inc.) Executive Vice President, Safety and Operations Executive Vice... -

Page 62

... retire from the board on 31 March 2008. He is a director of BP Pension Trustees Limited. I C Conn Iain Conn (45) joined BP in 1986. Following a variety of roles in oil trading, commercial reï¬ning, retail and commercial marketing operations, and exploration and production, in 2000 he became group... -

Page 63

... chairman and president of BP America Inc. and an executive vice president in mid-2006. He started his career in 1974 at Kennecott Copper Corporation, holding various roles in environmental engineering, operations and safety. From 1981 until 1988, he was director of health, safety and environment... -

Page 64

... reported by BP's businesses for non-compliance or unethical behaviour. This number excludes some dismissals from the retail business, mainly at service station sites, for incidents such as thefts of small amounts of money. BP continues to apply a policy that the group will not participate directly... -

Page 65

... the company secretary. The report is subject to the approval of shareholders at the annual general meeting (AGM). Contents Part 1 Summary Letter to shareholders Summary 2007 remuneration Pensions Historical TSR performance Part 2 Executive directors' remuneration 2007 remuneration Salary increases... -

Page 66

... portion vested. Review of policy With a new top team in place and having come through a testing time in terms of company performance, the committee decided to review remuneration policy during the year. The key area of review was the performance conditions applied to the EDIP share element. In... -

Page 67

... directors. Annual bonuses are shown in the year they were earned. a This information has been subject to audit. b Or equivalent plans in which the individual participated prior to joining the board. c Based on market price on vesting date (£5.37 per share/$62.91 per ADS). d Based on market price... -

Page 68

... will develop a signiï¬cant personal shareholding in order to align their interests with those of shareholders. - Pay and employment conditions elsewhere in the group will be taken into account, especially in setting annual salary increases. - The remuneration policy for executive directors will... -

Page 69

... on relevant operating results and personal leadership. The remuneration committee will also review carefully the underlying performance of the group in light of company business plans and will look at competitors' results, analysts' reports and the views of the chairmen of other BP board committees... -

Page 70

...-employee share saving schemes and savings plans applying in their home countries. Beneï¬ts in kind are not pensionable. Expatriates may receive a resettlement allowance for a limited period. Mr Inglis is currently based in Houston, US, and the company provides accommodation in London. a thousand... -

Page 71

BP ANNUAL REPORT AND ACCOUNTS 2007 69 Share element interests Share element of EDIPa Interests vested in 2007 and 2008 Market price of each share at date of award of performance shares £ Potential maximum performance sharesb Market price of each share at vesting date £ ... -

Page 72

... appointments as directors and are not subject to performance conditions. SAR = Stock Appreciation Rights under BP America Inc. Share Appreciation Plan. SAYE = Save As You Earn employee share scheme. a This information has been subject to audit. b Closing market price for information. Shares were... -

Page 73

...expire at a normal retirement age of 60 (subject to age discrimination). The contracts have a notice period of one year. The service contracts of UK directors may be terminated by the company at any time with immediate effect on payment in lieu of notice equivalent to one year's salary or the amount... -

Page 74

... audit, audit-related and taxation services for the group. Part 3: Non-executive directors' remuneration Policy The board sets the level of remuneration for all non-executive directors within a limit approved from time to time by shareholders. In accordance with BP's board governance principles... -

Page 75

... as a director and non-executive chairman of BP Pension Trustees Limited in October 2006 for a term of three years. During 2007, he received £150,000 for this role. This directors' remuneration report was approved by the board and signed on its behalf by David J Jackson, Company Secretary, on 22... -

Page 76

... relating to the board, governance and high-level strategy and the remuneration committee consulted with larger shareholders on elements of the executive remuneration plan. The group chief executive, other executive directors and senior management, company secretary's ofï¬ce, investor relations... -

Page 77

... board: terms of appointment The chairman and non-executive directors of BP serve on the basis of letters of appointment. Executive directors of BP have service contracts with the company. Details of all payments to directors are described in the directors' remuneration report. The service contracts... -

Page 78

... taking ofï¬ce. The chairman is accountable for the induction of new board members and is assisted by the company secretary's ofï¬ce in this task. Training and site visits Directors are kept briefed on BP's business, the environment in which it operates and other matters throughout their period in... -

Page 79

... publication to the board. Internal controls and risk management In 2007, the audit committee reviewed reports on risks, controls and assurance for the BP business segments (Exploration and Production and Reï¬ning and Marketing), together with gas, shipping, BP Alternative Energy and BP's trading... -

Page 80

... SEEAC monitors observance of the executive limitations policy relating to the environmental, health and safety, security and ethical performance of the company and compliance to its code of conduct. In common with the other BP board committees, the board governance principles set out the main tasks... -

Page 81

... the year included reviews of the progress of the six-point plan and the development of leading and lagging indicators of safety and operational performance. Site visits The committee visited BP's Gelsenkirchen reï¬nery in Germany in March 2007 and the Texas City reï¬nery in September. The annual... -

Page 82

... achieve business objectives and can only provide reasonable, and not absolute, assurance against material misstatement or loss. A joint meeting of the committees in January 2008 reviewed reports from BP's general auditor to support the board in its annual assessment of internal control. The reports... -

Page 83

... such shares of the company held from time to time by the BP Employee Share Ownership Plan (No.2) to facilitate the operation of the company's option schemes. No director has any interest in the preference shares or debentures of the company or in the shares or loan stock of any subsidiary company. -

Page 84

...,092 options for ordinary shares or their calculated equivalent under the BP group share options schemes. Additional details regarding the options granted, including exercise price and expiry dates, are found in the directors' remuneration report on page 70. Employee share plans The following table... -

Page 85

... by the UK Financial Services Authority. Under DTR 5, we have received notiï¬cation that Legal and General Group Plc hold 4.60% of the voting rights of the issued share capital of the company. Related party transactions Transactions between the group and its signiï¬cant jointly controlled entities... -

Page 86

...shares will be paid in pounds sterling and on BP ADSs in US dollars. The rate of exchange used to determine the sterling amount equivalent is the average of the forward exchange rate in London over the ï¬ve business days prior to the announcement date. The directors may choose to declare dividends... -

Page 87

... regional review on page 43. The offer and listing Markets and market prices The primary market for BP's ordinary shares is the London Stock Exchange (LSE). BP's ordinary shares are a constituent element of the Financial Times Stock Exchange 100 Index. BP's ordinary shares are also traded on stock... -

Page 88

...market quotations for BP's ordinary shares for the periods shown. These are derived from the Daily Ofï¬cial List of the LSE and the highest and lowest sales prices of ADSs as reported on the New York Stock Exchange (NYSE) composite tape. Pence Dollars Ordinary shares American depositary... -

Page 89

... UK Companies Act. Dividends on ordinary shares are payable only after payment of dividends on BP preference shares. Any dividend unclaimed after a period of 12 years from the date of declaration of such dividend shall be forfeited and reverts to BP. The directors have the power to declare and pay... -

Page 90

... ADSs, other than limitations that would generally apply to all of the shareholders. Disclosure of interests in shares The UK Companies Act permits a public company, on written notice, to require any person whom the company believes to be or, at any time during the previous three years prior to the... -

Page 91

... income to the date the payment is converted into US dollars will be treated as ordinary income or loss and will not be eligible for the 15% tax rate on qualiï¬ed dividend income. The gain or loss generally will be income or loss from sources within the US for foreign tax credit limitation purposes... -

Page 92

... instead of the cash dividend authorize the Depositary to sell sufï¬cient shares to cover this liability. Documents on display BP's Annual Report and Accounts is also available online at www.bp.com. Shareholders may obtain a hard copy of BP's complete audited ï¬nancial statements, free of charge... -

Page 93

BP ANNUAL REPORT AND ACCOUNTS 2007 91 Purchases of equity securities by the issuer and afï¬liated purchasers The following table provides details of ordinary shares repurchased. $ Total number of shares purchaseda b Average price paid per share Total number of shares purchased as part of... -

Page 94

... of ownership, dividend payments, the dividend reinvestment plan or the ADS direct access plan, or to change the way you receive your company documents (such as the Annual Report and Accounts, Annual Review and Notice of Meeting) please contact the BP Registrar or ADS Depositary. UK - Registrar's Of... -

Page 95

... exchange gains and losses 14 Research and development 15 Operating leases 16 Exploration for and evaluation of oil and natural gas resources 17 Auditors' remuneration 18 Finance costs 19 Other ï¬nance income and expense 20 Taxation 21 Dividends 22 Earnings per ordinary share 23 Property, plant... -

Page 96

... Annual Report and the consolidated ï¬nancial statements in accordance with applicable United Kingdom law and International Financial Reporting Standards (IFRS) as adopted by the European Union. The directors are required to prepare ï¬nancial statements for each ï¬nancial year that present fairly... -

Page 97

... by the Listing Rules of the Financial Services Authority, and we report if it does not. We are not required to consider whether the board's statements on internal control cover all risks and controls, or form an opinion on the effectiveness of the group's corporate governance procedures or its... -

Page 98

96 Group income statement For the year ended 31 December $ million Note 2007 2006 2005 Sales and other operating revenues 5 284,365 265,906 239,792 Earnings from jointly controlled entities - after interest and tax 3,135 3,553 3,083 Earnings from associates - after interest and tax 697 442... -

Page 99

BP ANNUAL REPORT AND ACCOUNTS 2007 97 Group balance sheet At 31 December $ million Note 2007 2006 Non-current assets 23 97,989 90,999 Property, plant and equipment Goodwill 24 11,006 10,780 Intangible assets 25 6,652 5,246 Investments in jointly controlled entities 26 18,113 15,074 ... -

Page 100

... to net cash provided by operating activities 16 347 624 305 Exploration expenditure written off Depreciation, depletion and amortization 9 10,579 9,128 8,771 Impairment and (gain) loss on sale of businesses and ï¬xed assets 7, 10 (808) (3,165) (1,070) Earnings from jointly controlled entities and... -

Page 101

... operations transferred to gain or loss on sale of 95 - - businesses and ï¬xed assets Tax on actuarial gain relating to pensions and other post-retirement beneï¬ts (427) (820) (356) Tax on available-for-sale investments (14) 108 (72) Tax on cash ï¬,ow hedges 26 (47) 63 Tax on share-based payments... -

Page 102

... B Hayward. BP p.l.c. is a public limited company incorporated and domiciled in England and Wales. The company's ordinary shares are traded on the London Stock Exchange. The consolidated ï¬nancial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as... -

Page 103

... the consolidated ï¬nancial statements, the assets and liabilities of non-US dollar functional currency subsidiaries, jointly controlled entities and associates, including related goodwill, are translated into US dollars at the rate of exchange ruling at the balance sheet date. The results and cash... -

Page 104

... of the legal agreement and economic useful life, which can range from three to 15 years. Computer software costs have a useful life of three to ï¬ve years. The expected useful lives of assets are reviewed on an annual basis and, if necessary, changes in useful lives are accounted for prospectively... -

Page 105

..., at which time the cumulative gain or loss previously reported in equity is included in the income statement. The fair value of quoted investments is determined by reference to bid prices at the close of business on the balance sheet date. Where there is no active market, fair value is determined... -

Page 106

... future cash ï¬,ows discounted at the current market rate of return for a similar ï¬nancial asset. Financial assets are derecognized on sale or settlement. Inventories Inventories, other than inventory held for trading purposes, are stated at the lower of cost and net realizable value. Cost is... -

Page 107

BP ANNUAL REPORT AND ACCOUNTS 2007 105 1 Signiï¬cant accounting policies continued At the inception of a hedge relationship the group formally designates and documents the hedge relationship for which the group wishes to claim hedge accounting, together with the risk management objective and ... -

Page 108

... rate based on high quality corporate bonds), less the fair value of plan assets out of which the obligations are to be settled directly. Fair value is based on market price information and, in the case of quoted securities, is the published bid price. Contributions to deï¬ned contribution schemes... -

Page 109

... gas or power have been determined to be for trading purposes, the associated sales and purchases are reported net within sales and other operating revenues whether or not physical delivery has occurred. Generally, revenues from the production of oil and natural gas properties in which the group... -

Page 110

... group's reported income or net assets as a result of adoption of this new standard. Also in August 2005, the IASB issued Amendment to IAS 1 'Presentation of Financial Statements' - Capital Disclosures, which requires disclosures of an entity's objectives, policies and processes for managing capital... -

Page 111

... on these acquisitions. Acquisitions in 2006 BP made a number of acquisitions in 2006 for a total consideration of $256 million. All these business combinations were in the Gas, Power and Renewables segment. Fair value adjustments were made to the acquired assets and liabilities and goodwill of $64... -

Page 112

... and discontinued operations Non-current assets held for sale On 5 December 2007, BP announced it had signed a memorandum of understanding with Husky Energy Inc. to form an integrated North American oil sands business. BP will contribute its Toledo reï¬nery to a US joint venture in return for Husky... -

Page 113

...normal course of business in any particular year, the group may sell interests in exploration and production properties, service stations and pipeline interests as well as non-core businesses. The group may also dispose of other assets, such as reï¬neries, when this meets strategic objectives. Cash... -

Page 114

... in 2007. During 2006, we disposed of our shareholding in Enagas, the Spanish gas transport grid operator. In 2005, the group sold its interest in the Interconnector pipeline and a power plant at Great Yarmouth in the UK. Other businesses and corporate There were no signiï¬cant disposals in 2007... -

Page 115

..., BP had three reportable operating segments: Exploration and Production; Reï¬ning and Marketing; and Gas, Power and Renewables. Exploration and Production's activities include oil and natural gas exploration, development and production, together with related pipeline, transportation and processing... -

Page 116

...$ million 2006 Production Marketing group By business operations Sales and other operating revenues Segment sales and other operating revenues 52,600 232,855 23,708 1,009 (44,266) 265,906 - - 265,906 Less: sales between businesses (36,171) (4,076) (4,019) - 44,266 Third party sales 16,429 228... -

Page 117

... ANNUAL REPORT AND ACCOUNTS 2007 115 5 Segmental analysis continued $ million 2005 Production Marketing group By business operations Sales and other operating revenues Segment sales and other operating revenues 47,210 213,326 25,696 21,295 (55,359) 252,168 (20,627) 8,251 239,792 Less: sales... -

Page 118

... area UK Europe US Total Sales and other operating revenues Segment sales and other operating revenues 109,800 78,366 105,120 74,462 - 367,748 Less: sales between areas (48,651) (12,024) (2,801) (19,907) - (83,383 Third party sales 61,149 66,342 102,319 54,555 - 284,365 Equity-accounted earnings... -

Page 119

...area UK Europe US Total Sales and other operating revenues Segment sales and other operating revenues 105,518 76,768 99,935 71,547 - 353,768 Less: sales between areas (50,942) (14,821) (5,032) (17,067) - (87,862 Third party sales 54,576 61,947 94,903 54,480 - 265,906 Equity-accounted earnings 5 13... -

Page 120

... 359 Loss on remeasurement to fair value less costs to sell and on 24 273 262 32 - 591 disposal of Innovene operations Losses on sale of businesses and ï¬xed assets - 37 8 64 - 109 Gains on sale of businesses and ï¬xed assets 107 1,017 282 132 - 1,538 Rest of Consolidation Rest of adjustment and... -

Page 121

... discovery in the Gulf of Mexico in the US and interests in the North Sea. In 2005 the major divestment was the sale of the group's interest in the Ormen Lange ï¬eld in Norway. BP also sold various oil and gas properties in Trinidad & Tobago, Canada and the Gulf of Mexico. Reï¬ning and Marketing... -

Page 122

..., BP adopted the US Securities and Exchange Commission (SEC) rules for estimating oil and natural gas reserves instead of the UK accounting rules contained in the Statement of Recommended Practice 'Accounting for Oil and Gas Exploration, Development, Production and Decommissioning Activities' (UK... -

Page 123

...discount rate is derived from the group's post-tax weighted average cost of capital. In some cases the group's pre-tax discount rate may be adjusted to account for political risk in the country where the asset is located. Exploration and Production During 2007, the Exploration and Production segment... -

Page 124

... from the group's post-tax weighted average cost of capital. In some cases the group's pre-tax discount rate may be adjusted to account for political risk in the country where the asset is located. The ï¬ve year business segment plans, which are approved on an annual basis by senior management, are... -

Page 125

... change in oil and gas prices would cause the headroom in any of the geographical segments to be reduced to zero. Estimated production volumes are based on detailed data for the ï¬elds and take into account development plans for the ï¬elds agreed by management as part of the long-term planning... -

Page 126

... gross margin assumptions increase on average by 1% a year over the plan period and marketing volume assumptions grow by an average of 1% a year over the plan period. The value assigned to the terminal value assumption is 6.5 times earnings (2006 6.5 times), which is indicative of similar assets in... -

Page 127

... exchange (gains) losses (credited) charged to income (189) 222 94 Innovene operations - - (80 Continuing operations (189) 222 14 14 Research and development $ million 2007 2006 2005 Expenditure on research and development 566 395 502 Innovene operations - - (128 Continuing operations... -

Page 128

... the year in respect of operating leases. Where an operating lease is entered into solely by the group as the operator of a jointly controlled asset, the total cost is included in this analysis, irrespective of any amounts that have been or will be reimbursed by joint venture partners. Where BP is... -

Page 129

...for ships on standard industry terms. The most signiï¬cant items of plant and machinery hired under operating leases are drilling rigs used in the Exploration and Production segment. In some cases, drilling rig lease rental rates are adjusted periodically to market rates that are inï¬,uenced by oil... -

Page 130

...-retirement beneï¬t plan assets (2,855) (2,410) (2,138 Interest net of expected return on plan assets (652) (470) (116) Unwinding of discount on provisions 283 245 201 Unwinding of discount on deferred consideration for acquisition of investment in TNK-BP - 23 57 Innovene operations Continuing... -

Page 131

... Currency translation differences (139) 201 (11) Exchange gain on translation of foreign operations transferred to loss on sale of businesses - - (95) Actuarial gain relating to pensions and other post-retirement beneï¬ts 427 820 356 Share-based payments (213) (26) - Cash ï¬,ow hedges (26) 47 (63... -

Page 132

... effective tax rate for the group reï¬,ects the impact of the use of capital and other losses in the UK and mainland Europe and audit closure of a variety of worldwide issues. The enactment of a 2% reduction in the rate of UK corporation tax on proï¬ts arising from activities outside the North Sea... -

Page 133

... weighted average number of shares outstanding during the year is adjusted for the number of shares that would be issued in connection with employee share-based payment plans using the treasury stock method. In addition, for 2006 and 2005, the proï¬t attributable to ordinary shareholders has been... -

Page 134

... land improvements Buildings Oil and gas properties Plant, machinery and equipment Fixtures, ï¬ttings and ofï¬ce equipment Oil depots, storage tanks and Transportation service stations Total Cost At 1 January 2007 4,442 3,129 123,493 32,203 3,006 11,930 11,076 189,279 Exchange adjustments... -

Page 135

BP ANNUAL REPORT AND ACCOUNTS 2007 133 24 Goodwill $ million 2007 2006 Cost and net book amount 10,780 10,371 At 1 January Exchange adjustments 126 524 Acquisitions 270 64 Reclassiï¬ed as assets held for sale (90) (60) Deletions (80) (119 At 31 December 11,006 10,780 25 Intangible assets... -

Page 136

... Atlantic LNG 2/3 Company of Trinidad and Tobago Plant processing Pan American Energy Ruhr Oel TNK-BP fee/natural gas Crude oil Reï¬nery operating costs Crude oil and oil products 241 6 902 918 - 2 18 46 254 4 758 2,662 - 2 32 85 190 661 384 908 - 81 134 17 The terms of the outstanding... -

Page 137

BP ANNUAL REPORT AND ACCOUNTS 2007 135 27 Investments in associates The signiï¬cant associates of the group are shown in Note 46. Summarized ï¬nancial information for the group's share of associates is set out below. $ million 2007 2006 2005 Sales and other operating revenues 9,855 8,792... -

Page 138

... is governed by appropriate policies and procedures and that ï¬nancial risks are identiï¬ed, measured and managed in accordance with group policies and group risk appetite. The group's trading activities in the oil, natural gas and power markets are managed within the integrated supply and trading... -

Page 139

...left unchanged. $ million Value at risk for 1 day at 95% conï¬dence interval 2007 2006 High Low Average Year end High Low Average Year end Group trading Oil price trading Natural gas price trading Power price trading Currency trading Interest rate trading Other trading 50 46 32 6 6 11... -

Page 140

... exchange rate ï¬,uctuations is not identiï¬able separately in the group's reported results. The main underlying economic currency of the group's cash ï¬,ows is the US dollar. This is because BP's major product, oil, is priced internationally in US dollars. BP's foreign currency exchange management... -

Page 141

... and business risk management processes are taken into account in the assessment, to the extent that this information is publicly available or otherwise disclosed to the group by the counterparty, together with external credit ratings, if any, including ratings prepared by Moody's Investor Service... -

Page 142

... liquidity risk, the group has access to a wide range of funding at competitive rates through capital markets and banks. The group's treasury function centrally co-ordinates relationships with banks, borrowing requirements, foreign exchange requirements and cash management. The group believes it has... -

Page 143

BP ANNUAL REPORT AND ACCOUNTS 2007 141 28 Financial instruments and ï¬nancial risk factors continued The table below shows cash outï¬,ows for derivative hedging instruments based upon contractual payment dates. The amounts reï¬,ect the maturity proï¬le of the fair value liability where the ... -

Page 144

... hand; current balances with banks and similar institutions; and short-term highly liquid investments that are readily convertible to known amounts of cash, are subject to insigniï¬cant risk of changes in value and have a maturity of three months or less from the date of acquisition. Cash and cash... -

Page 145

... ï¬,oating rate and ï¬xed rate debt, consistent with risk management policies and objectives. Additionally, the group has a well-established entrepreneurial trading operation that is undertaken in conjunction with these activities using a similar range of contracts. The fair values of derivative... -

Page 146

... business objective, and are recognized at fair value with changes in fair value recognized in the income statement. Trading activities are undertaken by using a range of contract types in combination to create incremental gains by arbitraging prices between markets, locations and time periods... -

Page 147

BP ANNUAL REPORT AND ACCOUNTS 2007 145 34 Derivative ï¬nancial instruments continued The following table shows the changes in the day-one proï¬ts deferred on the balance sheet. $ million 2007 2006 Natural gas price Power price Natural gas price Power price Fair value of contracts ... -

Page 148

... fair value relating to these contracts is recognized on the balance sheet with gains or losses recognized in the income statement. These contracts are valued using models with inputs that include price curves for each of the different products that are built up from active market pricing data... -

Page 149

BP ANNUAL REPORT AND ACCOUNTS 2007 147 34 Derivative ï¬nancial instruments continued The following table shows the changes during the year in the net fair value of embedded derivatives. $ million 2007 2006 Natural gas and LNG price Interest rate Natural gas and LNG price Interest ... -

Page 150

.... Note 28 outlines the group's approach to interest rate risk management. Hedges of net investments in foreign operations The group holds currency swap contracts as a hedge of a long-term investment in a UK subsidiary expiring in 2009. At 31 December 2007, the hedge had a fair value of $40 million... -

Page 151

BP ANNUAL REPORT AND ACCOUNTS 2007 149 35 Finance debt continued The following table shows, by major currency, the group's ï¬nance debt at 31 December 2007 and 2006 and the weighted average interest rates achieved at those dates through a combination of borrowings and derivative ï¬nancial ... -

Page 152

...maintain capital discipline in relation to investing activities while progressively growing the dividend per share. A managed share buyback programme is used to return to shareholders all sustainable free cash ï¬,ow in excess of the group's investment and dividend needs. From 2008, the group intends... -

Page 153

... decommissioning these production facilities and pipelines at the end of their economic lives has been estimated using existing technology, at current prices and discounted using a real discount rate of 2.0% (2006 2.0%). These costs are generally expected to be incurred over the next 30 years. While... -

Page 154

... date and the pension cost for 2008. % Financial assumptions UK US Other 2007 2006 2005 2007 2006 2005 2007 2006 2005 Discount rate for pension plan liabilities Discount rate for post-retirement beneï¬t plans Rate of increase in salariesa Rate of increase for pensions in payment... -

Page 155

.../cash 15-35 Property/real estate 0-10 Some of the group's pension funds use derivatives as part of their asset mix and to manage the level of risk. The group's main pension funds do not directly invest in either securities or property/real estate of the company or of any subsidiary. Return on asset... -

Page 156

...Past service cost 5 10 - - 15 Settlement, curtailment and special termination beneï¬ts 36 - - 2 38 Payments to deï¬ned contribution plans - 184 - 25 209 Total operating chargeb 533 421 43 159 1,156 Analysis of the amount credited (charged) to other ï¬nance expense Expected return on plan assets... -

Page 157

...service cost (74) 38 - 39 3 Settlement, curtailment and special termination beneï¬ts 4 - - 227 231 Payments to deï¬ned contribution plans - 161 - 16 177 Total operating chargeb 362 415 42 421 1,240 Analysis of the amount credited (charged) to other ï¬nance expense Expected return on plan assets... -

Page 158

...) 219 (297) 975 a b UK pension US pension US other postretirement beneï¬t plans The costs of managing the fund's investments are treated as being part of the investment return, the costs of administering our pensions fund benefits are generally included in current service cost, and the costs of... -

Page 159

... unpaid dividends and a premium equal to the higher of (i) 10% of the capital paid up on the preference shares and (ii) the excess of the average market price of such shares on the London Stock Exchange during the previous six months over par value. Repurchase of ordinary share capital The company... -

Page 160

... translation differences (net of tax) - - - - Exchange gain on translation of foreign operations transferred to (proï¬t) or loss on sale (net of tax) - - - - Actuarial gain relating to pension and other post retirement beneï¬ts (net of tax) - - - Issue of ordinary share capital for TNK-BP 27 1,223... -

Page 161

BP ANNUAL REPORT AND ACCOUNTS 2007 159 $ million Other reserve Own shares Treasury shares Foreign currency translation reserve Availablefor-sale investments Cash ï¬,ow hedges Sharebased payment reserve Proï¬t and loss account BP shareholders' equity Minority interest Total ... -

Page 162

... value for vested cash-settled share-based payments 22 23 41 For ease of presentation, option and share holdings detailed in the tables within this note are stated as UK ordinary share equivalents in US dollars. US employees are granted American depositary shares (ADSs) or options over the company... -

Page 163

... assessed on BP's relative return on average capital employed (ROACE) and earnings per share (EPS) growth compared with the other oil majors. After the performance period, the shares that vest (net of tax) are then subject to a three-year retention period. The director's remuneration report on pages... -

Page 164

... plan. Cash plans Cash-settled share-based payments / Stock Appreciation Rights (SARs) These are cash-settled share-based payments available to certain employees that require the group to pay the intrinsic value of the cash option/SAR/ restricted shares to the employee at the date of exercise... -

Page 165

...% Risk free interest rate 4.25% 4.00% 4.25% Expected exercise behaviour 5% years 4-9, 100% year 4 100% year 6 70% year 10 The group uses an appropriate valuation model of expected volatility of US ADSs for the quarter within which the grant date of the relevant plan falls. Management is responsible... -

Page 166

... security costs 771 751 754 Share-based payments 428 419 368 Pension and other post-retirement beneï¬t costs 504 770 929 11,263 10,351 10,746 Innovene operations - - (892 Continuing operations 11,263 10,351 9,854 Number of employees at 31 December 2007 2006 2005 Exploration and Production... -

Page 167

... of the current year of service measured in accordance with IAS 19 'Employee Beneï¬ts'. Share-based payments This is the cost to the group of senior management's participation in share-based payment plans, as measured by the fair value of options and shares granted accounted for in accordance... -

Page 168

... exist for various sites including reï¬neries, chemical plants, oil ï¬elds, service stations, terminals and waste disposal sites. In addition, the group may have obligations relating to prior asset sales or closed facilities. The ultimate requirement for remediation and its cost are inherently dif... -

Page 169

... (LNG) BP Trinidad and Tobago 75 South Africa Reï¬ning and marketing 100 England Exploration and production 100 Netherlands 70 US Exploration and production Exploration and production 100 Australia 100 Australia 100 Australia 100 Australia UK BP Capital Markets Finance BP Chemicals BP Oil UK... -

Page 170

...appraisal Exploration and production, pipelines Exploration and production Reï¬ning and marketing and petrochemicals Petrochemicals Integrated oil operations Pan American Energy is not controlled by BP as certain key business decisions require joint approval of both BP and the minority partner. It... -

Page 171

BP ANNUAL REPORT AND ACCOUNTS 2007 169 47 Oil and natural gas exploration and production activities a $ million 2007 UK Rest of Europe US Rest of Americas Asia Paciï¬c Africa Russia Other Total Capitalized costs at 31 December Gross capitalized costs 34,774 4,925 53,079 10,... -

Page 172

.... c Includes the value of royalty oil sold on behalf of others where royalty is payable in cash, property taxes, other government take and the fair value gain on embedded derivatives $515 million. d Excludes accretion expense attributable to exploration and production activities amounting to $153... -

Page 173

BP ANNUAL REPORT AND ACCOUNTS 2007 171 47 Oil and natural gas exploration and production activities continued a $ million 2005 Total UK Rest of Europe US Rest of Americas Asia Paciï¬c Africa Russia Other Capitalized costs at 31 December Gross capitalized costs 31,552 4,608 46,... -

Page 174

... the discovery is economically viable based on a range of technical and commercial considerations and sufï¬cient progress is being made on establishing development plans and timing. The following table provides the year-end balances and movements for suspended exploration well costs. $ million... -

Page 175

BP ANNUAL REPORT AND ACCOUNTS 2007 173 48 Suspended exploration well costs continued Country Project Cost $ million 2007 Years wells wells gross drilled Anticipated year of development project sanction Comment Angola Chumbo 26 2 2003-2005 2011-2014 Plutao/Saturno/Marte/Venus 51... -

Page 176

...ed as projects with completed exploration drilling activity at 31 December 2006 are not classiï¬ed as such at 31 December 2007: - The following projects were sanctioned for development in 2007: Skarv in Norway and Chachalaca in Trinidad & Tobago. - In Colombia, $43 million relating to the Volcanera... -

Page 177

... of internal accounting and risk management control reviews; $5 million (2006 $5 million and 2005 $3 million) in respect of non-statutory audits and $2 million (2006 $nil and 2005 $nil) in respect of project assurance and advice on business and accounting process improvement. The tax services relate... -

Page 178

... 51 Computation of ratio of earnings to ï¬xed charges $ million, except ratios For the year ended 31 December 2007 2006 2005 Proï¬t before taxation 31,611 34,642 31,921 Group's share of income in excess of dividends from equity-accounted entities (1,359) - (710) Capitalized interest, net of... -

Page 179

... net proved reserves For details of BP's governance process for the booking of oil and natural gas reserves, see page 15. 2007 million barrels Crude oila UK Rest of Europe US Rest of Americas Asia Paciï¬c Africa Russia Other Total Subsidiaries At 1 January 2007 458 189 1,916... -

Page 180

178 Supplementary information on oil and natural gas continued 2007 Movements in estimated net proved reserves Natural gasa billion cubic feet UK Rest of Europe US Rest of Americas Asia Paciï¬c Africa Russia Other Total Subsidiaries At 1 January 2007 1,968 242 10,438 3,932 1,359 1,032... -

Page 181

BP ANNUAL REPORT AND ACCOUNTS 2007 179 Supplementary information on oil and natural gas continued 2006 Movements in estimated net proved reserves Crude oila million barrels UK Rest of Europe US Rest of Americas Asia Paciï¬c Africa Russia Other Total Subsidiaries At 1 January 2006 496... -

Page 182

180 Supplementary information on oil and natural gas continued 2006 Movements in estimated net proved reserves Natural gasa billion cubic feet UK Rest of Europe US Rest of Americas Asia Paciï¬c Africa Russia Other Total Subsidiaries At 1 January 2006 2,382 245 11,184 3,560 1,459 934 -... -

Page 183

BP ANNUAL REPORT AND ACCOUNTS 2007 181 Supplementary information on oil and natural gas continued 2005 Movement in estimated net proved reserves Crude oila million barrels UK Rest of Europe US Rest of Americas Asia Paciï¬c Africa Russia Other Total Subsidiaries At 1 January 2005 559 ... -

Page 184

182 Supplementary information on oil and natural gas continued 2005 Movement in estimated net proved reserves Natural gasa billion cubic feet UK Rest of Europe US Rest of Americas Asia Paciï¬c Africa Russia Other Total Subsidiaries At 1 January 2005 2,498 248 10,811 4,101 1,624 1,015 ... -

Page 185

... based on year-end cost levels and assume continuation of existing economic conditions. Future decommissioning costs are included. c Taxation is computed using appropriate year-end statutory corporate income tax rates. d Future net cash flows from oil and natural gas production are discounted at 10... -

Page 186

...The following table shows crude oil and natural gas production for the years ended 31 December 2007, 2006 and 2005. Production for the yeara UK Rest of Europe US Rest of Americas Asia Paciï¬c Africa Russia Other Total Subsidiaries Crude oilb thousand barrels per day 2007 201 51 513 82... -

Page 187

... gas wells in the process of being drilled by the group and its equity-accounted entities as of 31 December 2007. Suspended development wells and long-term suspended exploratory wells are also included in the table. UK Rest of Europe US Rest of Americas Asia Paciï¬c Africa Russia... -

Page 188

.... Company law requires the directors to prepare ï¬nancial statements for each ï¬nancial year that give a true and fair view of the state of affairs of the company. In preparing these ï¬nancial statements, the directors are required: - To select suitable accounting policies and then apply them... -

Page 189

... part of the Directors' Remuneration Report to be audited in accordance with relevant legal and regulatory requirements and International Standards on Auditing (UK and Ireland). We report to you our opinion as to whether the parent company ï¬nancial statements give a true and fair view and whether... -

Page 190

... falling due after more than one year 5 71 57 Net assets excluding pension plan surplus 88,167 88,127 Deï¬ned beneï¬t pension plan surplus 6 5,338 4,067 Deï¬ned beneï¬t pension plan deï¬cit 6 (81) (76 Net assets 93,424 92,118 Represented by Capital and reserves 7 5,237 5,385 Called up share... -

Page 191

BP ANNUAL REPORT AND ACCOUNTS 2007 189 Company cash ï¬,ow statement For the year ended 31 December $ million Note 2007 2006 2005 Net cash (outï¬,ow) inï¬,ow from operating activities 9 (833) (3,703) (1,108 Servicing of ï¬nance and returns on investments 202 177 110 Interest received ... -

Page 192

...ï¬t pension and other post-retirement beneï¬t plans, plan assets are measured at fair value and plan liabilities are measured on an actuarial basis using the projected unit credit method and discounted at an interest rate equivalent to the current rate of return on a high-quality corporate bond... -

Page 193

BP ANNUAL REPORT AND ACCOUNTS 2007 191 1 Accounting policies continued A credit representing the expected return on the plan assets during the year is included within other ï¬nance income. This credit is based on an assessment made at the beginning of the year of long-term market returns on plan ... -

Page 194

...100 England Integrated oil operations BP Holdings North Americaa 100 England Investment holding BP Shipping 100 England Shipping BP Corporate Holdings 100 England Investment holding Burmah Castrol 100 Scotland Lubricants The carrying value of BP International Ltd in the accounts of the company at 31... -

Page 195

... the pension liabilities at that date and the pension cost for 2008. Financial assumptions 2007 2006 2005 Expected long-term rate of return Discount rate for plan liabilities Rate of increase in salaries Rate of increase for pensions in payment Rate of increase in deferred pensions In... -

Page 196

... to operating proï¬t Current service cost 473 411 360 Past service cost 5 (74) 4 Settlement, curtailment and special termination beneï¬ts 35 - 36 Total operating charge 513 337 400 Analysis of the amount credited (charged) to other ï¬nance income Expected return on pension plan assets 1,927... -

Page 197

... shares plus an amount in respect of accrued and unpaid dividends and a premium equal to the higher of (i) 10% of the capital paid up on the preference shares and (ii) the excess of the average market price of such shares on the London Stock Exchange during the previous six months over par value... -

Page 198

... gain on pensions (net of tax 785 Issue of ordinary share capital for TNK-BP 28 1,222 1,250 Repurchase of ordinary share capital (90) - 90 - - - (11,472) - (4,009) (15,481) Share-based payments 16 481 - 11 (11) 5 134 190 (79) 747 Proï¬t for the year 23,628 23,628 Dividends 7,686) (7,686... -

Page 199

... assessed on BP's relative return on average capital employed (ROACE) and earnings per share (EPS) growth compared with the other oil majors. After the performance period, the shares that vest (net of tax) are then subject to a three-year retention period. The directors' remuneration report on pages... -

Page 200

.... BP Share Option Plan (BPSOP) An equity-settled share option plan that applies to certain categories of employees. Participants are granted share options with an exercise price no lower than market price of a share immediately preceding the date of grant. There are no performance conditions and... -

Page 201

...-settled plan. Cash plans Cash settled share-based payments/Stock Appreciation Rights (SARs) These are cash-settled share-based payments available to certain employees that require the group to pay the intrinsic value of the cash option/SAR/restricted shares to the employee at the date of exercise... -

Page 202

...free interest rate 4.25% 4.00% 4.25% Expected exercise behaviour 5% years 4-9, 100% year 4 100% year 6 70% year 10 ShareSave ShareSave The group uses an appropriate valuation model of expected volatility of US ADSs for the quarter within which the grant date of the relevant plan falls. Management... -

Page 203

... supply of other services to the company is not presented in the parent company accounts as this information is provided in the group accounts. 13 Directors' remuneration Remuneration of directors $ million 2007 2006 2005 Total for all directors Emoluments Gains made on the exercise of share... -

Page 204

202 This page is intentionally left blank. -

Page 205

BP ANNUAL REPORT AND ACCOUNTS 2007 203 This page is intentionally left blank. -

Page 206

204 This page is intentionally left blank. -

Page 207

BP ANNUAL REPORT AND ACCOUNTS 2007 205 This page is intentionally left blank. -

Page 208

206 This page is intentionally left blank. -

Page 209

BP ANNUAL REPORT AND ACCOUNTS 2007 207 This page is intentionally left blank. -

Page 210

208 This page is intentionally left blank. -

Page 211

... Review 2007 in print from May 2008. www.bp.com/sustainability BP's reports and publications are available to view online or download from www.bp.com/annualreview. You can order a copy of BP's printed publications or the CD, free of charge, from: US and Canada BP Shareholder Services Toll-free... -

Page 212

beyond petroleum® www.bp.com