BMW 2014 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2014 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

157 GROUP FINANCIAL STATEMENTS

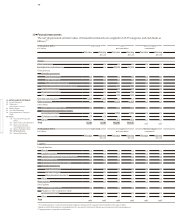

At 31 December 2014 the BMW Group held derivative

financial instruments (mainly forward currency and op-

tion contracts) with terms of up to 60 months (2013:

60 months) in order to hedge currency risks attached to

future transactions. These derivative instruments are

intended to hedge forecast sales denominated in a for-

eign

currency over the coming 60 months. The income

statement impact of the hedged cash flows will be

rec-

ognised as a general rule in the same periods in which

external revenues are recognised. It is expected that

€ 278 million of net losses, recognised in equity at the

end of the reporting period, will be reclassified to profit

and loss in the new financial year (2013: net gains of

€ 162 million).

At 31 December 2014 the BMW Group held derivative

financial instruments (mostly interest rate swaps) with

terms of up to one month (2013: 13 months) to hedge

interest rate risks. These derivative instruments are in-

tended to hedge interest-rate risks arising on financial

instruments with variable interest payments within

the coming month. The income statement impact of the

hedged cash flows will be recognised as a general rule

in the same periods over which the relevant interest

rates are fixed. It is expected that € 1 million of net

losses, recognised in equity at the end of the reporting

period, will be reclassified to profit and loss in the new

financial year (2013: € – million).

At 31 December 2014 the BMW Group held derivative

financial instruments (mostly commodity swaps) with

terms of up to 59 months (2013: 60 months) to hedge

raw materials price risks attached to future transactions

over the coming 59 months. The income statement im-

pact of the hedged cash flows will be recognised as a

general rule in the same period in which the derivative

instruments mature. It is expected that € 54 million of

net losses, recognised in equity at the end of the report-

ing period, will be reclassified to profit and loss in the

new financial year (2013: € 60 million).

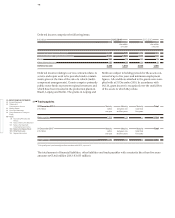

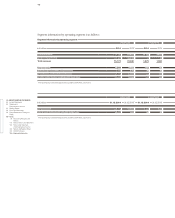

Fair value hedges

The following table shows gains and losses on hedging

instruments and hedged items which are deemed to be

part of a fair value hedge relationship:

The difference between the gains / losses on hedging

instruments (mostly interest rate swaps) and the results

recognised on hedged items represents the ineffective

portion of fair value hedges.

Fair value hedges are mainly used to hedge the market

prices of bonds, other financial liabilities and receivables

from sales financing.

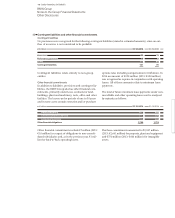

Bad debt risk

Notwithstanding the existence of collateral accepted,

the carrying amounts of financial assets generally take

account of the maximum credit risk arising from the

possibility that the counterparties will not be able to ful-

fil

their contractual obligations. The maximum credit risk

for irrevocable credit commitments relating to credit

card business amounts to € 1,181 million (2013: € 943

mil-

lion). The equivalent figure for dealer financing is

€ 22,025 million (2013: € 19,856 million).

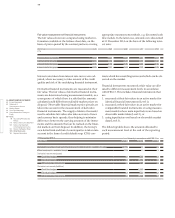

In the case of performance relationships underlying

non-derivative financial instruments, collateral will be

required, information on the credit-standing of the

counterparty obtained or historical data based on the

existing business relationship (i. e. payment patterns to

date) reviewed in order to minimise the credit risk, all

depending on the nature and amount of the exposure

that the BMW Group is proposing to enter into.

Within the financial services business, the financed

items (e. g. vehicles, equipment and property) in the

re-

tail customer and dealer lines of business serve as first-

ranking collateral with a recoverable value. Security is

also put up by customers in the form of collateral asset

pledges, asset assignment and first-ranking mortgages,

supplemented where appropriate by warranties and

guarantees. If an item previously accepted as collateral

is acquired, it undergoes a multi-stage process of repos-

session and disposal in accordance with the legal situa-

tion prevailing in the relevant market. The assets

in-

volved are generally vehicles which can be converted

into cash at any time via the dealer organisation.

Impairment losses are recorded as soon as credit risks

are identified on individual financial assets, using a

methodology specifically designed by the BMW Group.

in € million 31. 12. 2014 31. 12. 2013

Gains / losses on hedging instruments designated as part of a fair value hedge relationship 369 – 525

Gains / losses from hedged items – 359 503

Ineffectiveness of fair value hedges 10 – 22