BMW 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

26 Overall Assessment by Management

26

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

61 Comments on Financial Statements

of BMW AG

64 Events after the End of the

Reporting Period

65 Report on Outlook, Risks and

Opportunities

65 Outlook

70 Report on Risks and Opportunities

82 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

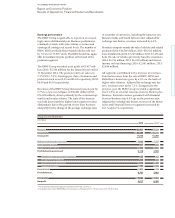

Income and expenses relating to equity accounted in-

vestments and recognised directly in equity (before tax)

reduced equity by € 48 million.

The dividend payment decreased equity by € 1,707 mil-

lion.

Minority interests increased by € 29 million. A

portion of the Authorised Capital 2014 created at the

Annual General Meeting held on 14 May 2009 in

con-

junction with the Employee Share Programme was used

during the financial year under report to issue shares

of

preferred stock to employees. An amount of € 15 mil-

lion was transferred to capital reserves in conjunction

with this share capital increase.

The equity ratio of the BMW Group fell overall by 1.5 per-

centage

points to 24.2 %. The equity ratio of the

Auto-

motive segment was 39.2 % (2013: 42.4 %) and that of the

Financial Services segment was 8.8 % (2013: 9.1 %).

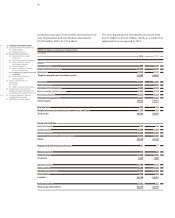

Other provisions increased from € 7,240 million to

€ 8,790 million during the year under report, mainly re-

flecting allocations to provisions for personnel-related

expenses and ongoing operational expenses as well as

the reclassification described in note 31.

The € 711 million increase in current other liabilities

was

attributable to the expansion of service and leasing busi-

ness and the related impact on amounts recognised as

deferred income. In addition, value added tax payables

were higher than at the end of the previous financial

year as a result of the higher volume of vehicles sold.

Deferred tax liabilities fell by € 485 million to € 1,974

mil-

lion as a result of lower fair values of derivative financial

instruments recognised directly in equity,

remeasure-

ments of the net defined benefit liability for pension

plans and currency factors. The € 729 million decrease

in current tax liabilities to € 1,590 million was mainly at-

tributable to a tax payment in the USA.

Overall, the results of operations, financial position and

net assets position of the BMW Group continued to de-

velop positively during the financial year under report.

Compensation Report

The compensation of the Board of Management com-

prises both a fixed and a variable component. Benefits

are also payable – primarily in the form of pension

benefits – at the end of members’ mandates. Further

details, including an analysis of remuneration by each

individual, are disclosed in the Compensation Report,

which can be found in the section “Statement on Corpo-

rate Governance”. The Compensation Report is a sub-

section of the Combined Management Report.

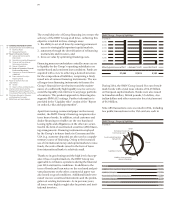

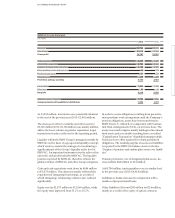

Value added statement*

The value added statement shows the value of work per-

formed less the value of work bought in by the BMW

Group during the financial year. Depreciation and amor-

tisation,

cost of materials and other expenses are treated

as bought-in costs in the value added calculation. The

allocation statement applies value added to each of the

participants involved in the value added process. It

should be noted that the gross value added amount treats

depreciation as a component of value added which, in

the allocation statement, is treated as internal financing.

Net value added by the BMW Group in 2014 increased

by 7.3 % to € 20,620 million and was once again at a high

level.

The bulk of the net value added (47.4 %) is again applied

to employees. The proportion applied to providers of

finance fell to 8.4 %, mainly due to the lower refinancing

costs on international capital markets for the financial

services side of the business. The government / public

sector (including deferred tax expense) accounted for

16.0 %. The proportion of net value added applied to

shareholders, at 9.2 %, was higher than in the previous

year. Minority interests take a 0.1 % share of net value

added. The remaining proportion of net value added

(18.9 %) will be retained in the Group to finance future

operations.

* Prior year figures have been adjusted in accordance with IAS 8, see note 9.