BMW 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

90 GROUP FINANCIAL STATEMENTS

90 Income Statements

90 Statement of

Comprehensive Income

92 Balance Sheets

94 Cash Flow Statements

96 Group Statement of Changes in

Equity

98 Notes

98 Accounting Principles and

Policies

116 Notes to the Income Statement

123 Notes to the Statement

of Comprehensive Income

124

Notes to the Balance Sheet

149 Other Disclosures

165 Segment Information

between two types of joint arrangements, namely joint

operations and joint ventures, and therefore results in

a change in the classification of joint arrangements. A

joint operation is a joint arrangement whereby the

par-

ties that have joint control of the arrangement have

rights to the assets, and obligations for the liabilities, re-

lating to the arrangement. A joint venture is a joint

ar-

rangement whereby the parties that have joint control

of the arrangement have rights to the net assets result-

ing from the arrangement. IFRS 11 requires joint opera-

tors to account for their share of assets and liabilities in

the joint operation (and their share of income and ex-

penses). Joint venturers are required to account for their

investment using the equity method. The withdrawal

of

IAS 31 means the removal of the option to account

for joint ventures using either the proportionate consoli-

dation or the equity method. The equity method must

be applied in accordance with amended IAS 28.

IFRS 12 sets out the requirements for disclosures relating

to all types of interests in other entities, including joint

arrangements, associated companies, structured entities

and unconsolidated entities.

Application of IFRS 10 has no impact on the scope of

entities included in the Group Financial Statements.

The removal of the option for accounting for joint ven-

tures (as stipulated by IFRS 11) does not have any im-

pact since the BMW Group already accounted for joint

ventures using the equity method. By contrast, the

classification of joint arrangements in accordance with

IFRS 11 has changed. The investments in SGL Automo-

tive

Carbon Fibers GmbH & Co. KG, Munich, SGL

Automotive Carbon Fibers Verwaltungs GmbH, Munich,

and SGL Automotive Carbon Fibers LLC, Dover, DE –

previously accounted for at equity – have been classi-

fied

with effect from the first quarter of the financial

year

2014 as joint operations and consolidated propor-

tionately

on the basis of the BMW Group’s 49 % share-

holding. This change in classification reflects the fact

that the arrangement is primarily designed to provide

the joint operators with an output (i. e. production) as

well as the fact that settlement of the liabilities relating

to the activities conducted through the arrangement

depends on both parties on a continuous basis.

Appli-

cation of IFRS 12 impacts the scope of disclosures

required to be made in the notes to the BMW Group

Financial Statements, in particular the requirement to

disclose more detailed financial information with

re-

spect to significant joint ventures. Further details can be

found in note 26.

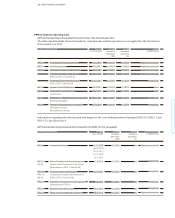

The new requirements pertaining to IFRS 10, IFRS 11

and IFRS 12 are required to be applied retrospectively.

In accordance with IAS 8.14, the resulting adjustments

relating to the financial year 2013 are presented in the

tables at the end of this section. The transition

require-

ments contained in these new Standards were com-

plied with and, accordingly, the impact on the Group’s

Balance Sheet, Income Statement and Cash

Flow State-

ment is not presented separately for the financial year

2014.

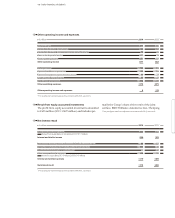

Restatement of income taxes in conjunction with leased

products in the USA

In previous years, there had been a misallocation between

current and deferred income taxes for leased products

in the USA. The figures have been restated in accordance

with IAS 8.41 et seq., involving a reclassification from

deferred tax liabilities to current tax payables. The

re-

lated interest and penalty charges up to 31 December

2012 were recorded directly in equity (in revenue re-

serves). Interest relating to the financial year 2013 is

reported as an expense for that period (in financial

result).

Prior year figures in the Balance Sheet, Income State-

ment, Statement of Comprehensive Income, Statement

of Changes in Equity, Cash Flow Statement and Notes

to the Group Financial Statements have been restated

retrospectively. The restatements also impacted the

figures reported for the Financial Services and Other

Entities segments. The Financial Service’s segment re-

sult for 2013 was reduced by € 20 million and amounted

to € 1,619 million after restatement, while segment as-

sets were reduced by € 19 million to € 8,388 million. Seg-

ment

assets reported for the Other Entities segment

amounted to € 55,300 million at the end of the financial

year 2013, correcting the previously reported amount

by € 1,050 million. The tables at the end of this section

show the impact for the Group.

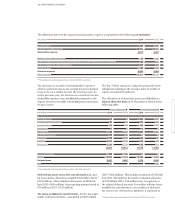

Change in presentation of term deposits within the Cash

Flow Statement

The BMW Group uses a broad range of instruments on

international capital markets to manage its liquidity.

Due to the situation on the financial markets, the BMW

Group is increasingly investing in term deposits with

longer terms (i. e. money deposits that mature after more

than three months). Term deposits were previously re-

ported in the Cash Flow Statement on the line “Change

in other operating assets and liabilities” within operating

cash flows. Since the payments related to these money

deposits qualify as instruments pursuant to IAS 7.16 c – d,

they are required to be presented as cash flows from

investing activities. In accordance with IAS 8.41 et seq.,

these amounts have been reclassified to the line items

“Investments in marketable securities and term deposits”