BMW 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

116 Notes to the Income Statement

123 Notes to the Statement

of Comprehensive Income

124

Notes to the Balance Sheet

149 Other Disclosures

165 Segment Information

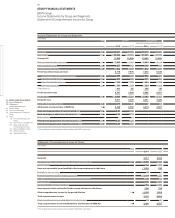

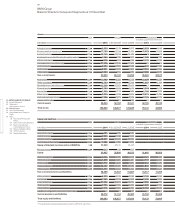

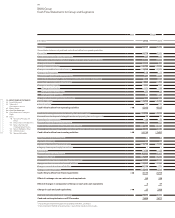

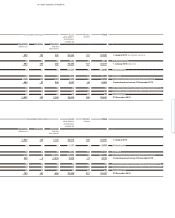

BMW Group

Cash Flow Statements for Group and Segments

Note Group

in € million 2014 2013

1

Net profit 5,817 5,329

Reconciliation between net profit and cash inflow / outflow from operating activities

Current tax 2,774 2,581

Other interest and similar income / expenses 127 147

Depreciation and amortisation of other tangible, intangible and investment assets 4,323 3,832

Change in provisions 1,103 480

Change in leased products – 2,720 – 2,048

Change in receivables from sales financing – 3,898 – 4,501

Change in deferred taxes 116 – 17

Other non-cash income and expense items 331 – 552

Gain / loss on disposal of tangible and intangible assets and marketable securities – 63 – 21

Result from equity accounted investments – 655 – 407

Changes in working capital – 551 986

Change in inventories – 971 – 195

Change in trade receivables 379 22

Change in trade payables 41 1,159

Change in other operating assets and liabilities 323 969

Income taxes paid – 4,252 – 2,787

Interest received 137 136

Cash inflow / outflow from operating activities 44

2,912 4,127

Investment in intangible assets and property, plant and equipment – 6,099 – 6,693

Proceeds from the disposal of intangible assets and property, plant and equipment 36 22

Expenditure for investments – 99 – 76

Proceeds from the disposal of investments 190 137

Investments in marketable securities and term deposits – 4,216 – 4,131

Proceeds from the sale of marketable securities and from matured term deposits 4,072 3,250

Cash inflow / outflow from investing activities 44

– 6,116 – 7,491

Issue / buy-back of treasury shares – –

Payments into equity 15 17

Payment of dividend for the previous year – 1,715 – 1,653

Intragroup financing and equity transactions – –

Interest paid – 133 – 122

Proceeds from the issue of bonds 10,892 8,982

Repayment of bonds – 7,249 – 7,242

Proceeds from new non-current other financial liabilities 5,900 6,626

Repayment of non-current other financial liabilities – 5,697 – 4,996

Change in current other financial liabilities 2,132 – 721

Change in commercial paper – 1,012 1,812

Cash inflow / outf low from f inancing activities 44

3,133 2,703

Effect of exchange rate on cash and cash equivalents 86 – 89

Effect of changes in composition of Group on cash and cash equivalents 2 47

Change in cash and cash equivalents 44

17 – 703

Cash and cash equivalents as at 1 January 7,671 8,374

Cash and cash equivalents as at 31 December 7,688 7,671

1 Prior year figures have been adjusted in accordance with IAS 8, see note 9.

2 Interest relating to financial services business is classified as revenues / cost of sales.