BMW 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

18 COMBINED MANAGEMENT REPORT

18

General Information on the

BMW

Group

18 Business Model

20 Management System

23 Report on Economic Position

23 General and Sector-specific

Environment

26 Overall Assessment by Management

26

Financial and Non-financial

Performance Indicators

29 Review of Operations

49 Results of Operations, Financial

Position and Net Assets

61 Comments on Financial Statements

of BMW AG

64 Events after the End of the

Reporting Period

65 Report on Outlook, Risks and

Opportunities

65 Outlook

70 Report on Risks and Opportunities

82 Internal Control System and Risk

Management System Relevant for

the

Consolidated Financial Reporting Process

83 Disclosures Relevant for Takeovers

and Explanatory Comments

87

BMW Stock and Capital Markets

within the leased products portfolio and partly due to

elimination reversal effects.

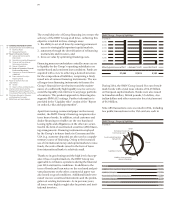

Financial position*

The consolidated cash flow statements for the Group

and the Automotive and Financial Services segments

show the sources and applications of cash flows for the

financial years 2014 and 2013, classified into cash flows

from operating, investing and financing activities.

Cash

and cash equivalents in the cash flow statements

correspond to the amount disclosed in the balance

sheet.

Cash flows from operating activities are determined in-

directly, starting with Group and segment net profit.

By contrast, cash flows from investing and financing

activities are based on actual payments and receipts.

The cash inflow from operating activities in 2014 de-

creased by € 1,215 million to € 2,912 million. This dete-

rioration was mainly due to higher cash outflows for

taxes

(up by € 1,465 million) and included, among other

items, a tax payment in the USA.

The cash outflow for investing activities amounted to

€ 6,116 million (2013: € 7,491 million) and was therefore

18.4 % down on the previous year, primarily reflecting a

€ 594 million reduction in investments in property, plant

and equipment and intangible assets (2014: € 6,099 mil-

lion) and a € 737 million reduction in the net outflow for

investments in marketable securities and term deposits

(2014: net outflow of € 144 million).

Further information on investments is provided in the

section on the net assets position.

Cash inflow from financing activities totalled € 3,133 mil-

lion

(2013: € 2,703 million). Proceeds from the issue of

bonds amounted to € 10,892 million (2013: € 8,982 mil-

lion), compared with an outflow of € 7,249 million (2013:

€ 7,242 million) for the repayment of bonds. Non-cur-

rent other financial liabilities resulted in a cash inflow

of € 5,900 million (2013: € 6,626 million) and a cash

outflow of € 5,697 million (2013: € 4,996 million). The

net cash inflow for current other financial liabilities

was € 2,132 million (2013: net cash outflow of € 721 mil-

lion).

The change in commercial paper gave rise to

a net cash outflow of € 1,012 million (2013: net cash

inflow of € 1,812 million). The payment of dividends

resulted in a cash outflow of € 1,715 million (2013:

€ 1,653 million).

The cash outflow from investing activities exceeded

the cash inflow from operating activities in 2014 by

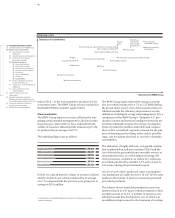

Change in cash and cash equivalents

in € million

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

Cash and cash Cash inflow Cash outflow Cash inflow Currency trans- Cash and cash

equivalents from operating from investing from financing lation, changes in equivalents

31.12. 2013* activities activities activities Group composition 31.12. 2014

7,671 + 2,912 – 6,116 + 3,133 + 88 7,688

* Prior year figures have been adjusted in accordance with IAS 8, see note 9.

* Prior year figures have been adjusted in accordance with IAS 8, see note 9.